- Dgenz Crypto Weekly

- Posts

- Dgenz Crypto Weekly 051

Dgenz Crypto Weekly 051

Your go-to newsletter for crypto market updates, trends and analysis.

Table of Contents

Market Pulse

The Shutdown Continues: 15 Days and Counting

The U.S. government shutdown has officially hit Day 15, and lawmakers are still playing political ping-pong. Back in September, the House passed a stopgap funding bill (aka a Continuing Resolution) that would've kept the lights on until November 21 but the Senate hit back with a hard nope. Why? Democrats want amendments added around healthcare, the most notable being to extend premium tax credits under the ACA (Obamacare), which would give more financial help to folks, even those above the 400% poverty line. Meanwhile, around 600,000 federal workers are benched without pay, while others are working for free. If you’re wondering what this means for the economy: every week the shutdown drags on it shaves around 0.1–0.2% off GDP growth. Some of that might get recovered later, but not all of it.

Consumer confidence is already slipping, and it’ll likely continue through until November if this keeps up. Data from predictive market platforms such as Polymarket and Kalshi show the probability of the shutdown lasting until the end of October has risen to about 70% but recent risk-aversion operations in financial markets stem more from President Trump's escalation of trade frictions rather than from the government shutdown.

Flying Blind in The Macro Blackhole

The Bureau of Labor Statistics (BLS) will not be announcing PPI & CPI data tomorrow due to the shutdown but they have confirmed they’ll drop the September CPI report on October 24 so that Social Security can still calculate its annual cost-of-living adjustments, crisis averted (for now). But things could get messy fast. This shutdown is already echoing the 16-day freeze from 2013, where all government agencies were impacted thanks to zero appropriation bills passing on time. If the current standoff drags into next week, markets could be flying blind. Back in 2013, key data like non-farm payrolls and CPI were delayed by weeks. October CPI collection only hit 75% of its usual target, and employment reports were pushed back nearly three weeks. Fast forward to now: if agencies like BLS can’t gather enough data this time around, we’re not just talking delays, we’re talking missing data altogether. That includes headline figures like inflation and unemployment. In a worst-case scenario, the October data could be skipped entirely, with stats jumping straight to November. For traders and analysts, that’s a macro black hole.

Juicy Rate Cuts Still On The Menu

Markets were already pricing in a 25bps rate cut at the next Fed meeting and then the government shutdown hit. And instead of cooling that down, it’s only added fuel to the fire. With no new economic data to go off thanks to agencies going dark, traders are betting even harder that the Fed will keep cutting. Powell didn’t exactly throw cold water on the idea either. In a speech yesterday he signaled that rate cuts and the end of QT are both still very much in play. And the latest data backs that up. Private sector jobs dropped by 32,000 (worst since March 2023), and unemployment is ticking up to 4.34% based on Chicago Fed projections. Consumer confidence is fading, and CPI is expected to rise just 0.27% MoM, nothing spicy enough to flip the script. So what’s next? Brace for a November and December data overload. If the shutdown ends, we’re looking at up to three jobs reports and two CPI prints crammed into a few weeks before the Fed’s December meeting. That’s when the next big pivot could happen, if it’s going to. As for the dollar, the shutdown’s playing both sides. Short term? Risk-off flows and lack of data give it a lift. Medium term? A slowing economy and rising odds of rate cuts could crush it. The longer this drags out, the more bearish the setup gets.

Bank Boldly. Climb Higher.

Peak Bank offers an all-digital banking experience, providing all the tools and tips you need to make your way to the top. Take advantage of competitive rates on our high-yield savings account and get access to a suite of smart money management tools. Apply online and start your journey today.

Member FDIC

Weekly Charts

Others

The $OTHERS chart (aka total crypto market cap minus the top 10) just pulled off a clean deviation retest yesterday and that’s usually a green light for altcoin longs. So while CT is busy crying bear, I’m not seeing it. Yeah, some alts closed their daily candles below support after that liquidation nuke, and that’s definitely not ideal. But for most, this setup looks way more like a deviation retest than a full-on breakdown. Until we see a daily close below support, this still screams “buy-the-dip”, not “send-it-short.”

Stablecoin Dominance

You’re probably feeling pretty bullish now right? And you should be. But here’s some charts flashing a quiet warning. Just like we saw on the $OTHERS chart, $STABLE.C.D just completed a deviation retest of resistance after bouncing from the golden pocket. Sounds bullish, right? And it is, to a point. But here’s the part we’re watching closely: this chart’s been forming a clean series of higher highs, a bullish structure you don’t want to ignore. When stablecoin dominance is climbing like this, it’s a sign capital’s moving out of risk assets and into safety. For now, resistance is still doing its job. But keep your eyes glued to this level, because if it breaks and we start closing above daily then risk-on appetite could disappear faster than airdrops after TGE. Why? Because that would push us into uncharted territory and signal that liquidity is rushing back into stables and not crypto.

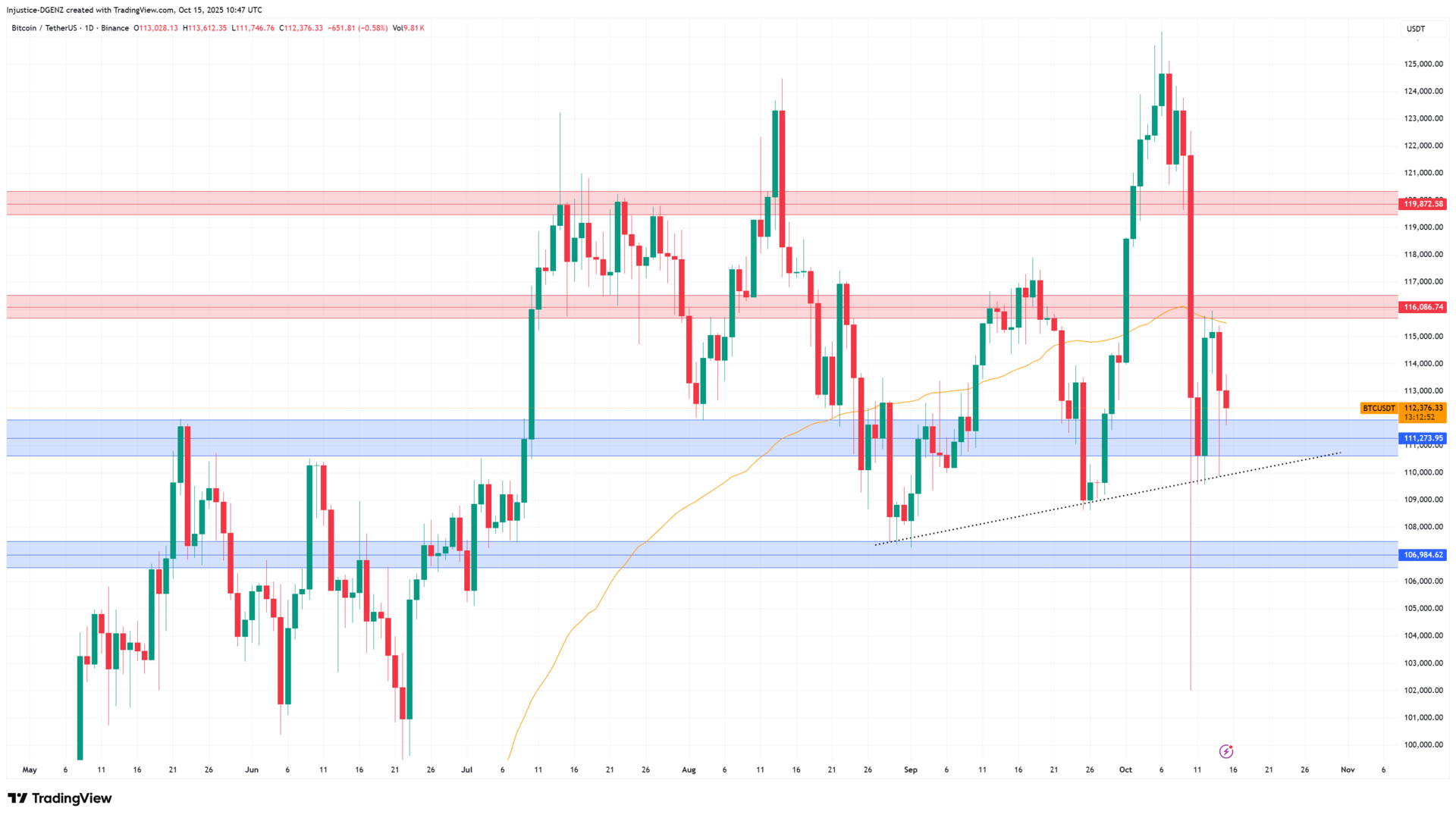

Bitcoin

Bitcoin has been repeatedly bouncing off this trendline since the beginning of September, and with 9 touches already it’s only a matter of time until this leads to a break down. If support gives way then its likely this leads to a ~50% wick fill, meaning we run lower to around $107k where our next level of support lies. All that being said, a bounce soon is still likely since we are currently retesting support again. Though, I wouldn’t expect to see that $116k break too easily since we also have our 1D QVWAP lying in the same region.

Total

If you want a true read on the crypto market’s health, zoom out to the $TOTAL chart. Unlike $OTHERS or $TOTAL2, this one includes Bitcoin’s dominance (currently ~59%) so it gives you a full picture of where the market’s headed. Back in early August, when everyone was bearish, we spotted a clean deviation on $TOTAL. That signal led the way before BTC took off, and it worked because it captured what price action alone couldn’t. Fast forward to now and BTC is pulling back, but I’m not sweating it. Why? Because $TOTAL just printed a confirmed deviation below the $3.65T–$3.75T support range. We’ve had back-to-back daily closes above that level since, which makes this more likely to be a bullish deviation retest. And this is usually when smart money buys the dip. Unless we see a daily close back under $3.65T, the broader market structure still leans bullish. BTC could wick down to $108K–$106K short term, sure, but that doesn’t break the macro picture, not until we lose $98K. The setup still favors upside from here.

Get up to $8,000 for free thanks to our partners at MEXC! Scan the QR code or simply click the image below to sign up and start trading with a massive bonus. Don’t miss out!

Token of the Week

Polygon - $POL

Polygon has fully transitioned from $MATIC to $POL as the native token for gas, staking, and governance across its upgraded Polygon 2.0 multichain ecosystem. $POL now powers everything: network security, cross-chain coordination, and growth incentives as Polygon seeks to become a unified “network of blockchains.”

What Does Polygon Do?

$POL serves three primary roles: it pays gas fees on Polygon chains (including Polygon PoS), enables staking to secure multiple chains simultaneously, and grants governance rights over protocol changes and treasury decisions. It also underpins ecosystem incentives (through its Community Treasury) and aligns token value with platform usage.

How It Works?

$POL is an ERC-20 used in Polygon Staking Hub smart contracts where validators stake $POL to validate multiple Polygon chains via restaking. Validators using the same stake can perform block production, zk-proof generation, sequencer roles, and data validation across chains. The AggLayer (Aggregation Layer) connects all chains, and POL stakers help secure and validate cross-chain transactions, bridging liquidity natively. Through Polygon CDK, new chains can plug into the ecosystem and optionally use $POL for staking and gas, leveraging the shared security model.

Tokenomics & Incentives

$POL started with a 10 billion token supply via a 1:1 swap from $MATIC. It introduces capped 2% annual emissions (200 million tokens/year) after June 2025. That emission is split 50/50 with 1% to validator rewards and 1% to the Community Treasury for grants and ecosystem funding. Governance can reduce (but not raise) emissions later. This model supports security while funding growth.

Ecosystem Impact

Since the transition, ~99% of $MATIC has been swapped to $POL, and Polygon PoS now uses $POL for transactions. The AggLayer is live, aggregating chains and enabling seamless cross-chain interactions, with connected chains like zkEVM and others already integrated. Through CDK, many emerging chains (gaming, DeFi, social) are building with shared validator access via $POL. This has the effect of concentrating security and liquidity under one token, while enabling scalable expansion.

Recent Developments

- In Sept 2024, Polygon PoS fully switched to $POL, all gas and staking now use $POL.

- New on-chain governance framework (councils, treasury boards) were established.

- Polygon PoS has undergone performance hard forks, raising throughput and lowering latency in preparation for the 2.0 architecture.

- Cross-chain connectivity is ramping; early integrations with zkEVM and external chains already using state proofs via the layer.

What’s Coming Next?

- Polygon PoS is expected to be upgraded into a ZK validium and fully integrated with the AggLayer, making it much more scalable and secure under $POL.

- Polygon aims to add dozens of new chains to its ecosystem; when they join, $POL stakers will share in those chains’ economics.

- The community could vote to reduce emission rates, balancing scarcity and growth.

- More dApps, DeFi, gaming, and real-world use cases built on Polygon 2.0 will drive demand for $POL, making the token more than just a gas coin.

TL;DR

$POL is the new native token for Polygon’s 2.0 era, replacing $MATIC in gas, staking, and governance. It empowers a shared validator/security model across multiple chains via restaking, backs the Aggregation Layer for native cross-chain activity, and funds ecosystem growth through emissions split between staking rewards and grants. With the transition mostly complete and expansion underway, $POL is now at the heart of Polygon’s ambition to scale to hundreds of interoperable chains under one unified token.

Technical Analysis

As we talked about earlier we have a clean deviation below support with a succesful retest and close back above. We are now currently retesting this area of support again so entering here gives us a high risk to reward play but save room to DCA within the box. A daily close below the box would be your sign to cut your losses and move on. Although it may only go into a ~10% drawdown to the lows, it could also drop much further to fill that big wick to the downside and flip this level to resistance.

Market Cap - $2,100,897,805

24HR Volume - $109,446,493

Current Price - $0.199

All-Time High - $1.29 (-84%)

All-Time Low - $0.1284 (+55%)

This information does not constitute financial advice. Always DYOR.

Want to stay ahead of the moves? Join our trading community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections | Dgenz Trade Calculator  The best way to manage risk and maximize your gains is with the right tools. Use the Free Dgenz Trade Calculator to size positions, track spot & futures trades, and master risk management across crypto, stocks, and forex markets. |

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!