- Dgenz Crypto Weekly

- Posts

- Dgenz Crypto Weekly 049

Dgenz Crypto Weekly 049

Your go-to newsletter for crypto market updates, trends and analysis.

Table of Contents

Market Pulse

125K Reasons Bears Should’ve Stayed Hibernating

Bitcoin just did what it does best, obliterated expectations and nuked shorts. The king of crypto smashed through $125,000 for the first time in its 17-year reign, lighting up Asia trading hours with nearly $50 billion in volume. As price shot up, the bears got burned, $100 million in short positions were liquidated in one hour. Ouch. So what’s fuelling the fire? A perfect storm of macro tailwinds and institutional FOMO. Interest rates cooling, government shutdown drama, and a growing thirst for hard assets are pushing BTC deeper into the “store of value” spotlight. And according to the suits at Standard Chartered, we’re just getting started. Their top digital asset analyst Geoff Kendrick dropped a spicy prediction: Bitcoin could hit $135K soon, and maybe even $200K before Santa comes. With the market still leaning bullish and no real signs of weakness holding ground, the rocket might not be done climbing yet. Strap in, cause the bull run ain’t over.

Pitch Decks Printing More than Tokens

Crypto VC funding isn’t just back, it’s booming. According to DefiLlama, 77 crypto companies raked in over $3.3 billion in September alone, bringing this years total to over $17B, already crushing 2024’s full-year number by over $7B. And Analysts at PitchBook are calling for $18B in total funding this year, while Galaxy Ventures and Codebase say $25B is on the table if the pace keeps up. Here are the biggest raises of the month:

Figure Technology raised $787.5M in its Nasdaq debut, reaching a $5.3B valuation. The company, founded by ex-SoFi CEO Mike Cagney, builds blockchain rails for loans and digital trading. They've already funded $16B+ in loans, and their investor list includes Stanley Druckenmiller. Huge.

Kraken reportedly bagged $500M in a private raise to fuel its $1.5B acquisition of NinjaTrader, not for an IPO, despite the rumors. Co-CEO Arjun Sethi says they’re not chasing a listing like everyone else. Still, the raise values Kraken at $15B.

Rapyd, a fintech platform bridging TradFi and crypto, also raised $500M in a Series F, backed by BlackRock, Fidelity, and General Catalyst. They're building out everything from fiat ramps to crypto custody and DeFi-friendly payment rails.

With numbers and names like these, it’s clear that smart money’s not on the side-lines, it’s backing big players before the next leg up.

Birb, Birb, B-BIRBs the Word

Moonbirds are back… and this time, they’re flying to Solana. The once-hyped pixel owl NFT project just announced $BIRB, a new culture coin set to launch “soon(ish).” First revealed at their Birbhalla event during Token2049 in Singapore, this move aims to breathe new life into a collection that once hit $280M volume in two days… before crashing hard. Originally created by Proof Collective in 2022, Moonbirds was later scooped up by Yuga Labs (and left to rot), but got another chance when Orange Cap Games acquired it earlier this year in May. Now the team is betting big on a Solana-based token to tap into the “culture coin” trend that’s reviving old NFT projects, think Pudgy’s PENGU or Doodles’ DOOD. So far, it’s working: the Moonbirds floor price pumped to over 4 ETH or $15.5K after the BIRB teaser (currently sitting at 3.3 ETH, or ~$14.8K). Details on $BIRB are still locked away in the nest, but early signals suggest this won’t be a stealth drop. Moonbirds has confirmed holders will get plenty of notice before launch.

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Weekly Charts

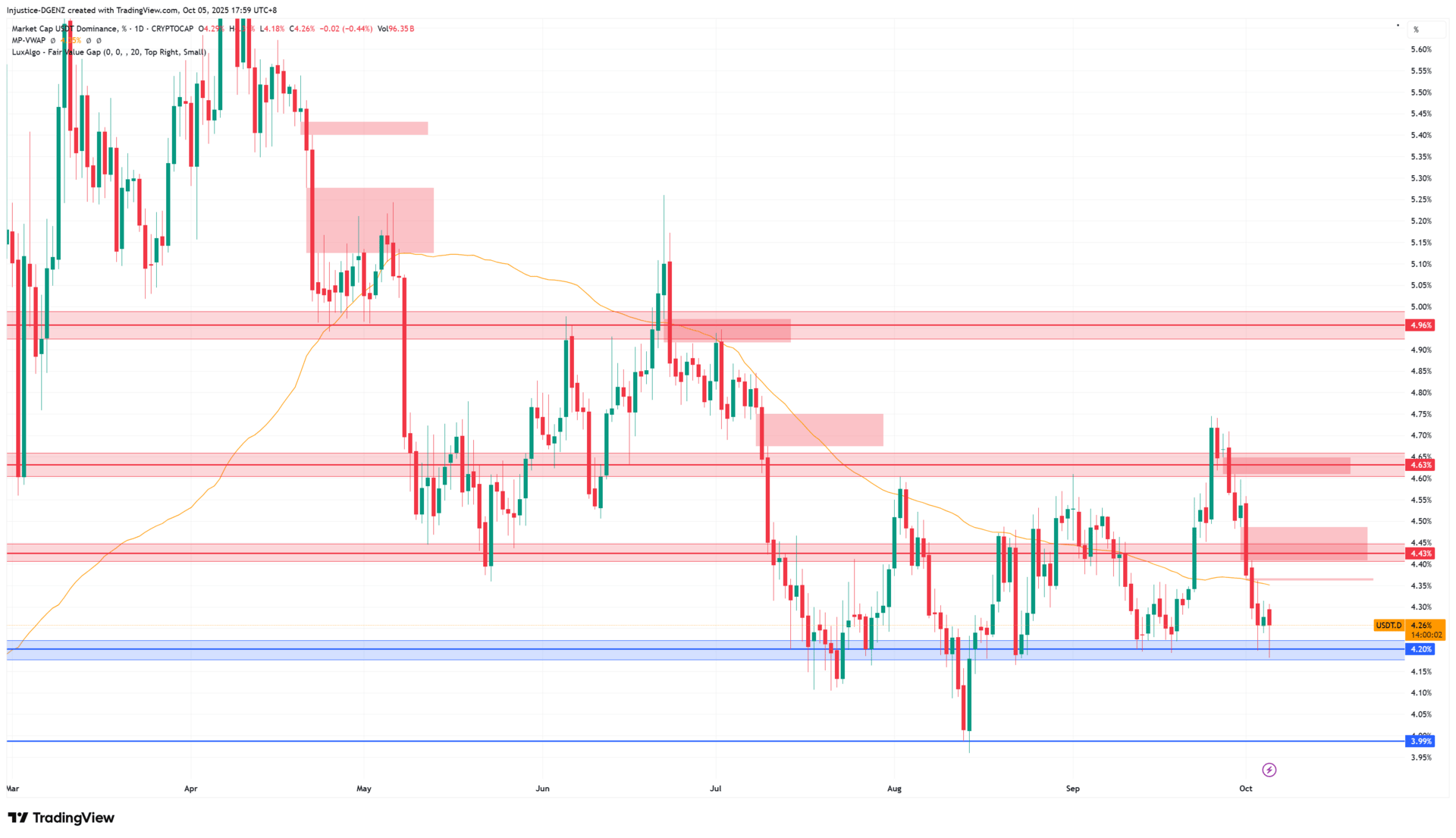

USDT Dominance

$USDT.D played out exactly like I said it would last week, bounced from the support and went on to retest our 4.6% resistance giving us a 10% dip across the board like I warned. And now we have a very similar scenario again here, but just the inverse. We violently broke down through our 4.4% support and have now tagged the lower support at 4.2%. As you can see we have left behind some bearish daily fair value gaps (FVG) at both of our resistances above. I doubt we see a move back up to 4.6%, the more likely scenario is we bounce back up from here only to fill that thin FVG laying just above the 1D QVWAP, with a potential wick into that 4.4% resistance and bigger FVG. Then what we really want to see is a loss of that support at 4.2%. The last time we saw this was in August, just before $BTC set it’s previous ATH, and before that we saw it happen in mid Jan a few days before Trump’s inauguration which was ATH’s again for $BTC as well as $SOL, and not to mention a solid rally across the altcoin market.

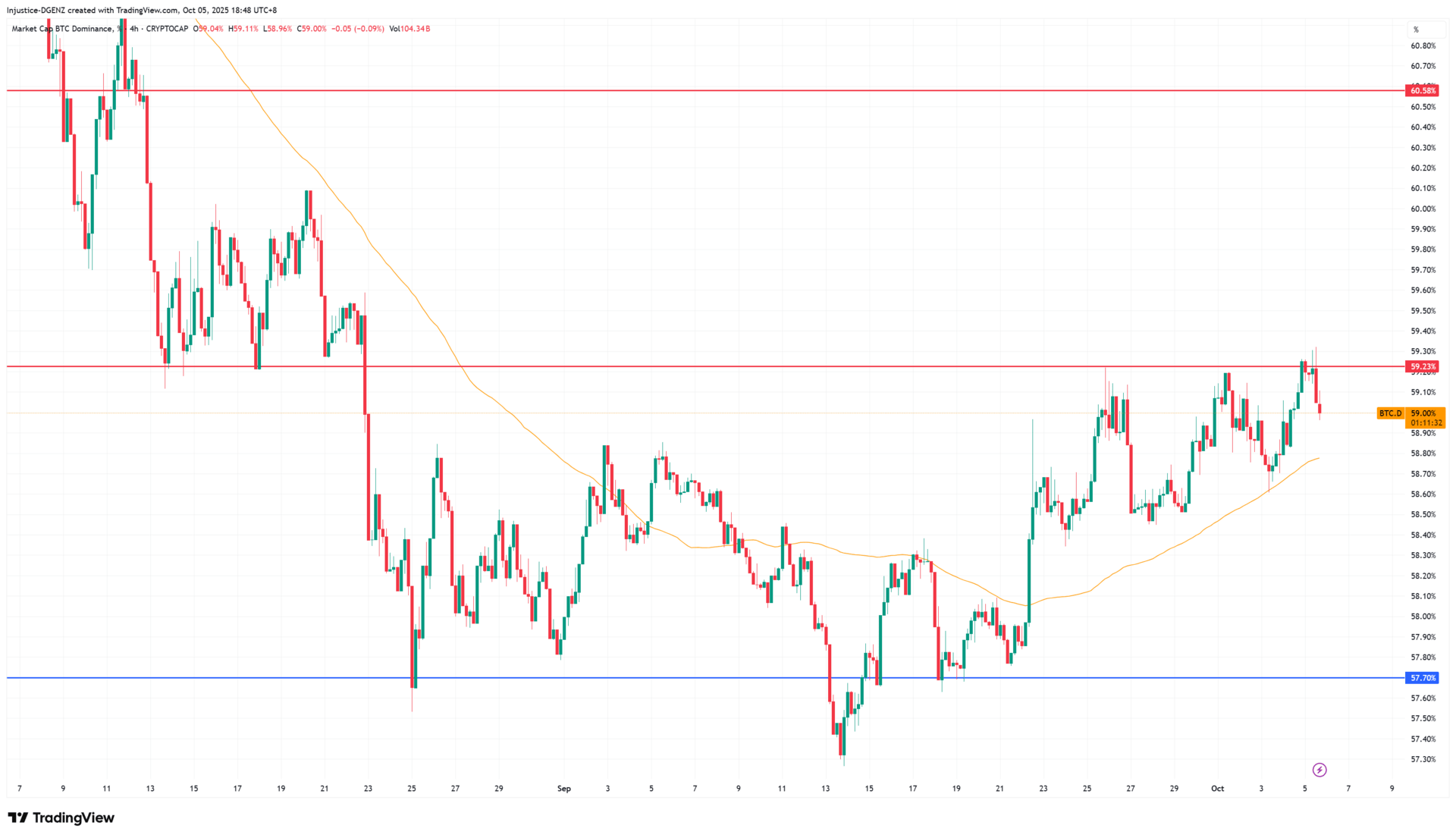

Bitcoin Dominance

As $BTC set all time highs today, $BTC.D also ran into resistance which is why we can now see it begin to cool off. This is good for alts as long as $BTC can at least remain stable, but what we really want to see is Bitcoin continue to climb while $BTC.D drops, this is when altcoins start to move up fast and we can see another solid rally across the board.

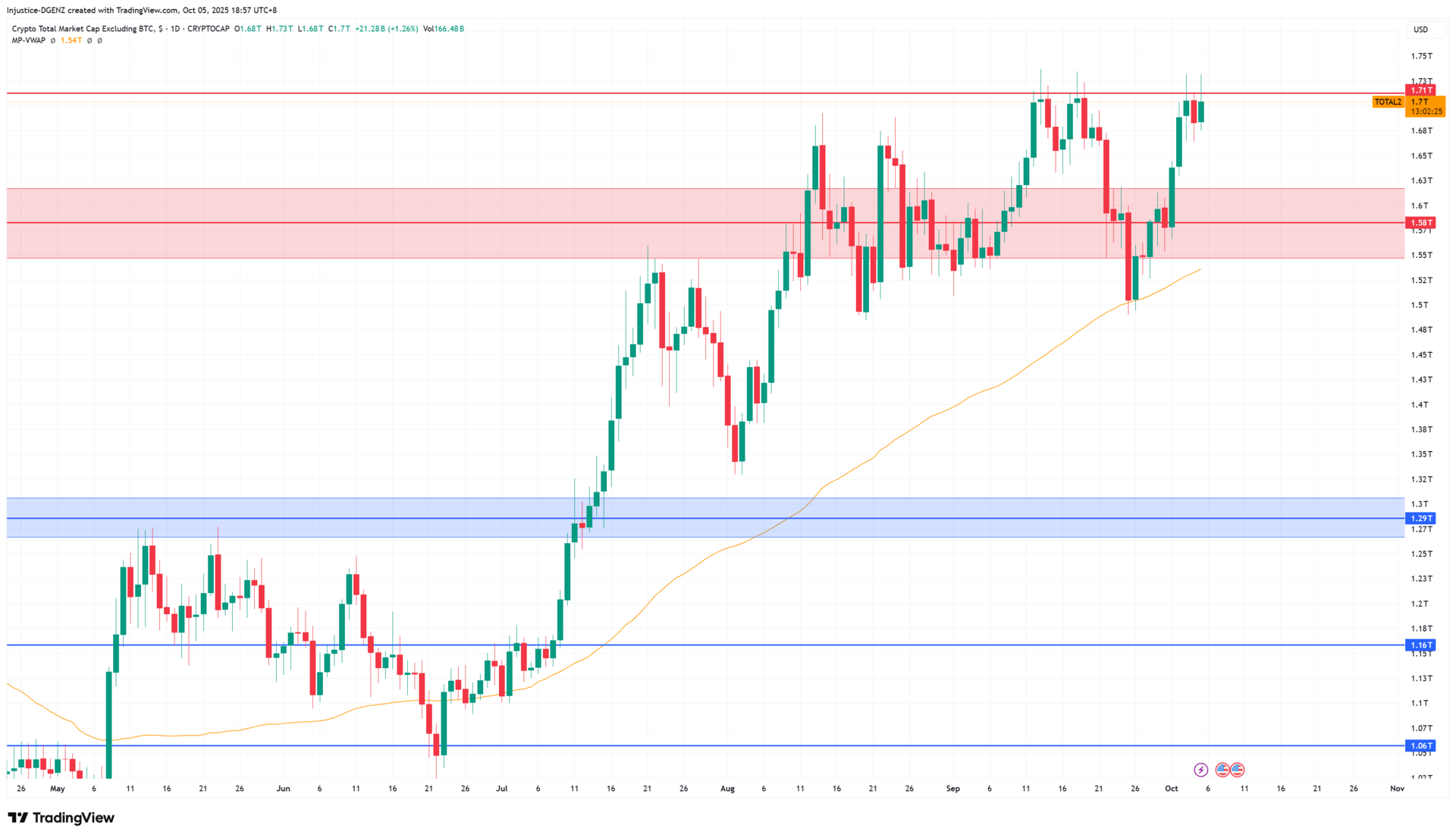

TOTAL2

$TOTAL2 is currently testing this key resistance level once again after this little crypto rally. For the real fun to begin though we will need to see a daily close above 1.71T, until then you can just expect us to continue to chop in between there and 1.55T. As you can see on all of these indices, we are once again at a make or break moment, and the more times we continue to do this, the closer we get to that eventual breakout, but until then treat the levels as what they are instead of hoping for a breakout. Sure, you might miss a few % in gains by waiting for the flip, but its a much better alternative to buying the top.

Get up to $8,000 for free thanks to our partners at MEXC! Scan the QR code or simply click the image below to sign up and start trading with a massive bonus. Don’t miss out!

Token of the Week

Bonk - $BONK

BONK is a community-launched meme token on Solana (SPL standard) that went live in December 2022 with a large airdrop to Solana users and builders. It has since grown into a broader “BONK ecosystem” spanning a Telegram trading bot (BONKbot), a token-launch platform (LetsBONK/Bonk.fun), and a community DAO that has executed multiple burns.

What Does Bonk Do?

At its core, BONK is a Solana-native meme/utility token used for tipping, payments in some apps, NFT tie-ins, and as the unit that aligns incentives across BONK-branded products. BONK’s most visible utility today is inside BONKbot, a popular Telegram trading bot that routes orders through Solana DEX liquidity (via Jupiter) and charges a fee; a portion of that fee stream has been shared with the BONK DAO and used for burns. BONK is also integrated into the LetsBONK/Bonk.fun launchpad, where platform fees have been described as feeding BONK buybacks/burns.

How It Works?

BONK is an SPL fungible token (gas fees are paid in SOL). Being SPL means it inherits Solana’s high throughput and low fees, and integrates natively across Solana wallets, DEXs and apps. Governance over parts of the ecosystem and treasury is handled by BonkDAO on Realms, where holders (often via BONK locked in BONKrewards) can vote on proposals like burns and grants. BONKbot collects trading fees and shares revenue to the DAO, which has approved several treasury burns via on-chain votes.

Tokenomics & Incentives

- Initial supply was 100 trillion BONK, with a large community airdrop at launch; subsequent DAO-approved burns have reduced outstanding supply to 88 trillion.

- BONK does not secure Solana (no protocol staking); yield opportunities come from locking in BONKrewards and/or exchange/DeFi programs—not base-chain staking.

- In April–July 2024, BonkDAO proposals to burn ~278–284B BONK (incl. an ~84B tranche from BONKbot Q2 revenue) were approved/executed; in 2025 the team/DAO announced plans to burn ~1T BONK as 1M holders neared (timeline not fixed at announcement).

Ecosystem Impact

- BONKbot has become one of Solana’s most-used Telegram trading tools, driving order flow across DEXs (via Jupiter routing) and generating DAO revenue that funded burns.

- LetsBONK/Bonk.fun emerged in 2025 as a leading Solana memecoin launchpad; multiple industry write-ups report it overtook rivals in market share.

- NFT & app tie-ins (e.g. BONK-themed collections/activations on Magic Eden) help reinforce brand and community engagement around the token.

Recent Developments

- Community votes executed large treasury burns (hundreds of billions of BONK) and later announced a plan to burn ~1T BONK as 1M holders neared; several outlets and exchange learn-pages covered the plan. (plan announcement ≠ completed burn; check DAO for status.)

- Binance removed a risk tag/classification for BONK in July 2025, which CoinDesk noted alongside elevated volume; BONK remains widely listed.

- BONKbot fee structure and documentation published; continuing usage supports the DAO revenue stream that financed prior burns.

What’s Coming Next?

- Track the ~1T BONK burn plan at BonkDAO/official channels to confirm if/when execution occurs and what source of tokens is used.

- Ongoing locking/reward mechanics via BONKrewards may evolve; official listings show active users and recurring lock programs.

- Continued LetsBONK/Bonk.fun growth (if sustained) would keep creating fee flows that, per public materials, support BONK buybacks/burns. Monitor platform updates.

TL;DR

BONK is Solana’s flagship meme token that has grown a real product loop: BONKbot trading and LetsBONK/Bonk.fun launchpad activity feed the BonkDAO, which has repeatedly burned tokens via community votes. Liquidity got a major boost from Coinbase/Binance/Kraken listings, and the ~1T planned burn is the headline catalyst to track for 2025. For newcomers, it’s a high-volatility, sentiment-driven asset; if you follow it, watch DAO proposals, burn transactions, and product usage rather than CT hype.

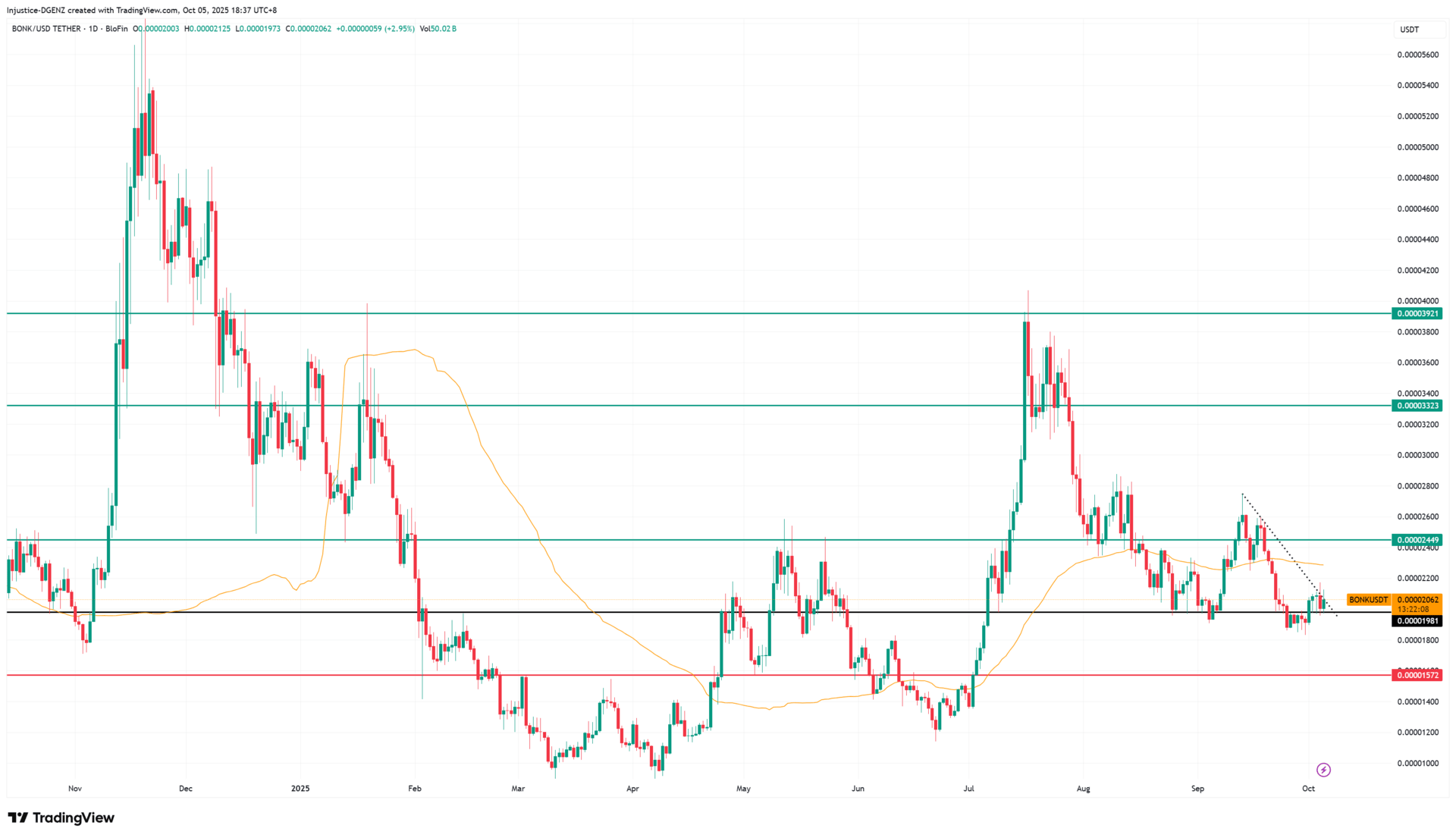

Technical Analysis

$BONK is currently sitting in a very tight spot here between this downtrend and level of support. We do already have a 4HR close above the trendline but as mentioned above its likely that $USDT.D is gonna bounce here which should give us another test of support. Even so, it wouldn’t be a bad idea to enter light here at current prices so you at least have some exposure. If you still believe Solana has room to run then you should be buying $BONK too as this is a solid $SOL beta play.

Market Cap - $1,605,838,237

24HR Volume - $368,087,351

Current Price - $0.00002061

All-Time High - $0.00005825 (-64%)

All-Time Low - $0.00000008614 (+23,996%)

This information does not constitute financial advice. Always DYOR.

Want to stay ahead of the moves? Join our trading community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections | Dgenz Trade Calculator  The best way to manage risk and maximize your gains is with the right tools. Use the Free Dgenz Trade Calculator to size positions, track spot & futures trades, and master risk management across crypto, stocks, and forex markets. |

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!