- Dgenz Crypto Weekly

- Posts

- Dgenz Crypto Weekly 041

Dgenz Crypto Weekly 041

Your go-to newsletter for crypto market updates, trends and analysis.

Table of Contents

Market Pulse

Another Day, Another Stablecoin

Oops. Someone at Aave pressed the big red button a little early and accidentally leaked MetaMask’s secret stablecoin plans. According to a governance proposal that mysteriously vanished shortly after it was posted, MetaMask is launching a new dollar-pegged stablecoin called mmUSD in partnership with Stripe. Yes, Stripe. The one that powers half the internet’s payments. The proposal called mmUSD the “cornerstone” of MetaMask’s future — the main currency used across swaps, buys, sells, yield farming, and probably whatever other magic they cook up next. It is also backed by stablecoin infrastructure project M0, which means they are not playing small ball here. MetaMask parent company Consensys gave the classic “we don’t comment on speculation” line, but the leak is already out there, and crypto Twitter is not exactly known for forgetting. This all comes a week after MetaMask and Aave teamed up to let users earn yield through Aave pools directly inside the MetaMask app. So yeah, mmUSD is not looking like a maybe. It is looking like a soon. Meanwhile, the stablecoin space is having its hottest year ever. Circle went public and its stock mooned 186 percent overnight. PayPal has its own stablecoin with a 962 million dollar cap. Stripe spent over a billion acquiring a stablecoin project last year. Robinhood and Revolut are both rumoured to be working on theirs. Everyone wants in. Why? Because stablecoins are the golden goose of crypto. Fast transfers, instant settlement, high yield, no volatility. The market is already worth 268 billion dollars and big brains at Citi think it could hit 3.7 trillion in five years. That is not a typo. MetaMask launching mmUSD makes sense. They have the users. They have the wallets. And now, it looks like they want the coin too.

This Market Has Mood Swings Worse Than Your Ex

Bitcoin ETFs are looking like a leaky faucet this week, with investors pulling out cash for the fourth day in a row. According to SoSoValue, spot BTC funds in the US saw another 196 million dollars in outflows on Tuesday. That sounds bad, but it is actually a bit of a breather compared to the previous days. Monday saw 333 million exit, and Friday hit a brutal 812 million, the second-biggest dump since these ETFs launched back in January. Add it all up and that is 1.4 billion dollars that just peaced out of Bitcoin ETFs in less than a week. The main culprit? Good old-fashioned macro fear. Donald Trump is back on the mic threatening new tariffs on India, pharma imports, and semiconductors, which has the market in full risk-off mode. Translation: institutions are feeling jittery and are pulling some chips off the table. Despite all this, Bitcoin is still chilling around 114K, down a little on the week but not in panic territory. Meanwhile, Ethereum ETFs just said “hold my beer” and snapped a two-day losing streak with 73 million dollars in fresh inflows on Tuesday. That comes after back-to-back outflows of 465 million and 152 million earlier this week. Before that, ETH ETFs were on a 20-day heater, riding a wave of price hype and retail love. TLDR? Bitcoin ETFs are getting dumped, ETH ETFs are bouncing back, and the market is currently vibing somewhere between “cautious optimism” and “everyone’s staring at the Fed.”

Ethereum Devs Are Cooking & The Recipe Is Lean

Ethereum just turned ten and instead of throwing a birthday party, it dropped a full-blown master plan for the next decade. Meet Lean Ethereum, the new long-term vision revealed by researcher Justin Drake that lays out how the network plans to survive, scale, and simplify its way into the future. Once known internally as Beam Chain, the project has evolved into a total rethink of Ethereum’s architecture, now called “Lean” to reflect a sleek, modular, and minimal approach. The idea is split into two vibes: fort mode and beast mode. Fort mode is all about going full cockroach, making Ethereum resilient enough to survive quantum computers, state-level attacks, and whatever else the future throws at it. Think post-quantum cryptography, hash-based signatures, and removing fancy dependencies. Beast mode, on the other hand, is full throttle. The goal? One gigagas per second on Layer 1 and one teragas per second on Layer 2. In non-nerd speak, that is a lot of firepower. Ethereum’s recent stats back the ambition too. ETH is up 49 percent, onchain activity is spiking, data usage is through the roof, and the network is processing more transactions than ever. Ethereum L1 just hit 46.7 million transactions in a month and L2s pushed data usage past 100,000 MiB. Meanwhile, core devs are working on big changes behind the scenes like a SNARK-native execution layer, post-quantum data sampling, and hardened finality for the Beacon Chain. And they’re not doing it in the shadows either. A new public tracker called leanroadmap.org just dropped, mapping out the whole journey and showing how client teams, researchers, and rollup builders are syncing up to make it happen. This is not some hype-fueled moonshot. The shift from Beam to Lean is Ethereum growing up. It is not about the next quick upgrade, it is about building a protocol that can still be running, and dominating a hundred years from now.

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

Weekly Charts

USDT Dominance

$USDT.D broke its trendline, gave us a classic bearish retest, and is now heading south. We're already chilling below the 1D 12 EMA, so momentum is clearly fading. Eyes are now on the 4.24% level, that’s the next support and your cue to start taking profits. If $USDT.D somehow bounces back to retest 4.4%, that would also be a solid trigger to jump into some long positions. Until then, sit tight and let the chart do its thing. As for Bitcoin, we still need a clean 4HR close above $116.5K to break it’s downtrend and go long on $BTC.

The USDT.D chart shows the market dominance of Tether (USDT), indicating the proportion of crypto market value held in Tether and reflecting investor sentiment towards risk, as higher dominance often signals a move towards stability.

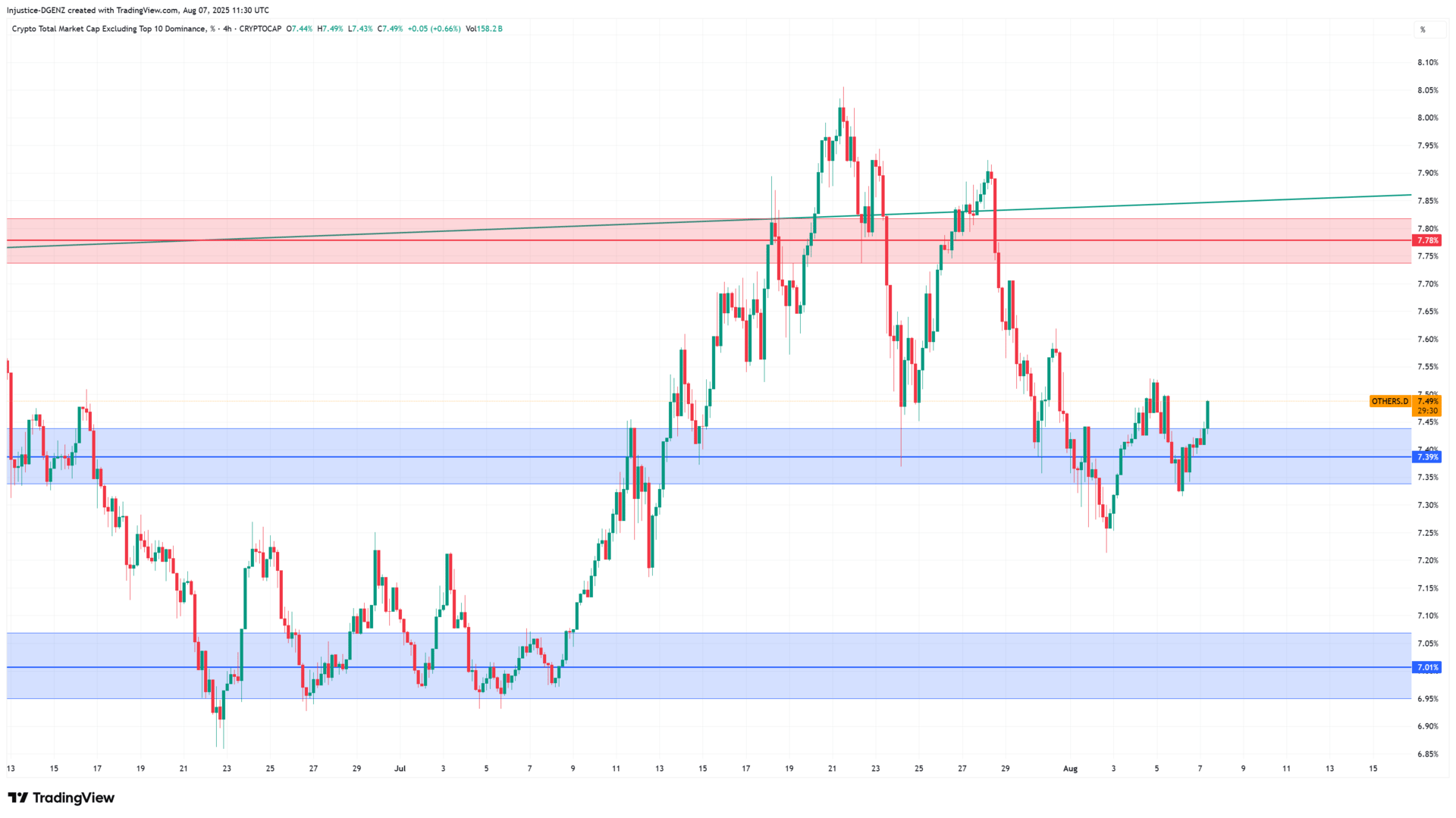

Others Dominance

$OTHERS.D is breaking out above support and trying to reclaim its bullish momentum. If we get a 4HR close above 7.53%, that confirms a market structure shift back in the bulls favour. From there, the next level to watch is resistance around 7.74% which is a solid spot to be locking in profits. Just remember, August is chop season, so do not get greedy and expect a clean breakout. Respect the levels, secure the bag, and avoid getting caught in the emotional rollercoaster.

The OTHERS.D chart highlights the market share of altcoins outside the top 10 by market cap, giving investors insight into capital flow and interest in the broader crypto market.

Get up to $8,000 for free thanks to our partners at MEXC! Scan the QR code or simply click the image below to sign up and start trading with a massive bonus. Don’t miss out!

Token of the Week

Pudgy Penguins - $PENGU

$PENGU is the official memecoin of Pudgy Penguins, one of the most recognized NFT brands in Web3. Launched on Solana in March 2024, it combines meme culture, mass retail branding, and a strong IP that all play into one of the fastest-growing community tokens. While it started as a joke, $PENGU now rides on Pudgy Penguins' massive ecosystem expansion across toys, media, and gaming which could help push it far beyond a typical meme coin.

What Does $PENGU Do?

$PENGU isn’t just another frog or dog coin. It’s built around the viral reach of the Pudgy Penguins IP and used to reward, engage, and unite their growing fanbase. Holders use $PENGU for gaming, merchandise discounts, giveaways, social rewards, and tipping across the Pudgy World. The token plays a role in community challenges and future integrations inside Pudgy’s gaming platform and mobile experiences.

How It Works?

Built on Solana, $PENGU benefits from low fees and lightning-fast transactions which is perfect for micro-tipping and gaming. The team has emphasized that $PENGU is not an investment or governance token, but a community reward layer meant to grow the Pudgy ecosystem. While no hard utility has been promised, early adopters and NFT holders have received airdrops, and the token continues to be tied to experiences across toys, social quests, and the Pudgy World gaming universe.

Tokenomics & Incentives

- The total supply of $PENGU is 100 billion tokens.

- 20% was airdropped to NFT holders, penguins.camp participants and $SOL community.

- 25% was allocated for liquidity and centralized exchange listings.

- 35% is reserved for ecosystem growth, future partnerships, and rewards.

- 20% is allocated to the team and DAO with vesting schedules in place.

- There are no token taxes or burns, value is driven by demand and community activity.

Ecosystem Impact

- Tied to Pudgy Penguins’ IP, which has toys in Walmart, Amazon, and Target.

- Part of Pudgy World, a growing metaverse product backed by LayerZero and Uniswap.

- Over 500K wallets received $PENGU via airdrop.

- Viral campaigns have driven millions of impressions across X and TikTok.

- Backed by investors like 1kx, CRV’s Michael Egorov, and LayerZero’s Bryan Pellegrino.

Recent Developments

- Over $130M in volume in first week, with top 5 Solana memecoin status.

- New Pudgy-themed arcade game teaser hints at token use.

- Pudgy Penguins ranked #1 in plush sales on Amazon during multiple months in 2024.

What’s Coming Next?

- Integration of $PENGU into Pudgy World, accessible via QR codes on 1M+ physical toys.

- More social gamification via quests, leaderboard rewards, and community events.

- Expansion of token utility via digital merch, in-game bonuses, and partnerships.

- Closer ties between toy sales, on-chain identity, and token engagement.

TL;DR

$PENGU is the memecoin of Pudgy Penguins that combines retail IP, viral branding, and tokenized community rewards. It’s built on Solana, backed by big names, and tied to a fast-growing Web3 world that spans Walmart shelves to metaverse games. It may not have DeFi utility, but it does have cultural firepower.

Market Cap - $2,326,300,398

24HR Volume - $616,330,933

Current Price - $0.03699

All-Time High - $0.06845 (-45%)

All-Time Low - $0.003715 (+901%)

Want to stay ahead of the moves? Join our community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections | Weekly Crypto Stream  The best way to keep up with crypto is to surround yourself with the right people. Tune into the Weekly Crypto Roundtable on YouTube every Thursday, hosted by Dgenz community members, for sharp insights, market updates, and discussions that matter. |

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!