- Dgenz Crypto Weekly

- Posts

- Dgenz Crypto Weekly 039

Dgenz Crypto Weekly 039

Your go-to newsletter for crypto market updates, trends and analysis.

Table of Contents

Market Pulse

ETH Maxis Rejoice: Corporates are Buying Bags

Move over Bitcoin, Ethereum’s got its own sugar daddies now. SharpLink Gaming just flexed hard, bringing its Ethereum treasury to a monstrous 360,000 ETH, worth $1.3 billion, after scooping up nearly 80,000 ETH last week alone. The Nasdaq-listed firm, known for its gambling tech, isn’t just betting on sports anymore, it’s all-in on ETH. Its stock surged over 10% and is up 206% this month as it plans to raise a jaw-dropping $6 billion to fund even more Ethereum buys. And they’re not alone: Bit Digital grabbed nearly 20,000 ETH and BitMine Immersion, backed by Peter Thiel, dumped $500M into ETH last week with dreams of controlling 5% of all Ethereum ever held or staked. With ETH peaking at $3,848 before settling near $3,700, it’s clear the smart money thinks Ethereum isn’t done climbing. Whether it’s treasury diversification or full-blown ETH addiction, one thing is certain: Ethereum is the new corporate flex, and these companies are hoarding it like it's going out of style.

NFT Market Blinks Back to Life.. Temporarily

Don’t call it a comeback… okay fine, call it a comeback then you filthy degen. NFTs just had their busiest day since February, with $26M in trading volume Sunday and another $25M Monday, driven by Ethereum and Solana collections bouncing alongside altcoin prices. Leading the charge? The OGs. CryptoPunks saw their floor price jump 20% to 48 ETH ($177K), with sales volume exploding 460%. The Infinite Node Foundation, which recently acquired the Punk IP from Yuga Labs, might’ve sprinkled some magic on the pixelated icons. Meanwhile, Pudgy Penguins waddled up 38%, Mutant Apes clawed out a 26% gain, and Fidenzas from generative artist Tyler Hobbs surged 64%. On Solana, Mad Lads, Claynosaurz, and Solana Monkey Business NFTs all posted 25–45% gains. Even Bitcoin NFTs got a piece of the pie, with Taproot Wizards and Bitcoin Puppets seeing price hikes. Still, no one’s hitting all-time highs yet, so temper that FOMO. But with OpenSea volume up 44% and Blur spiking 120%, the JPEG crowd is back in action, at least for now. Enjoy the pump, just don’t mortgage the house for a penguin.

From Hashes to Holdings: Bitfarms Buys Back

In a plot twist worthy of a financial soap opera, Bitcoin miner Bitfarms is buying back nearly 10% of its own shares, roughly $64 million worth, sending its stock price flying 14% on Nasdaq. Why the self-love? According to CEO Ben Gagnon, Wall Street just doesn’t get how valuable their mining biz and AI pivot really are. The company believes its shares are undervalued, and it's backing that belief with cash. The buyback move isn't just corporate fluff, it’s a signal to investors that Bitfarms thinks it’s sitting on a digital goldmine, especially after acquiring Stronghold Digital Mining to break into the AI arena. With 15 mining farms spread across Canada, the U.S., Argentina, and Paraguay, they’ve got enough servers to either mine Bitcoin or train the next ChatGPT. But let’s not forget mining is a brutal game: high energy costs, growing difficulty, and Bitcoin price swings mean one bad week can wreck your margins. That said, Bitfarms isn’t just digging for blocks anymore, they’re planting flags in AI territory, and this buyback might be their way of saying, “We’re not going anywhere.”

Train AI & Get Paid - No Coding Required

If you're tired of trading tokens or decoding chart patterns, here's your chance to earn crypto doing something even ChatGPT can’t legally recommend, data labelling. Sahara AI just launched a platform that pays users in crypto to tag images, transcribe audio, and rate AI outputs. Do small tasks, get paid, and repeat. The platform uses a bug bounty model where companies post data jobs, and contributors get rewarded in $SAHARA tokens, stablecoins, or partner tokens. Some tasks offer ownership stakes and passive income later, kind of like staking but with actual work. CEO Sean Ren says they’re using every trick in the book to keep cheaters out, from honeypot questions to peer reviews to requiring token staking for access. Ironically, they’re even using AI to catch people using AI to cheat on AI tasks. With $450K in rewards up for grabs and big-name clients already onboard, this could become the next gig-economy goldmine for crypto users. So if you’ve got some free time and decent mouse skills, go earn while teaching robots the difference between a cat and a toaster.

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

Weekly Charts

USDT Dominance

Despite flashing a few juicy 4HR RSI bull divs, price action has just been chopping around in the same range over the last few days. RSI is now back near the 50 zone, aka the indecision pit, where things usually flip or flop. Personally, I’m leaning toward a rejection here and a sweep of the recent lows. We’re still stuck under this 4HR resistance and grinding inside a bear flag. This current candle is trying to break out, but unless we flip that red box into support, I’m not convinced. If we do get that flip though, that’s where my invalidation hits and I’d be eyeing a pullback on Bitcoin all the way to $110K. Until then, it’s just more chop and cope.

The USDT.D chart shows the market dominance of Tether (USDT), indicating the proportion of crypto market value held in Tether and reflecting investor sentiment towards risk, as higher dominance often signals a move towards stability.

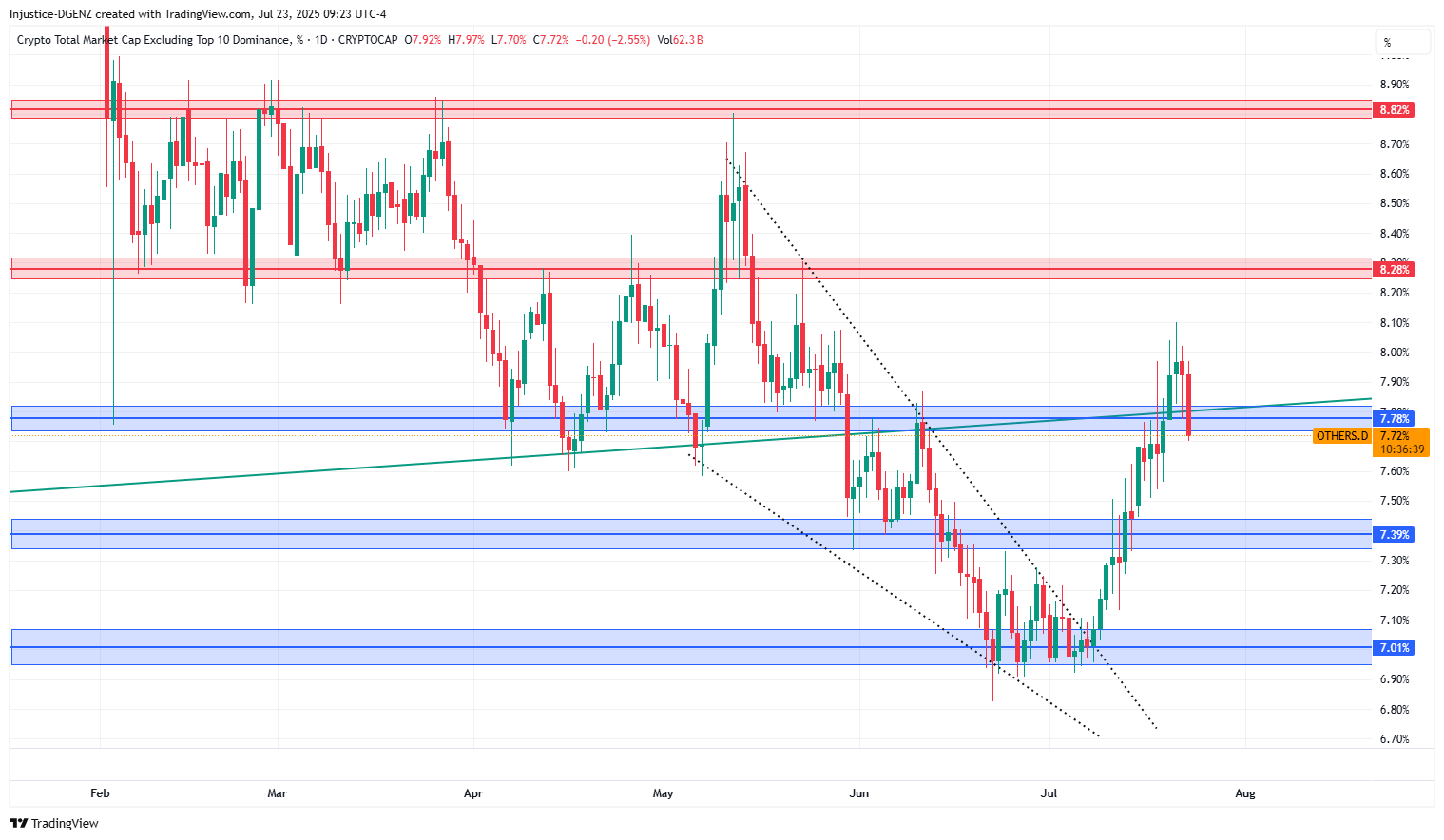

Others Dominance

$OTHERS.D is back at the 7.78% level for a support retest, which is nothing we haven’t seen before. Last time it reclaimed 7.4%, we got the same textbook dip-and-rip setup: quick pullback, then straight continuation up. Right now, people are sweating because they’re over leveraged, but this kind of mini flush is pretty standard and honestly, it’s just a healthy correction in disguise. Unless we lose the 7.8% to 7.65% zone with conviction, the broader outlook stays bullish. Until then, we’re treating this as a reload zone, not a panic button.

The OTHERS.D chart highlights the market share of altcoins outside the top 10 by market cap, giving investors insight into capital flow and interest in the broader crypto market.

Get up to $8,000 for free thanks to our partners at MEXC! Scan the QR code or simply click the image below to sign up and start trading with a massive bonus. Don’t miss out!

Token of the Week

Ondo Finance - $ONDO

Ondo Finance is the leading platform bridging real-world assets (RWAs) like U.S. Treasuries to DeFi. Backed by giants like BlackRock and Coinbase, Ondo lets users earn stable, on-chain yield through tokenized funds, while $ONDO powers governance and (soon) its own blockchain. With over $1.4B in tokenized assets and a growing presence across Ethereum, Solana, and its upcoming Layer 1, Ondo is becoming the central hub for compliant, institutional-grade DeFi.

What Does Ondo Do?

Ondo offers tokenized versions of traditional assets like Treasuries and money market funds, giving crypto users access to ~5% yield. Products like OUSG, USDY, and OMMF let users park stablecoins and earn yield backed by U.S. government bonds without leaving crypto. Ondo’s platform makes this possible through partnerships with BlackRock, Coinbase Custody, and top Wall Street custodians. These tokens can also be used in DeFi lending, trading, and liquidity protocols.

How It Works?

Users pass KYC and deposit stablecoins, which Ondo routes into assets like Treasury ETFs. In return, they receive yield-bearing tokens (e.g. OUSG) that accrue interest from the underlying fund. Ondo also runs Flux Finance, a lending protocol where users borrow against tokenized Treasuries. Assets are custodied off-chain by licensed firms, and Ondo ensures compliance and investor protection. It’s also launching Ondo Chain, a Cosmos-based blockchain where $ONDO will be used for staking and securing the network.

Tokenomics & Incentives

- 10B fixed supply, with ~31% in circulation.

- Use cases include governance, staking (future), and network security.

- ~50% supply for community/rewards, ~30% team/early contributors, ~15% public + VCs.

- Holders vote on protocol upgrades and may earn staking rewards post-chain launch.

Ecosystem Impact

- Over $1.4B in RWAs tokenized, Ondo leads this fast-growing DeFi segment.

- USDY on Solana and other cross-chain launches are expanding reach.

- Flux Finance unlocks use of tokenized Treasuries as DeFi collateral.

- Ondo’s partnerships with BlackRock, BNY Mellon, and others give it rare credibility.

- RWA tokens are becoming a new standard for stable yield and Ondo is at the centre of it.

Recent Developments

- $250M fund with Pantera to back other RWA startups.

- Acquired Oasis Pro, a licensed U.S. broker-dealer, to offer tokenized stocks.

- Acquired Strangelove to accelerate development of their Ondo Chain.

- 21Shares filed for a spot ONDO ETF, a first for any DeFi token.

What’s Coming Next?

- Launch of Ondo Chain, where $ONDO will be staked for rewards and validation.

- Rollout of tokenized stocks for non-U.S. investors.

- Wider cross-chain integration and more DeFi use cases for RWAs.

- Potential ETF approval could bring institutional inflows.

- Expansion of RWA DeFi ecosystem through grants and Catalyst investments.

TL;DR

Ondo Finance tokenizes real-world assets like Treasuries, bringing stable yield and compliance to DeFi. $ONDO governs the ecosystem and will power the Ondo Chain. Backed by BlackRock and poised to launch tokenized stocks, Ondo is leading the RWA revolution and $ONDO sits at the centre of it all.

Market Cap - $3,405,699,724

24HR Volume - $464,763,118

Current Price - $1.08

All-Time High - $2.14 (-49%)

All-Time Low - $0.08217 (+1212%)

Want to stay ahead of the moves? Join our community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 3 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections | Weekly Crypto Stream  The best way to keep up with crypto is to surround yourself with the right people. Tune into the Weekly Crypto Roundtable on YouTube every Thursday, hosted by Dgenz community members, for sharp insights, market updates, and discussions that matter. |

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!