Fear, Uncertainty & Doubt

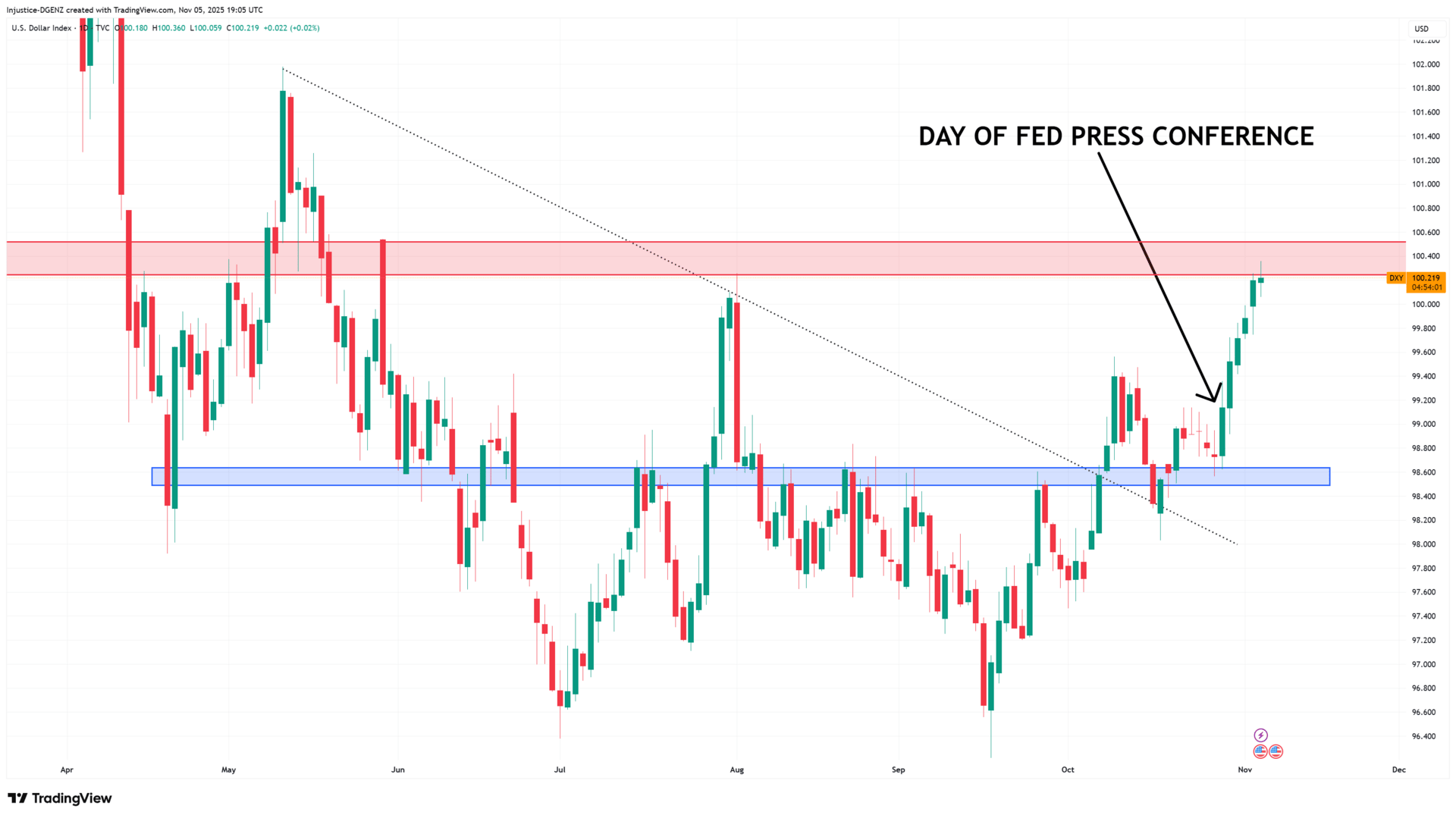

At the October 29 fed press conference, papa Powell came out swinging with a hawkish tone, basically saying “A rate cut in December? Yeah… don’t count on it.”

Translation for the non-macro nerds:

When the Fed keeps rates high, the dollar gets stronger. And big money loves that, it means they can earn a safe yield without touching risky stuff like crypto. And when TradFi suits are comfy earning 5% on cash, they’re not exactly aping into JPEGs or memecoins.

So what’s been pumping since Powell dropped the line?

You guessed it… the U.S. dollar.

But as you can see on the chart above we are now testing a key resistance area.

The higher this goes, the more pressure it puts on risk assets, so it’s good to keep an eye on whether this rejects here or breaks above and keeps the move going.

Institutions Getting Cold Feet

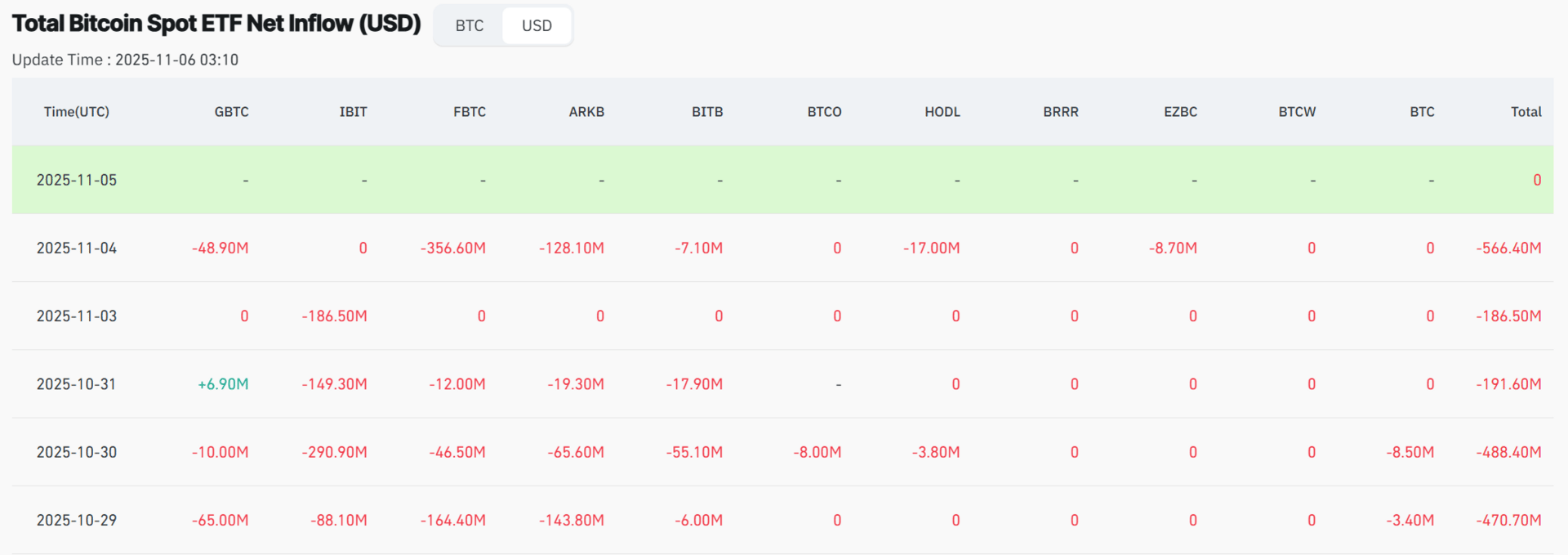

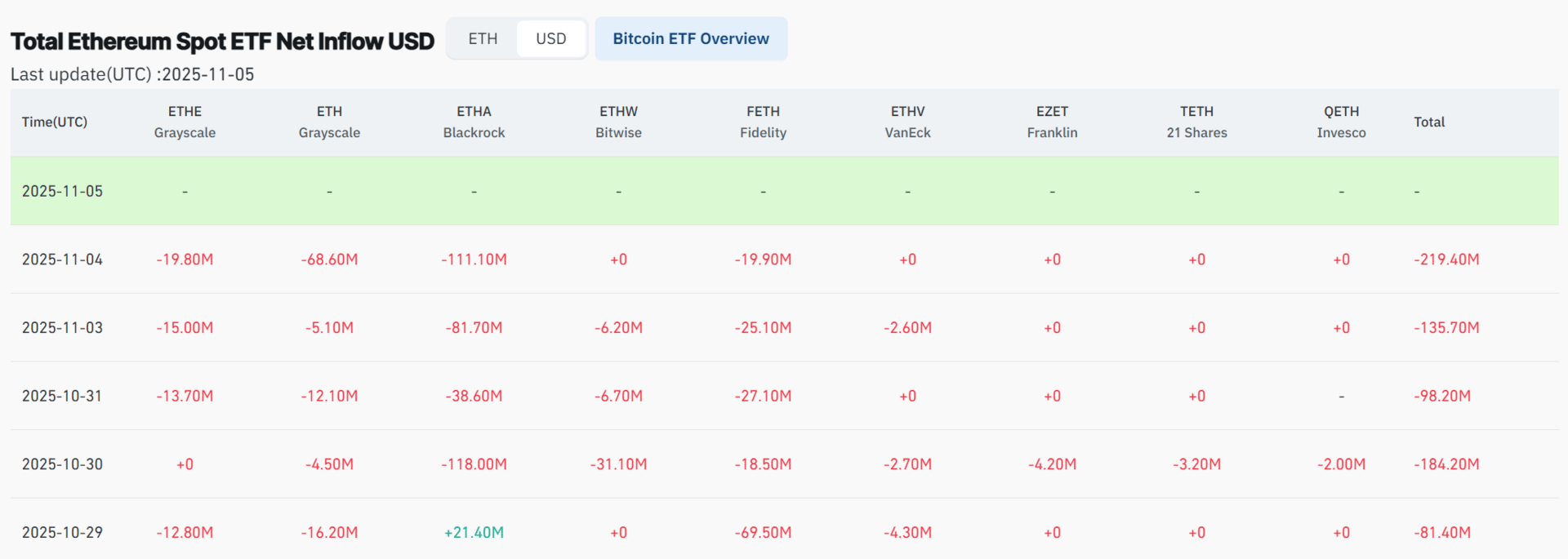

Powell’s comments even spooked the big dogs. Institutions started hitting the eject button and trimming risk from their portfolios. And guess what sits at the top of the “too spicy” list? Yep, crypto. When the suits start de-risking, they’re not selling bonds or blue chips first, they’re dumping their Bitcoin and alts.

From October 29 up until today, over $1.9 billion has left $BTC ETFs

Meanwhile, $718.9 million has left $ETH ETFs

Pelosi Made 178% While Your 401(k) Crashed

Nancy Pelosi: Up 178% on TEM options

Marjorie Taylor Greene: Up 134% on PLTR

Cleo Fields: Up 138% on IREN

Meanwhile, retail investors got crushed on CNBC's "expert" picks.

The uncomfortable truth: Politicians don't just make laws. They make fortunes.

AltIndex reports every single Congress filing without fail and updates their data constantly.

Then their AI factors those Congress trades into the AI stock ratings on the AltIndex app.

We’ve partnered with AltIndex to get our readers free access to their app for a limited time.

Congress filed 7,810 new stock buys this year as of July.

Don’t miss out on direct access to their playbooks!

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

So What Are The Results So Far?

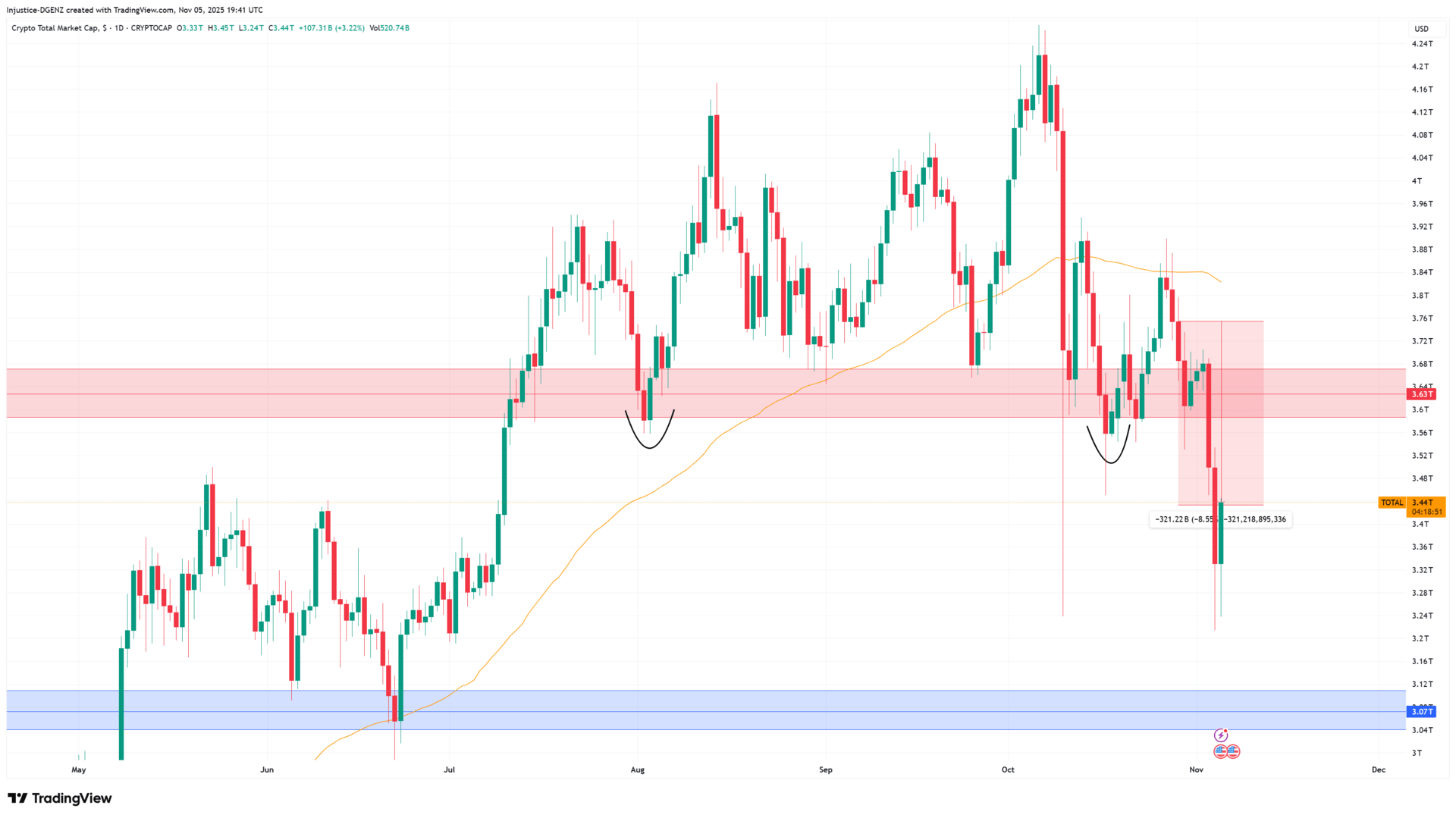

The total crypto market cap has dropped 8.5% losing over $321 billion.

$TOTAL does have a good support in the $3.2T range and with this sweep of the October 10 low we can treat it as an SFP, but don’t forget that $TOTAL has lost the $3.6T support and the first retest of this level is going to be one of the best shorting opportunities for anyone who missed this last leg down.

The Free Ride Ends Here.. But The Alpha Doesn’t

The rest of this newsletter is exclusive to our Dgenz Insider members.

Upgrade your subscription today to unlock access to all of the degen insights above, plus:

📈 Chart breakdowns of the majors like $BTC, $ETH & $SOL

🎯 Technical analysis on $USDT.D, $OTHERS.D, $BTC.D, $TOTAL and more

💰 Deep dives on our Token of the Week with key buy and sell levels

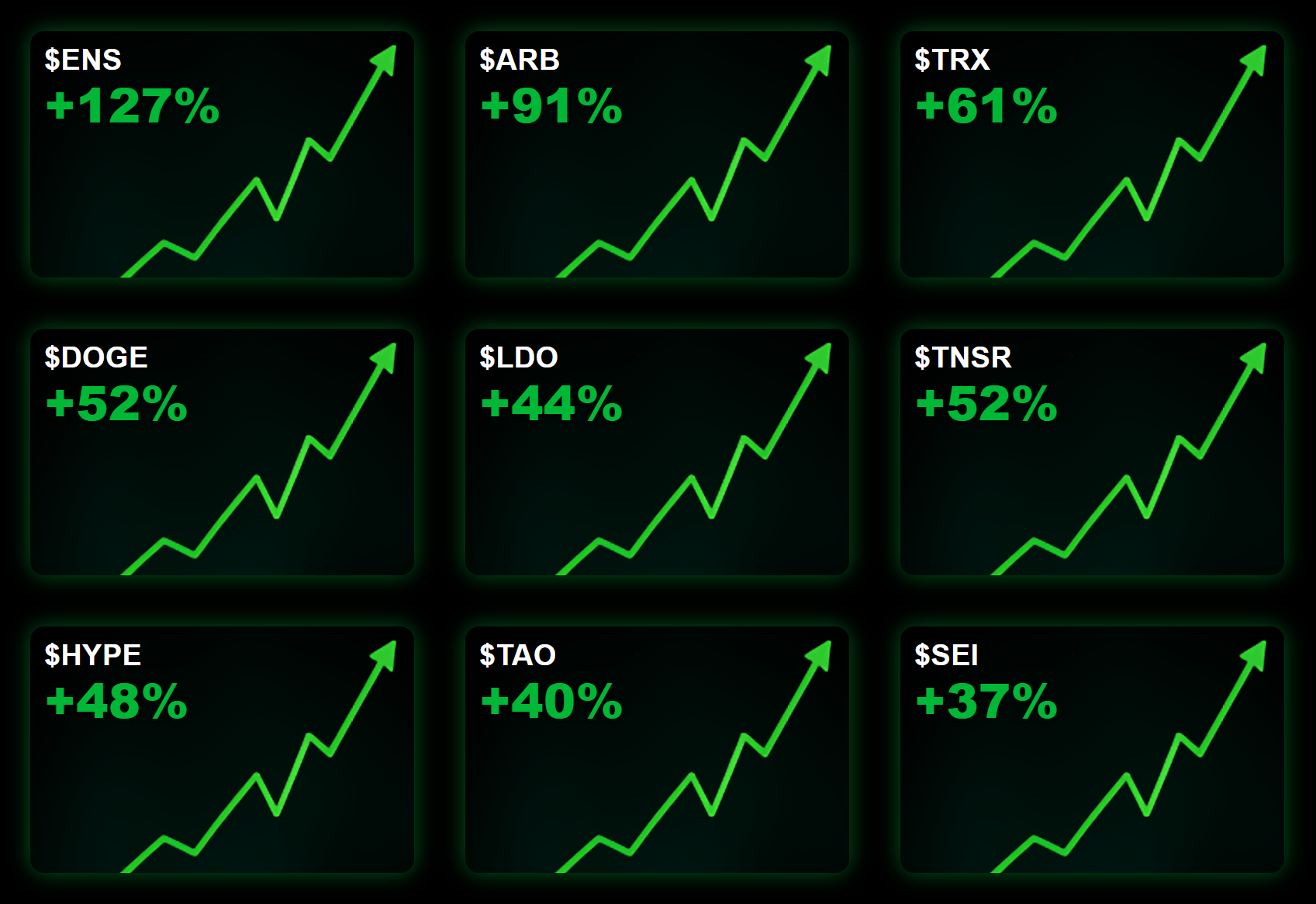

You’ve probably already seen what our calls can do, but if not, then let me tell you that over the last year we have delivered over 947% total gains to our readers for free.

That’s an average profit of 18% to be made every single week, and if you don’t believe me then you can go and read our first 50 issues here and see for yourself.

If you’re too lazy to do that then just take a look at some of our biggest wins below.

Want to stay ahead of the moves? Join our Discord community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections

Dgenz Trade Calculator

The best way to manage risk and maximize your gains is with the right tools. Use the Free Dgenz Trade Calculator to size positions, track spot & futures trades, and master risk management across crypto, stocks, and forex markets.

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!