- Dgenz Crypto Weekly

- Posts

- Dgenz Crypto Weekly 052

Dgenz Crypto Weekly 052

Your go-to newsletter for crypto market updates, trends and analysis.

Table of Contents

Market Pulse

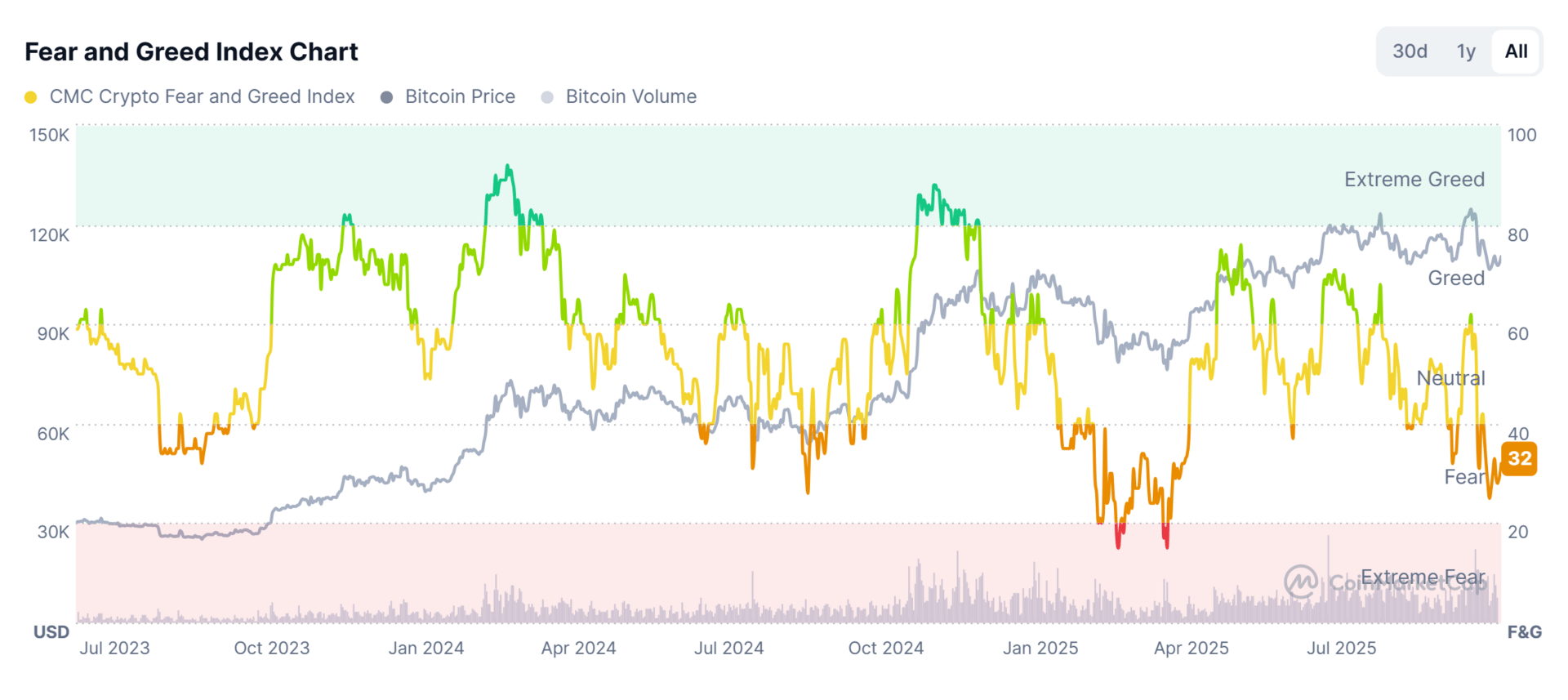

Markets Going Sideways, Sentiment’s Going Downhill

The charts might be snoozing after the October 13 crash, but sentiment? It’s falling off a cliff. The Fear & Greed Index took a nosedive from Neutral to Fear, and it’s teetering on the edge of Extreme Fear. Usually these dips are quick, a few days max, but this one’s overstaying its welcome at 10+ days and counting. Bad news? Vibes are trash. Good news? This kind of fear usually marks a local bottom. So yeah.. fear’s up, price is down, but this is often where the best setups are born. Chill out, zoom out, and prep your bags.

Fed Rate Cuts Now Just a Formality

After weeks of silence thanks to the government shutdown, the September inflation numbers finally dropped and the markets liked what they saw. The Consumer Price Index came in softer than expected across the board. Monthly inflation slowed to 0.3% instead of the projected 0.4%, and core CPI, which strips out food and energy, came in at 0.2%, also below forecasts of 0.3%. On the yearly view, headline CPI was 3.0%, a notch lower than economists anticipated and that was enough to send stocks flying. The Dow added 500 points, the Nasdaq ticked up 1%, and Treasury yields dipped back below 4%. Even Bitcoin saw a pop, jumping to $111.6k after the release. Behind the scenes, this puts more fuel on the fire for a Fed rate cut. Markets were already leaning in that direction, but after this data, they’re almost fully pricing in a 25bps cut at the next meeting with a 92% chance we see another cut in December as well. So while Washington might be at a standstill, Wall Street isn’t. Inflation is cooling, risk assets are crab walking, and the Fed’s next move is becoming more of a formality than a mystery.

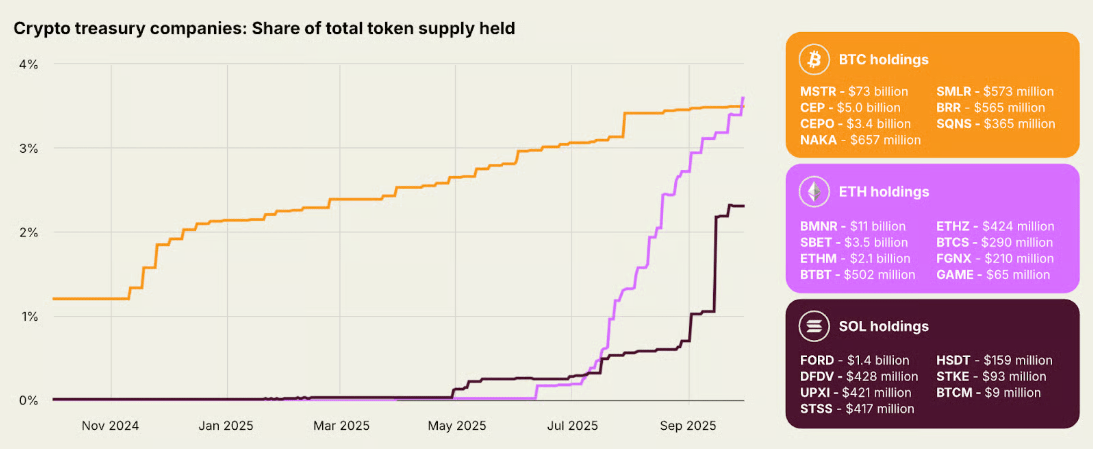

Supply Squeeze Surprise

Michael Saylor’s MicroStrategy ($MSTR) has been going full degen, throwing down a wild $7.3B+ on Bitcoin. Yeah.. that’s not a typo. Billions. With a B. And yet, it’s no longer the biggest story in town. Digital Asset Treasury (DAT) companies now collectively hold $82.56B in BTC and $18.09B in ETH. But here’s the twist: ETH is having a bigger impact on supply than BTC despite holding only a fifth as much. Why? Simple math. ETH is cheaper, so treasury buys lock up more of the total supply. And when supply tightens, price tends to rip. But let’s not forget our favourite coin, Solana went on an absolute tear last month and leads me to believe we may be retelling this story by years end in its favour instead.

Crypto’s Most Influential Event

This May 5-7 in 2026, Consensus will bring the largest crypto conference in the Americas to Miami’s electric epicenter of finance, technology, and culture.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus Miami will gather 20,000 industry leaders, investors, and executives from across finance, Web3, and AI for three days of market-moving intel, meaningful connections, and accelerated business growth.

Ready to invest in what’s next? Consensus is your best bet to unlock the future, get deals done, and party with purpose. You can’t afford to miss it.

Weekly Charts

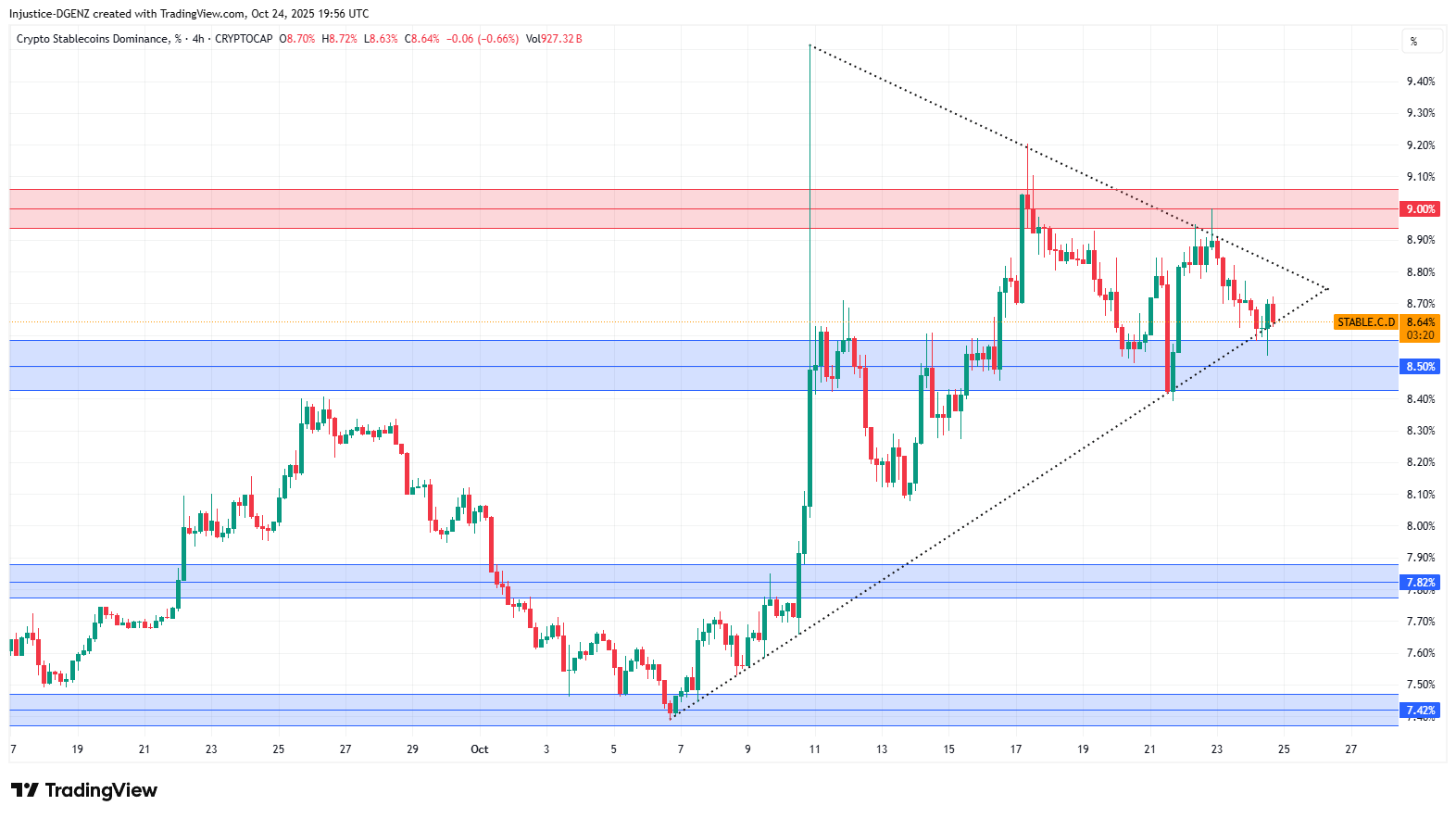

Stablecoin Dominance

$STABLEC.D is bouncing off its support and ascending trendline again but things are tightening up fast. Price is now wedged inside a shrinking triangle, and volatility is getting ready to pop. Odds are we break to the downside. But the real trigger stays the same: a clean 4H (ideally 1D) close below 8.4% for a confirmed breakout to activate our long bias. Until then? Expect more fakeouts, chop, and sideways pain. Unless you’re sniping top gainers or extreme movers on a market structure shift, the best play right now might be no play at all. Wait for the breakout and let stablecoin dominance show its hand.

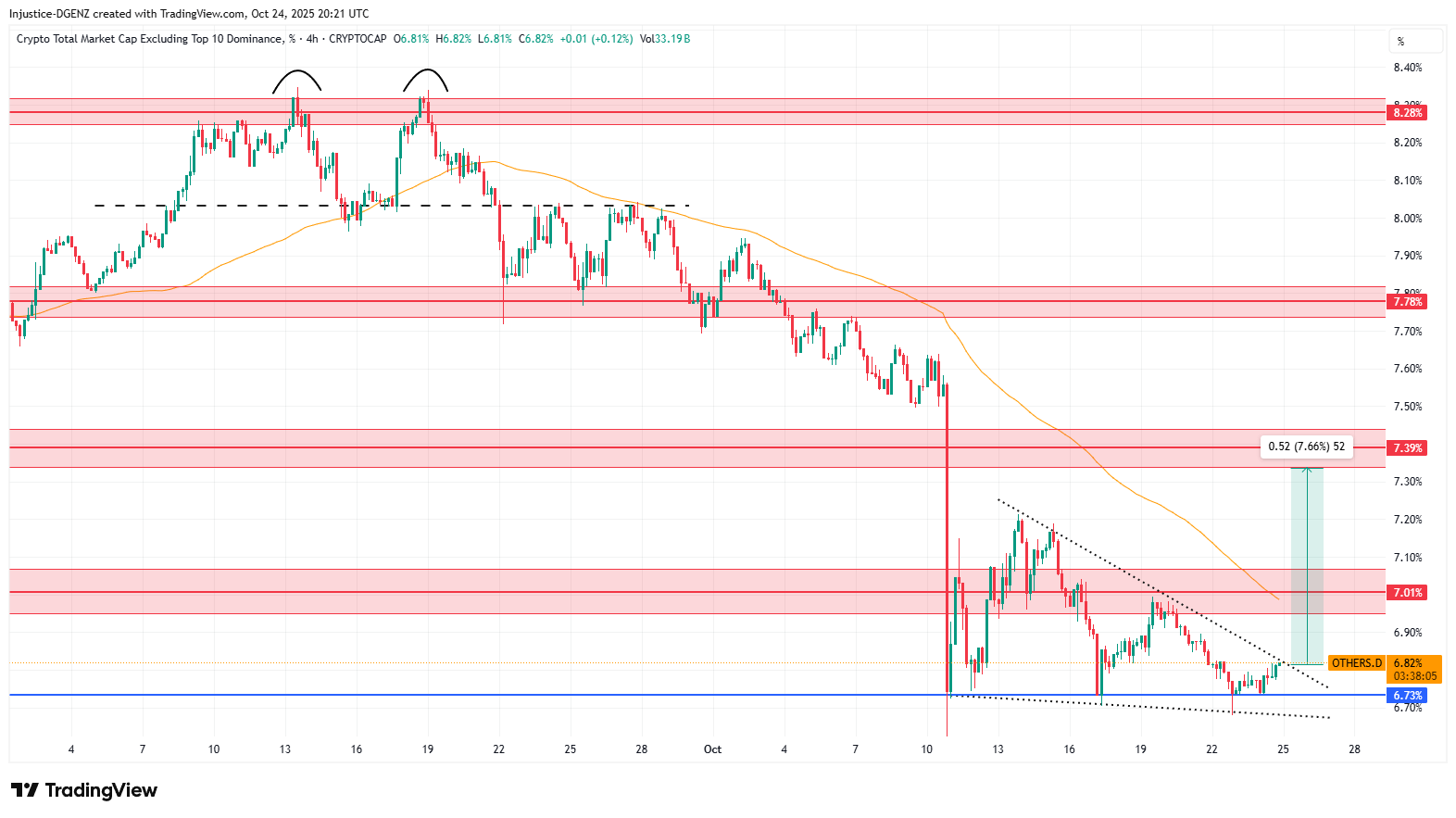

Others Dominance

The $OTHERS.D chart (aka total crypto dominance excluding top 10) is tightening inside a classic falling wedge, which is just technical speak for a downtrend that's losing steam and looking to pop. You’ll see it’s been printing clean lower highs and lower lows. But now? Compression is just about maxed out. It’s coiled like a spring and itching to move. The safest play for bulls here is a breakout followed by a clean retest. That’s your signal. The technical target? Around 7.4%, which is a full rip through the 7% resistance. But don’t forget, targets are just technical, not guarantees. Although it’s looking like the upside is starting to outweigh the chop. Sit tight, wedge breakouts are where the real moves begin.

Get up to $8,000 for free thanks to our partners at MEXC! Scan the QR code or simply click the image below to sign up and start trading with a massive bonus. Don’t miss out!

Token of the Week

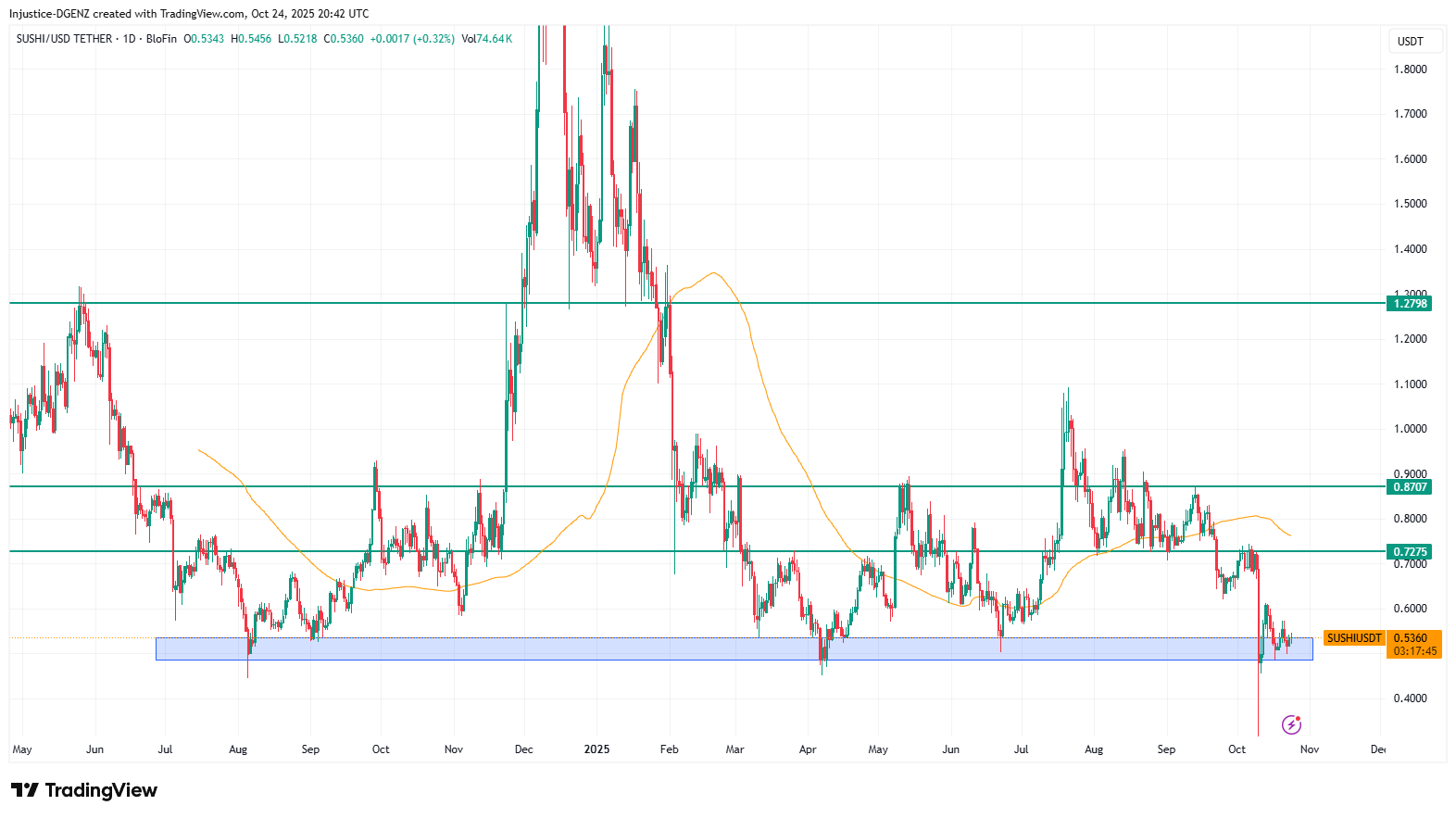

SushiSwap - $SUSHI

SushiSwap is a decentralized, multi-chain DEX that started as a Uniswap fork but evolved into one of DeFi’s most diverse ecosystems. With a suite of tools from AMMs to lending, xSwap to Kashi, and cross-chain swaps, Sushi aims to be the one-stop shop for everything DeFi, powered by the $SUSHI token.

What Does SushiSwap Do?

SushiSwap lets users trade crypto without a middleman using an automated market maker (AMM). Users can also earn yield by providing liquidity, borrow and lend assets, or use SushiXSwap to move tokens across chains. Sushi is deployed across 30+ blockchains and rollups, making it one of the most widely integrated DeFi protocols.

How It Works?

At its core, Sushi runs liquidity pools where users deposit pairs of tokens and earn a cut of trading fees. Those who stake LP tokens can earn $SUSHI, which can then be locked as xSUSHI for revenue-sharing from all protocol fees. SushiXSwap enables one-click cross-chain trades via Stargate, and newer products like Route Processor v2 optimize swaps with better pricing. The Blade AMM, now in development, promises IL-free swaps using time-based liquidity routing.

Tokenomics & Incentives

- Max supply: 250M $SUSHI (with emissions tapering off)

- Earn $SUSHI by farming LP pools or through staking

- Stake $SUSHI as xSUSHI to earn protocol fees and vote on governance

- Blade AMM will use $SUSHI as its fee token

- Governance handles fee structure, emissions, and treasury allocations

Ecosystem Impact

- Deployed on 30+ chains including Ethereum, Arbitrum, Polygon, BNB, and Base

- One of the first DeFi platforms to launch a cross-chain swap protocol

- Over $1.5B+ in cumulative protocol fees generated

- Partnerships include Stargate, LayerZero, Arbitrum, Optimism, and more

Recent Developments

- New core team led by Jared Grey has restructured Sushi’s governance and roadmap

- Launched Route Processor v2 and SushiXSwap to improve capital efficiency

- Working on Blade: a new AMM with no impermanent loss, targeting institutional LPs

- Building a new tokenomics model to make $SUSHI more deflationary and utility-driven

What’s Coming Next?

- Launch of Blade AMM with upgraded liquidity incentives

- Tokenomics 2.0 rollout to reduce emissions and boost xSUSHI rewards

- Further integrations with LayerZero and L2s to scale SushiXSwap

- Expansion of Sushi’s lending product to newer chains

TL;DR

SushiSwap is a DeFi veteran that’s evolving fast. They offer swaps, yield, lending, and now cross-chain liquidity. The $SUSHI token powers the ecosystem, offering governance, staking rewards, and future utility in Blade. With a refreshed roadmap, deflationary upgrades, and cross-chain traction, SushiSwap is positioning itself for a second wind.

Technical Analysis

Similar to the $POL call I made last week, we had a deviation below support with a succesful retest and close back above. We have been holding this area of support well so entering here gives us a solid 4R+ play given you DCA within the box down to $0.46. I will admit, I do have a soft spot for this coin, it made me a tonne of money back in 2021 when I rode it from a pretty similar spot as to where it is now, all the way up to $18. I doubt we see that again, but given the market lately, I would be stoked with a $1 this time.

Market Cap - $103,454,889

24HR Volume - $19,566,935

Current Price - $0.5365

All-Time High - $23.38 (-98%)

All-Time Low - $0.2548 (+110%)

This information does not constitute financial advice. Always DYOR.

Want to stay ahead of the moves? Join our trading community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections | Dgenz Trade Calculator  The best way to manage risk and maximize your gains is with the right tools. Use the Free Dgenz Trade Calculator to size positions, track spot & futures trades, and master risk management across crypto, stocks, and forex markets. |

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!