- Dgenz Crypto Weekly

- Posts

- Dgenz Crypto Weekly 037

Dgenz Crypto Weekly 037

Your go-to newsletter for crypto market updates, trends and analysis.

Table of Contents

Market Pulse

Trump Bets Big on Crypto with Blue Chip ETF

Trump Media & Technology Group is going all in on crypto with a fresh ETF filing that aims to track top digital assets. Dubbed the Truth Social Crypto Blue Chip ETF, the fund will allocate 70% to Bitcoin, 15% to Ethereum, 8% to Solana, 5% to Cronos, and 2% to XRP. The filing was made last week with the SEC and, if approved, the ETF will list on the NYSE. Crypto.com has been chosen as custodian, staking provider, and prime execution agent, while Yorkville America Digital will sponsor the fund. This is the latest in a string of filings from Trump Media, which previously announced three other ETFs: one focused solely on Bitcoin, another split between BTC and ETH, and a third aimed at stablecoin income. What’s more, Trump Media raised over $2.3 billion earlier this year to build out a Bitcoin treasury, though they’ve yet to make their first BTC purchase. A $400 million stock buyback was also just announced. While the political overtones are strong, the moves reinforce a growing intersection between government, Wall Street, and crypto and signal the firm’s ambitions to play a major role in U.S. crypto finance.

NFT Prices Crash, But Sales Boom

NFT volume dropped 45% in Q2 hitting just $823 million, down from over $4 billion a year ago, but it’s not all doom and gloom. A DappRadar report shows NFT sales jumped 78% to 12.5 million transactions, with falling prices making the space more accessible. The TON blockchain drove most of the action thanks to a surge in anonymous domain NFTs tied to Telegram accounts. These numeric domains don’t require SIM cards, offering privacy-focused users a real utility. Meanwhile, OpenSea bucked the market, seeing a 156% rise in Q2 trading volume as users rushed to farm points ahead of its upcoming $SEA token airdrop. Cheaper collections have become hot targets for speculators hunting future rewards. Elsewhere, AI-related dapps now make up 18.6% of the market, up sharply from last quarter, and while gaming remains dominant, Web3 also saw one of its worst quarters for hacks with $6.3 billion lost. Despite the setbacks, the NFT space is showing signs of life, just in a very different form than the 2021 bull run.

Bitcoin Down Under: DigitalX Raises $13.5M

ASX-listed crypto fund manager DigitalX (DCC) has secured AU$20.7 million (US$13.5M) in fresh funding to bolster its Bitcoin position and expand operations. The raise drew heavyweight participants including Animoca Brands, ParaFi Capital, and UTXO Management, and included a warrant sweetener for investors—one warrant for every two shares, exercisable at double the placement price. DigitalX plans to use roughly $12.8 million of the funds to acquire more BTC, with the remainder going toward general operations and a new strategic advisory board. The firm appointed Animoca’s Yat Siu and crypto advisor Hervé Larren as inaugural members. Why it matters: DigitalX is the only ASX-listed company giving Australian investors regulated exposure to Bitcoin, meaning investors can add BTC to their superannuation portfolios (similar to the American’s 401k). In a country where crypto ETFs are still in early stages, DCC offers a rare pathway for institutional and retail investors to gain long-term BTC exposure through traditional markets.

Ondo Enters Tokenized Equities Race

Ethereum based DeFi platform Ondo Finance has acquired Oasis Pro, a regulated broker dealer and trading platform, to enable the legal sale of tokenized stocks to U.S. investors. The acquisition gives Ondo access to Oasis Pro’s key licenses as a broker dealer, ATS, and transfer agent which is critical infrastructure for compliant on-chain trading. This comes on the heels of Ondo’s expansion into tokenized global markets earlier this year, offering tokenized stocks, bonds, and ETFs to non-U.S. investors. With this acquisition, it’s now ready to challenge Robinhood, Kraken, and other players aiming to tokenize real world assets (RWAs) like equities. Ondo has also partnered with Pantera Capital to deploy $250 million into RWA tokenization projects, positioning itself to capture a major share in a market expected to reach $13 trillion by 2030. While others race to get there, Ondo is betting that regulatory clarity and its full stack infrastructure will give it the edge.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Weekly Charts

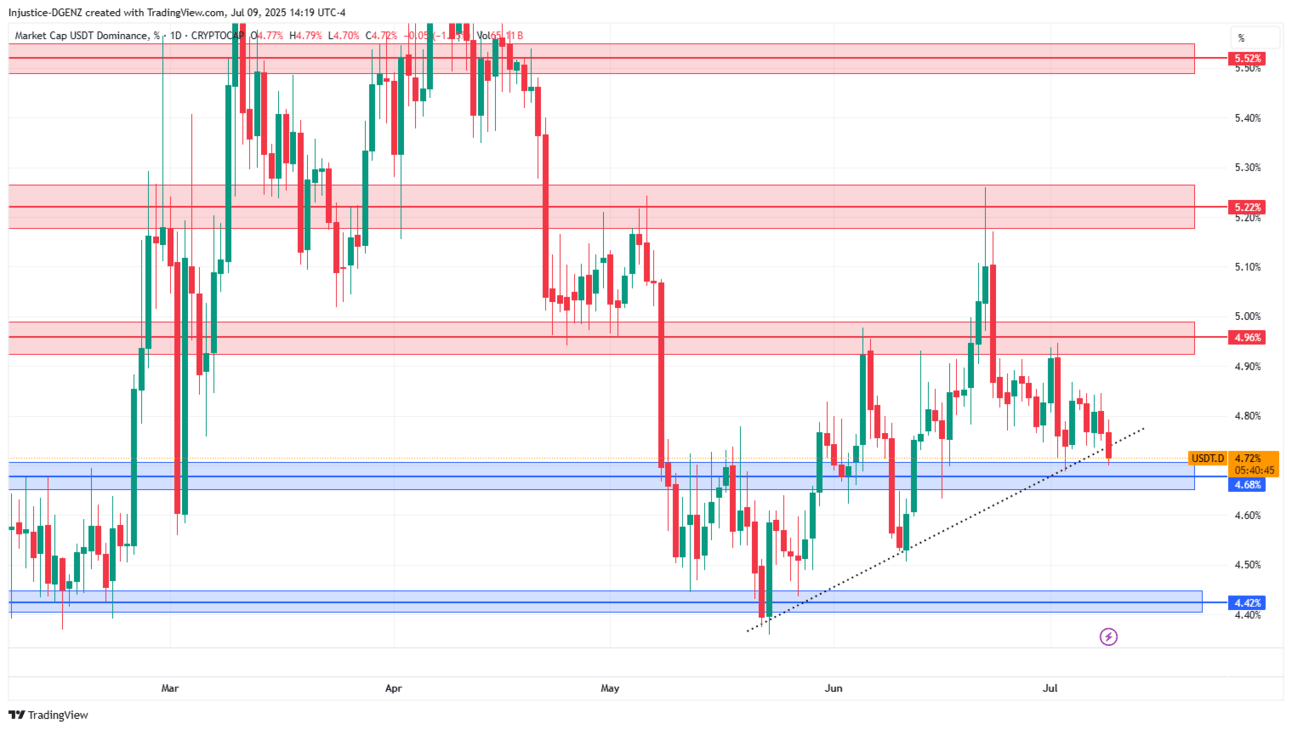

USDT Dominance

$USDT.D is breaking below the trendline but as you can see we are still sitting at a strong daily support. Although it is now the fourth touch of this support making it a weak one, you still have to treat it as it stands. Once we break below this support level we should start to see the market really begin to heat up, but until then I would advise caution.

The USDT.D chart shows the market dominance of Tether (USDT), indicating the proportion of crypto market value held in Tether and reflecting investor sentiment towards risk, as higher dominance often signals a move towards stability.

Others Dominance

$OTHERS.D has officially broken out of its falling wedge pattern, with multiple 4-hour candles closing above both the trendline and the key support zone around 7%. While the altcoin market reaction has been relatively subdued, largely due to Bitcoin's lack of momentum and $USDT.D at support, this breakout presents an opportunity for mid and low-cap assets to gain traction. Our next major area of interest lies at the 7.35% resistance level where we could see stronger market activity.

The OTHERS.D chart highlights the market share of altcoins outside the top 10 by market cap, giving investors insight into capital flow and interest in the broader crypto market.

Get up to $8,000 for free thanks to our partners at MEXC! Scan the QR code or simply click the image below to sign up and start trading with a massive bonus. Don’t miss out!

Token of the Week

Hyperliquid - $HYPE

Hyperliquid is a high-speed decentralized perpetuals exchange built on its own Layer-1 blockchain. With lightning fast execution and a CEX like experience, it’s quickly become the #1 DEX for leveraged crypto trading – all while being non-custodial, transparent, and fully on-chain.

What Does Hyperliquid Do?

Hyperliquid lets traders buy and sell crypto perpetual futures with up to 50x leverage using a fully on-chain order book. Unlike most DEXs that rely on AMMs, Hyperliquid gives traders precise limit orders, tight spreads, and low latency – basically offering the feel of Binance but with DeFi level transparency and self-custody. It's also designed for high throughput, with a custom Layer-1 chain processing trades in under a second.

How It Works?

Hyperliquid runs on a custom Layer-1 blockchain using its own HyperBFT consensus, which allows it to process trades at high speed with no gas fees. Unlike AMM based DEXs, it uses a fully on-chain order book where every order, trade, and liquidation is transparently recorded. Users can deposit assets from over 30 chains and begin trading instantly with no wallet pop-ups or transaction signing delays. Behind the scenes, validators maintain oracles, handle liquidations, and secure the network. Hyperliquid also includes built-in social trading features like public trader leaderboards and vaults, letting users follow top performers and participate in strategy-based trading.

Tokenomics & Incentives

- 1B max supply. 31% was airdropped, 38.9% reserved for community rewards, and 23.8% to the team (vested).

- Staking $HYPE unlocks up to 20% off trading fees, similar to Binance’s BNB model.

- Around 97% of all fees go to buy back and burn $HYPE, reducing supply over time.

- Staking supports the network and can earn a modest APY of up to 2-3% as well as gain perks like discounts and governance votes.

- Users can deposit USDC to provide liquidity and earn yields from trading fees which can be up to ~24% APY for market-making.

Ecosystem Impact

- Hyperliquid now dominates decentralized perpetuals, regularly handling $400M–$1B+ daily volume.

- Over $1T in cumulative volume, 500K+ users, and top 10 chain by TVL (~$1.75B locked).

- $HYPE’s fully diluted valuation hit ~$40B this year making it one of the largest DeFi tokens by market cap.

- One of crypto’s largest token launches, giving over $11B in value to users with no VC allocations.

Recent Developments

- Trader PnL leaderboards and vaults have gone viral, turning Hyperliquid into the go-to platform for on-chain degens.

- HyperEVM alpha launch brings EVM-compatible smart contracts to Hyperliquid for future DeFi apps and dApps.

- Validator expansion from 4 to 16+, with plans to decentralize further without losing speed.

- Over $900M in buyback funds accumulated, aggressively reducing supply based on platform usage.

What’s Coming Next?

- HyperEVM rollout expanding the ecosystem from just trading to full DeFi functionality.

- Efforts underway to reduce reliance on a small validator set and single multisig wallet.

- Expect more reward programs, copy trading tools, and referral incentives.

- As a non-KYC platform with centralized elements, compliance may become a concern.

TL;DR

Hyperliquid is a fast, fully on-chain perps exchange with CEX-like UX and DEX-level transparency. $HYPE fuels the ecosystem, with strong utility, aggressive buybacks, and a social-first trading model that’s captured the attention of degens and pros alike.

Market Cap - $13,263,426,214

24HR Volume - $199,661,816

Current Price - $39.70

All-Time High - $45.57 (-13%)

All-Time Low - $3.81 (+944%)

Want to stay ahead of the moves? Join our community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 3 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections | Weekly Crypto Stream  The best way to keep up with crypto is to surround yourself with the right people. Tune into the Weekly Crypto Roundtable on YouTube every Thursday, hosted by Dgenz community members, for sharp insights, market updates, and discussions that matter. |

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!