- Dgenz Crypto Weekly

- Posts

- Dgenz Crypto Weekly 053

Dgenz Crypto Weekly 053

Your go-to newsletter for crypto market updates, trends and analysis.

Free Alpha for a Year.. You’re Welcome

One whole year of Dgenz Crypto Weekly. That’s 365 days of surviving scammy launches, leverage addiction, Trump’s tantrums, and somehow still waking up bullish.

We didn’t get here with VC backing. No seed round. No influencer pumps. Zero funding. Just raw crypto alpha served straight to your inbox every damn week.

So if you’ve been reading since day one, or just hopped on the band wagon, respect. You’re a part of the Dgenz family now.

So today’s issue hits a little different. It’s not just a market recap, it’s a celebration of the grind, the gains, and the growing Dgenz community.

This week? Banger market calls, some spicy chart breakdowns, and as always, more alpha than your average TikTok guru could dream of.

Now, back to the charts!

Table of Contents

Market Pulse

Fed Week Is Here And It’s Spicier Than Usual

Yeah yeah, every Fed week is "the most important ever" but this time, it might actually be true. Here’s the deal:

The U.S. government’s been shut down, which means the Fed hasn’t had access to key economic data. No jobs numbers, no unemployment stats, nothing. Basically, they’re flying blind other than the softer than expected CPI data we saw last week.

And then there’s Quantitative Tightening (QT), aka the Fed’s "suck money out of the system" plan that started in 2022 might be coming to a surprise end this week. Most people, including myself, expected it in December, but the market's showing signs of stress and big dogs like JP Morgan and Bank of America think the Fed could pull the plug early.

So what’s that mean for you?

If the Fed ends QT and cuts rates this week, it’s technically bullish. But the thing is, everyone already expects that, so markets might just shrug. No shock = no pump.

The real alpha will be in Powell’s press conference. If he drops any hints about when they’ll start printing again (aka balance sheet expansion), then we might see some fireworks, but I’m doubtful he dives into it at this meeting.

So all in all, you can expect a small bounce, maybe some volatility, but don’t expect your ride to the moon to be taking off today… but, maybe tomorrow?

Trump & Xi Are About to Shake the Markets… Again

Get ready degens, we’ve got a real market-moving faceoff on Thursday.

Donald Trump and Xi Jinping are about to meet in South Korea, and this isn’t just another handshake and photo-op. It’s a full on trade war sequel with your portfolio in the crossfire. Here’s the quick backstory:

Tariffs are back on the table. Trump’s threatening 100% tariffs on Chinese imports by Nov 1st and China’s clapped back with rare earth export bans, triggering shortages in critical tech components. The last few weeks have been pure chaos fuelled by confusion.

Now, after some low-key progress in Malaysia, the two are meeting in-person for the first time since Trump got back in office. And the Nov 10 deadline for a trade truce is creeping up fast.

This kind of summit doesn’t just move headlines — it moves markets.

Every time Trump opens his mouth about tariffs, risk assets like crypto and stocks get smacked around. Think more volatility, less liquidity, and traders running for cover.

On the flip side, if this meeting ends in a handshake and a “yeah we all g bruh” you could see a short-term risk rally.

But don't get comfy. Here's what they’re fighting about:

Fentanyl

Trump slapped tariffs back in Feb over China not cracking down on fentanyl exports. If they strike a deal, some tariffs might get rolled back.

Rare Earths

China controls 90% of global rare earth processing. Their new export curbs = supply chain nightmares. Bad for tech stocks, messy for global markets.

Soybeans

China stopped buying U.S. soybeans. That’s tanked American farmer sentiment and stirred the political pot.

Russia

Trump wants Xi to quit buying Russian oil, or face more tariffs. It’s geopolitical judo.

Tech Chips

The U.S. banned advanced chip exports to China. China’s not happy. Neither are investors betting on Big Tech’s global revenue.

Taiwan

Beijing wants the U.S. to stop supporting Taiwan’s independence. If Powell’s pressers shake markets, this topic causes earthquakes.

Port Fees

Both sides are now taxing each other’s ships for docking. Petty? Yes. Expensive? Also yes.

TikTok

US assets are required to be sold to American buyers under US law. A finalized deal could be reached in this week’s meeting, Trump said.

Crypto’s Most Influential Event

This May 5-7 in 2026, Consensus will bring the largest crypto conference in the Americas to Miami’s electric epicenter of finance, technology, and culture.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus Miami will gather 20,000 industry leaders, investors, and executives from across finance, Web3, and AI for three days of market-moving intel, meaningful connections, and accelerated business growth.

Ready to invest in what’s next? Consensus is your best bet to unlock the future, get deals done, and party with purpose. You can’t afford to miss it.

Weekly Charts

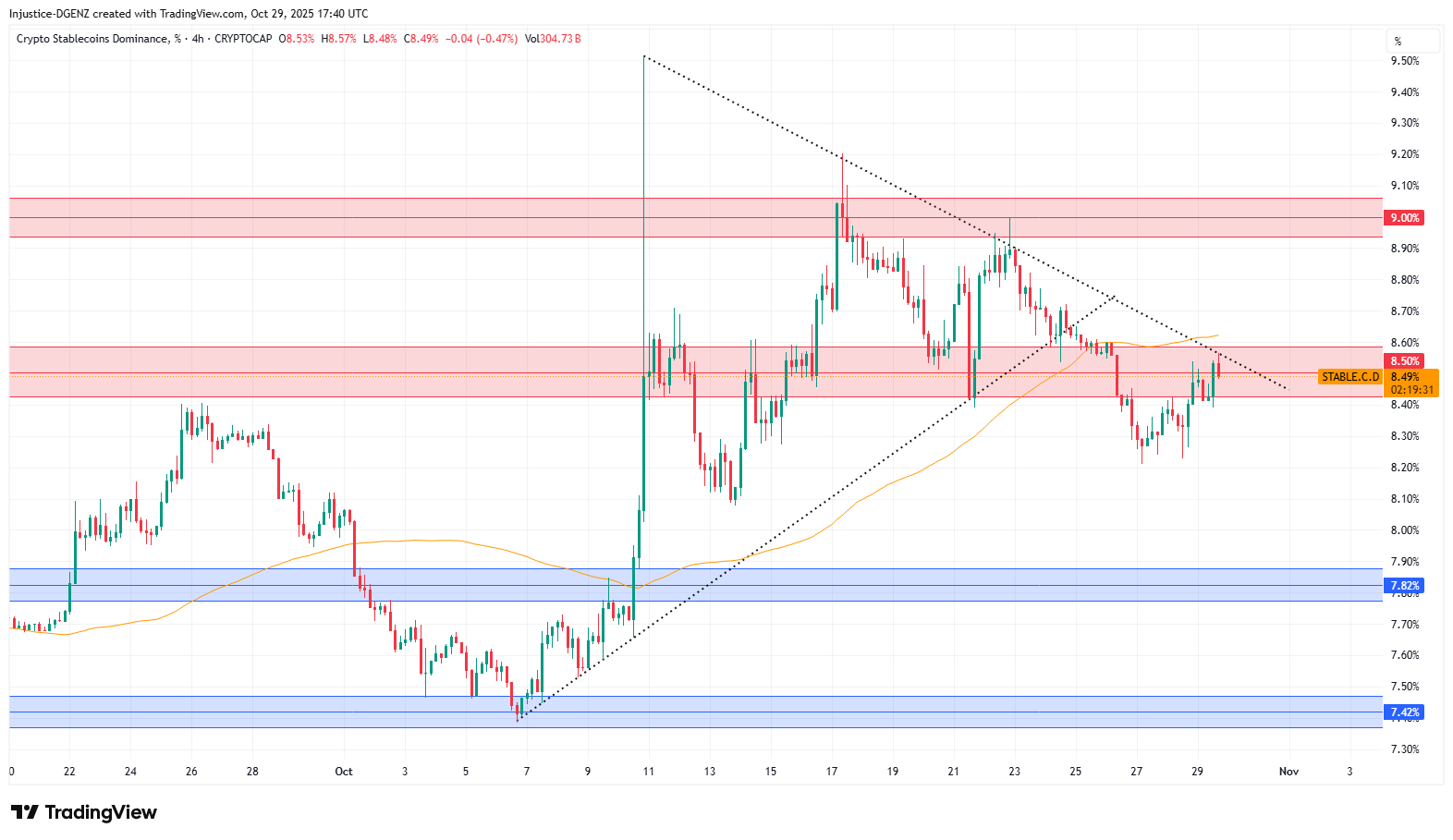

Stablecoin Dominance

As we discussed last week, $STABLE.C.D broke to the downside and even managed a daily close below what was our support, now turned resistance. And as you can see here we are currently testing this resistance as well as that downtrend. Not to mention we also have our 4H QVWAP line sitting just above resistance too so the likelihood of us breaking back above are slim, especially considering it’s the first retest. And if we know anything about first retests, it’s that they usually offer the biggest bounces. So I don’t think this little breather across the markets is done just yet, we should see more green. A pre FOMC pullback is pretty standard and not too much to fret over.

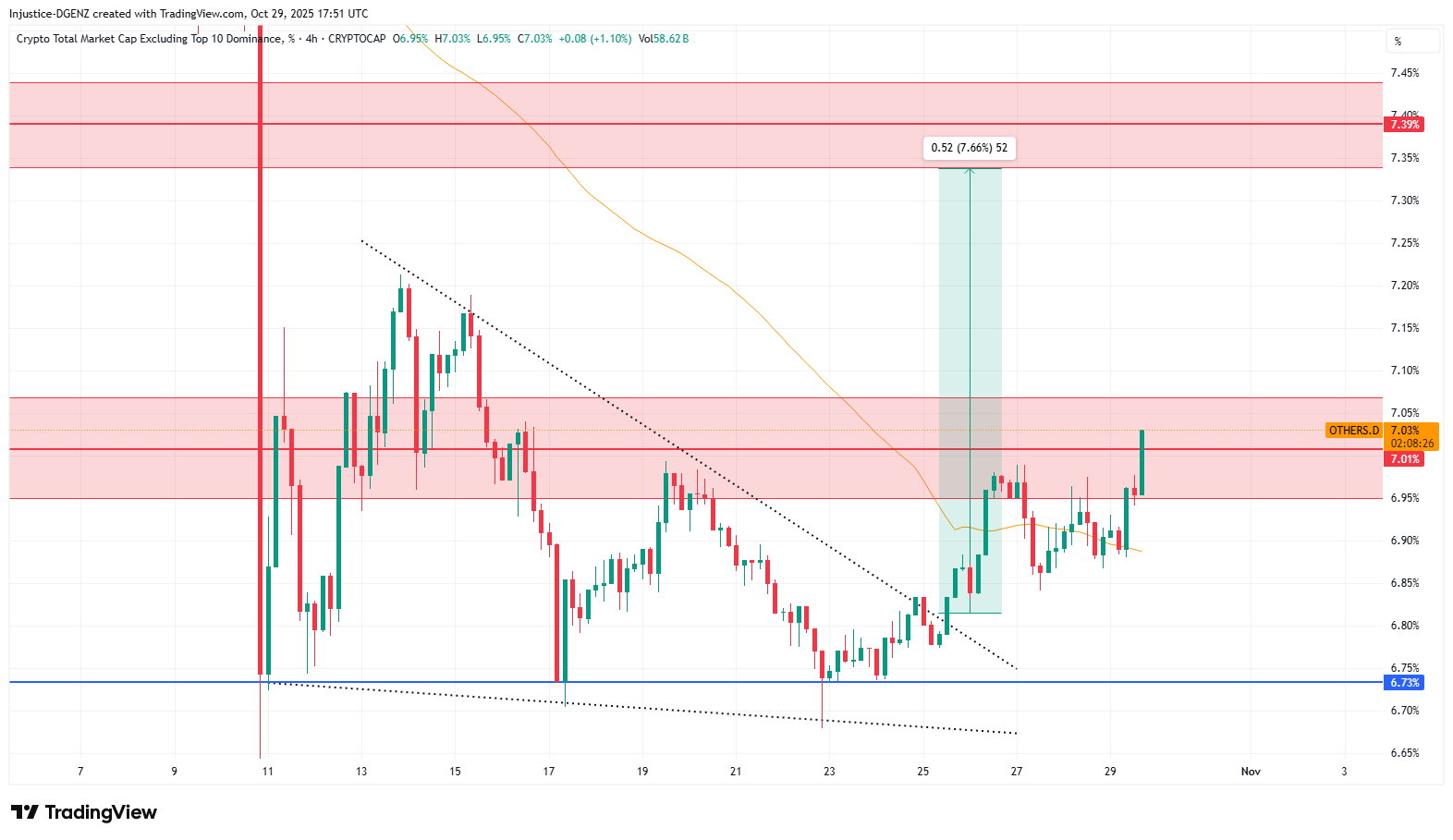

Others Dominance

The $OTHERS.D chart (aka total crypto dominance excluding top 10) broke out of the falling wedge we discussed last week and is currently testing our 7% resistance and hopefully heading towards our technical breakout target at 7.34%. One way to know if alts are going to continue climb is to monitor the daily chart and watch for a daily close above 7.01%. If we can close this daily candle where we are at now then we have a bullish change of character and can expect to see more upside. But, the rally could only last a day if the meeting between the US and China turns into another dick swinging contest.

Get up to $8,000 for free thanks to our partners at MEXC! Scan the QR code or simply click the image below to sign up and start trading with a massive bonus. Don’t miss out!

Token of the Week

Curve DAO - $CRV

Curve Finance is a decentralized exchange (DEX) designed for efficient swaps between similarly priced assets like stablecoins and liquid staking tokens. It’s one of DeFi’s core liquidity layers, operating across Ethereum and major Layer 2s like Arbitrum and Optimism. The $CRV token powers its governance, fee distribution, and liquidity incentives.

What Does Curve Do?

Curve enables low-fee, low-slippage trades between pegged assets (e.g., USDC/USDT or stETH/wETH) using a specialized AMM curve. It's ideal for large stablecoin swaps without moving market prices. Users provide liquidity to earn fees and $CRV rewards, while the protocol is widely integrated into other DeFi yield strategies.

How It Works?

Curve uses its StableSwap AMM algorithm, optimized for assets with similar values. Liquidity providers earn fees and $CRV rewards. $CRV holders can lock tokens into veCRV for up to 4 years to gain voting power, higher rewards, and a share of protocol fees. Curve runs on Ethereum and has deployed across L2s like Arbitrum, Optimism, Base, Polygon, and zkSync, expanding reach and liquidity access.

Tokenomics & Incentives

- CRV has a max supply of 3.03B with emissions tapering ~16% annually.

- Team/investors hold ~30%, with the majority distributed to liquidity providers.

- Locking CRV as veCRV boosts rewards and grants governance rights.

- veCRV holders direct CRV emissions via voting and earn a share of swap fees.

Ecosystem Impact

- Core infrastructure for DeFi liquidity and stablecoin routing.

- Heavily integrated into protocols like Convex, Yearn, and Lido.

- Deployed across 10+ chains with multi-billion-dollar cumulative volume.

- Pioneered vote-escrow tokenomics now copied across DeFi.

- Launched its own overcollateralized stablecoin: crvUSD.

Recent Developments

- Curve’s stablecoin crvUSD now live with ~$140M+ in circulation.

- Cross-chain pools now live on Arbitrum, Optimism, Polygon, and zkSync.

- Ongoing integration with LSD protocols and real-world assets.

- Improved UI/UX and community-led gauge weight voting governance.

What’s Coming Next?

- Deeper crvUSD integrations into lending markets and vaults.

- Curve v2 expansion into volatile assets and new pool types.

- Enhanced cross-chain liquidity routing and governance sync.

TL;DR

Curve is DeFi’s go-to DEX for stable and LSD swaps, powered by deep liquidity and precision AMMs. $CRV aligns users with long-term incentives through vote-locking (veCRV), giving governance rights and protocol fees. With cross-chain deployments, crvUSD expansion, and integrations across DeFi, Curve continues to play a foundational role in decentralized finance.

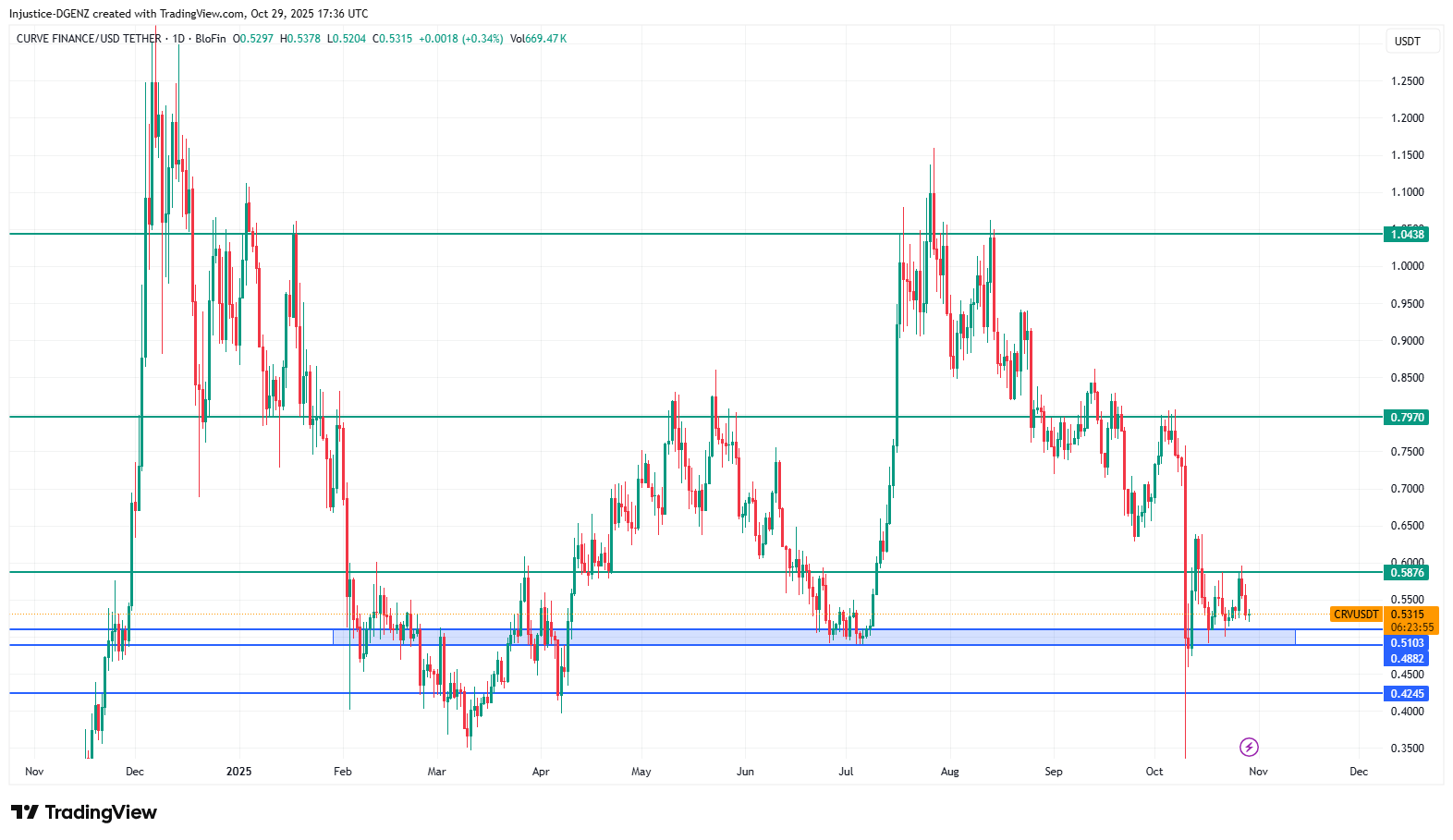

Technical Analysis

I’m looking to catch another pullback to our support in the blue box for an entry on $CRV. If you were to look at the line chart you would see we have broken the daily bearish structure with that last high. Personally, I will be buying at $0.5103 as I don’t expect this dip to be as deep, but I will DCA down to $0.4245 if the opportunity is given. This is likely to be a hold for at least a few weeks, but we may see our first take profit target come sooner if the market gets a breath of fresh air.

Market Cap - $748,409,413

24HR Volume - $468,014,942

Current Price - $0.5276

All-Time High - $15.37 (-97%)

All-Time Low - $0.1804 (+193%)

This information does not constitute financial advice. Always DYOR.

The Free Alpha’s Over, Broke Boyz Exit Here

Week after week, we’ve dropped alpha, nailed token picks, and helped our readers bank serious gains. How serious? Our Token of the Week picks have delivered over 947% total gains so far. That’s an average of 18% profit every single week.

If you’ve been with us for a while then you probably caught a bunch of these bangers and know how good these calls are, if not, then here’s a few of the highlights for you.

Unfortunately things this good don’t stay free forever, so starting next week, only the Market Pulse section will remain free for everyone. If you want access to our Weekly Charts and the Token of the Week deep dives, you’ll need to become a paid subscriber and upgrade to our Dgenz Insider Calls.

It’s only $4.99/month, that’s less than your venti green tea frappucino with a strawberry smoothie base, two pumps of caramel, three espresso shots, topped with whipped cream and a caramel drizzle. And let’s be real, we’re serving you up way better value.

Subscribe now so you don’t miss out on next week’s issue!

Want to stay ahead of the moves? Join our trading community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections | Dgenz Trade Calculator  The best way to manage risk and maximize your gains is with the right tools. Use the Free Dgenz Trade Calculator to size positions, track spot & futures trades, and master risk management across crypto, stocks, and forex markets. |

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!