Fear Meet Floor

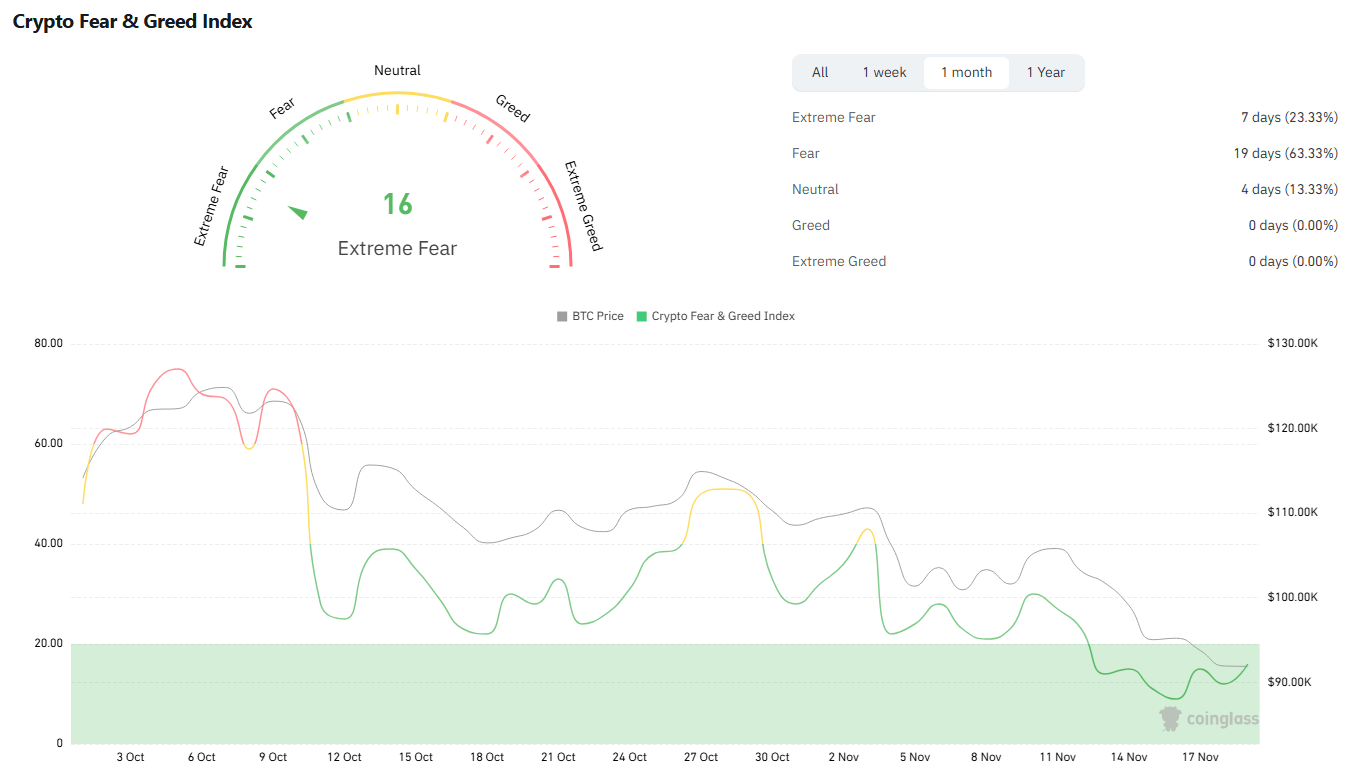

We’ve hit that part of the cycle where even your group chat’s loudest bull is suddenly quiet. The memes are gone. The hopium tank’s running on fumes. And the Fear & Greed Index? It’s deep in “oh no” territory.

In fact, we dropped from full-on Greed to Extreme Fear in just a little over a month.

This is the lowest sentiment we’ve seen since the Terra-Luna meltdown back in 2022.

And just like then, it ain’t comfy here. But here’s the silver lining: when you’ve hit rock bottom, there’s nowhere to go but up (unless we find a basement, which… yeah, let’s not).

Now don’t get too excited, we’re not saying all-time highs are next week. Historically though, crypto doesn’t hang around Extreme Fear for more than a month. And we’ve already been here since November 10th, so if history tells us anything then we should only have to endure this bloody mess for another 2-3 weeks. Clock’s ticking.

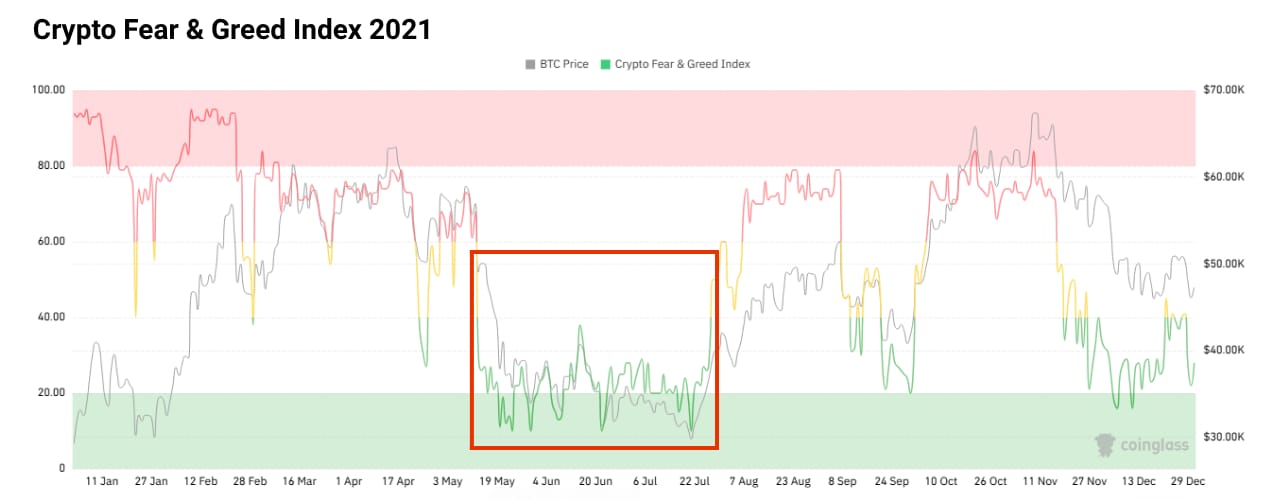

Need a reminder? In 2021, arguably the wildest bull run ever, we spent three months stuck in Fear territory right before Bitcoin doubled and the market entered up only mode.

So what’s the takeaway?

Yes, this market sucks. Yes, there could still be short-term pain. But we’re near max fear and that’s usually where opportunity knocks (quietly, so it doesn’t spook the bears).

There’s a reason Coinglass marks “Extreme Fear” in green and “Extreme Greed” in red. An it’s the same reason Warren Buffett said: “Be fearful when others are greedy, and greedy when others are fearful.”

When Death Comes Knocking

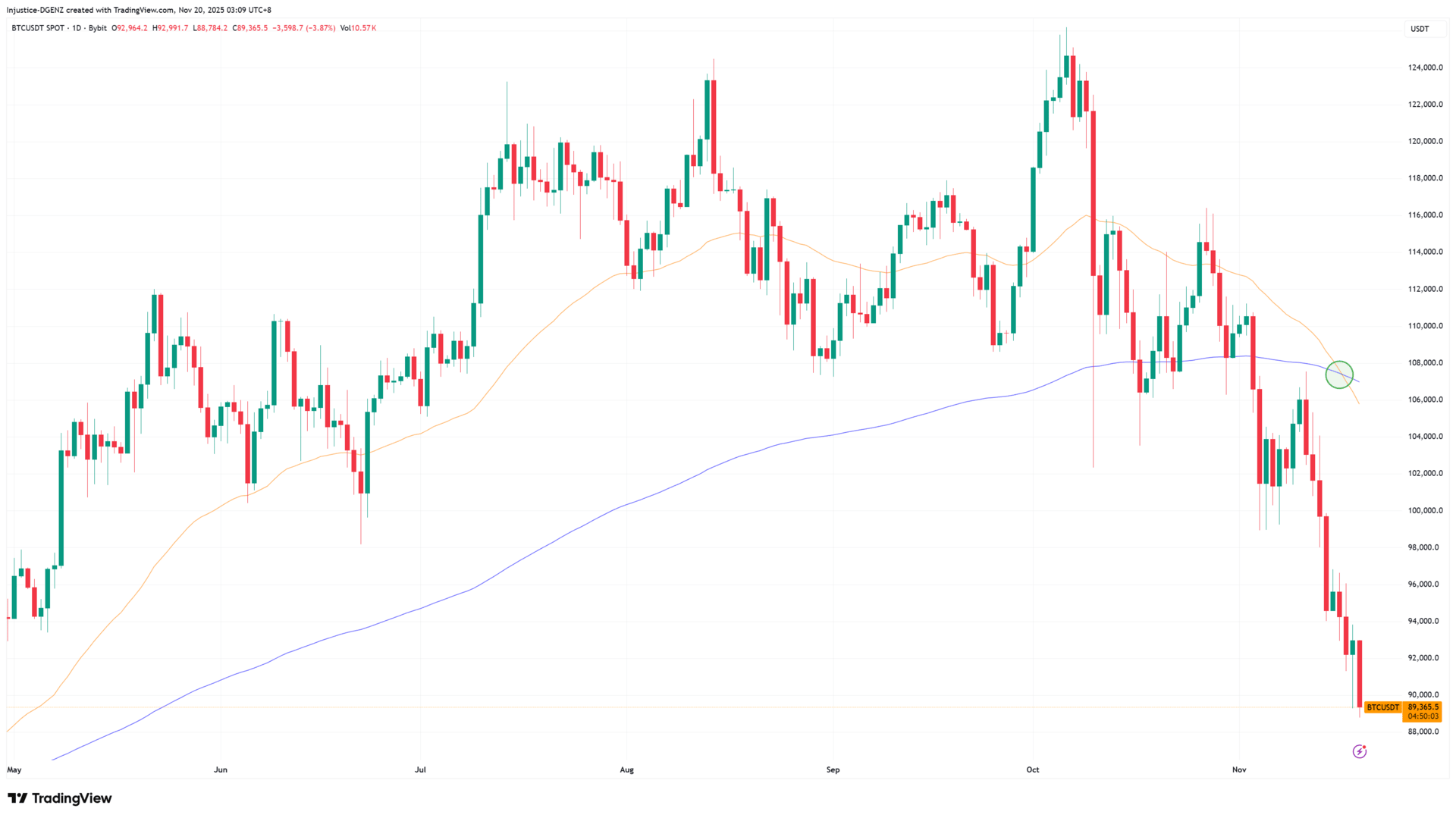

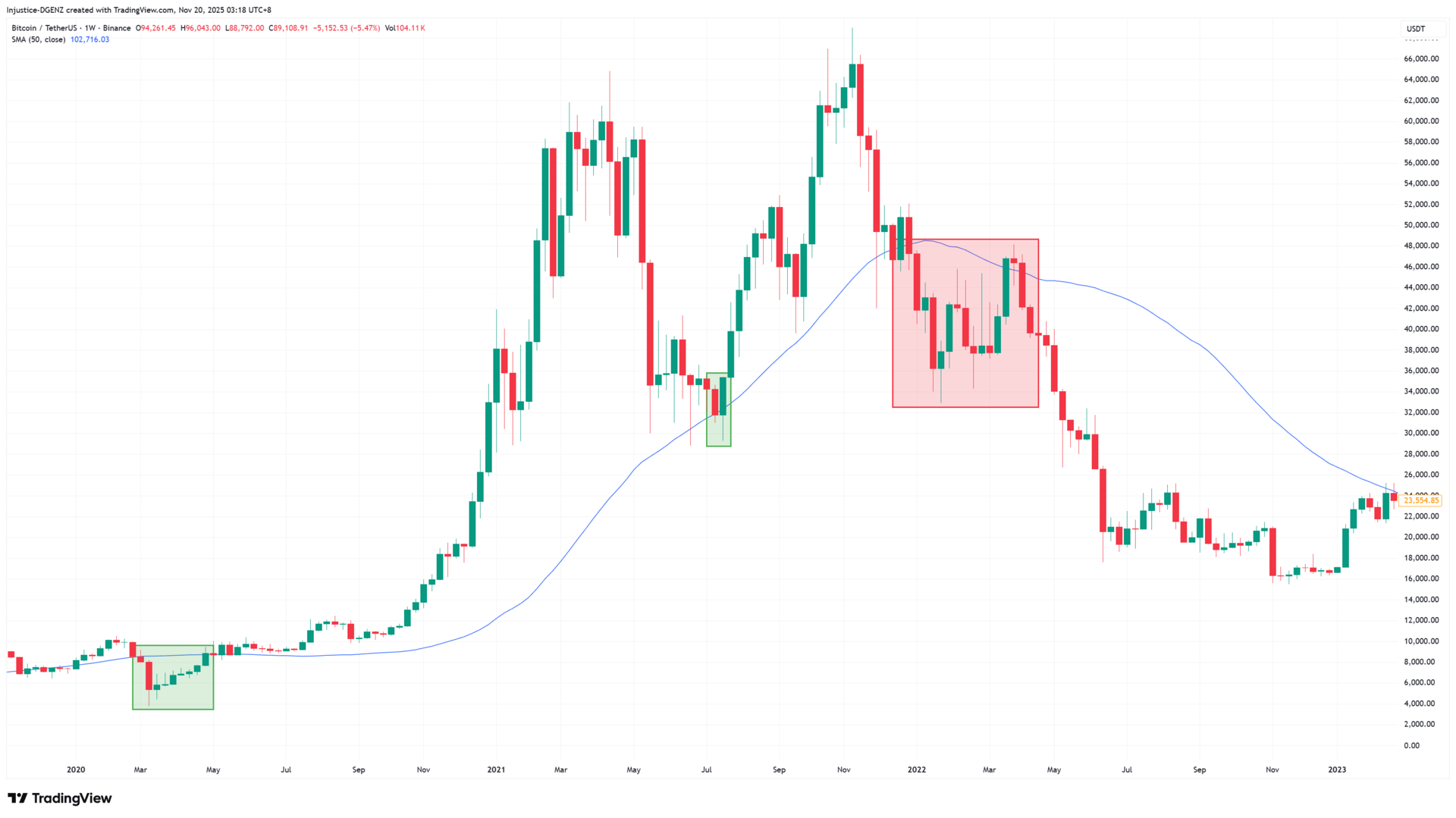

Bitcoin has triggered a death cross and the first weekly candlestick close below the 50-week moving average, two technical but critical signals that hint at a potential start to Bitcoin’s bear market.

A death cross occurs when the 50-day moving average crosses below the 200-day moving average. The popular bearish indicator suggests that short-term momentum is falling faster than the long-term trend, potentially signalling the start of a bear market.

$BTC is down nearly 14% this past week and now chilling at ~$89K. That’s after dumping below its 50-week moving average, a level that’s basically the market’s long-term heartbeat.

Flatline? Maybe. But there’s context…

While that close is definitely not bullish, it doesn’t always mean we’re diving into a bear cave. Let’s rewind:

2020: 2 months under the 50W MA… then BTC said “hold my beer” and 16x’d

2021: Closed under it again… then boom: a 2x and new ATHs

2022: Yeah, that one was rough. No recovery. Bear mode confirmed.

3 Newsletters That Are Worth Cluttering Your Inbox

We don’t shill often, but when we do, it’s bangers only.

Here are three free crypto newsletters worth your precious email real estate.

Stimulus. Liquidity. Fresh Cash.

So what’s the difference between the good timelines and the doom ones?

In 2020-2021, central banks around the world were basically firehosing money into the economy. Stimmy checks, rate cuts and QE everywhere.

The perfect cocktail for risk assets to send it.

Fast forward to now… and we might be back in that zone soon:

The US is preparing $2,000 stimulus checks

Japan is preparing a $110 billion stimulus package

China has approved a $1.4 trillion stimulus package

The fed is officially ending QT December 1st

Canada is restarting its QE program

Global M2 supply at a record $137T

320+ rate cuts globally in past 2 years

So while a close under the 50W MA is spooky, it might just be the pre-game stretch before BTC gets off the bench again.

This could be 2020 vibes in disguise. Or 2022 again. Too early to say. But the macro tailwinds are starting to shift in our favour.

Copium? Maybe.

History repeating? Also maybe.

But in crypto, maybe is often enough.

The Free Ride Ends Here.. But The Alpha Doesn’t

The rest of this newsletter is exclusive to our Dgenz Insider members.

Upgrade your subscription today to unlock access to all of the degen insights above, plus:

📈 Chart breakdowns of the majors like $BTC, $ETH & $SOL

🎯 Technical analysis on $USDT.D, $OTHERS.D, $BTC.D, $TOTAL and more

💰 Deep dives on our Token of the Week with key buy and sell levels

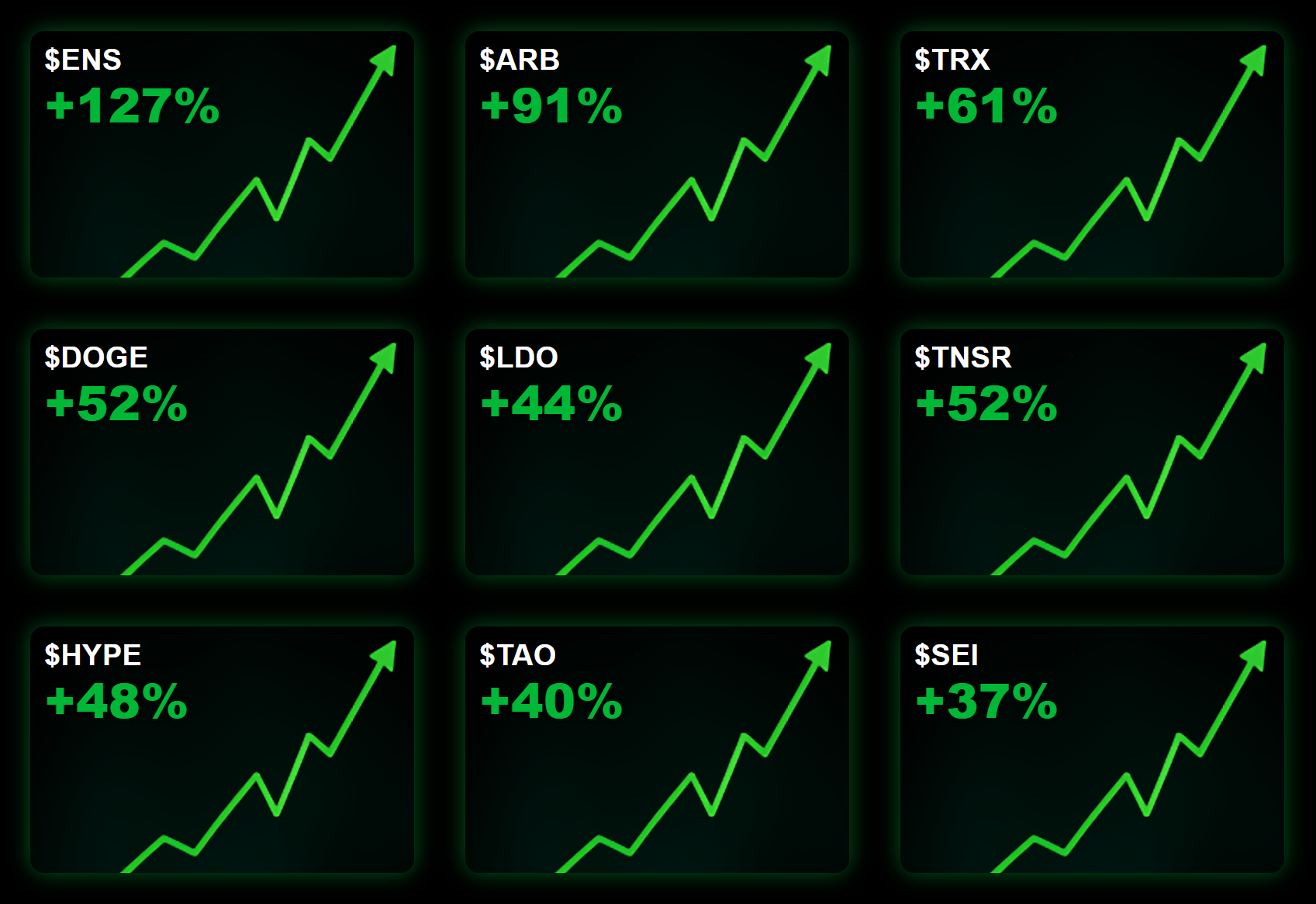

You’ve probably already seen what our calls can do, but if not, then let me tell you that over the last year we delivered 947% total gains to our readers for free. To put that into perspective for you, the S&P 500’s 2024 annual returns were 23.8%.

We gave an average profit of 18% to be made every single week, and if you don’t believe me then you can go and read our first 50 issues here and see for yourself.

If you’re too lazy to do that, I gotchu bro, just look at some of our biggest wins below.

Want to stay ahead of the moves? Join our Discord community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections

Dgenz Trade Calculator

The best way to manage risk and maximize your gains is with the right tools. Use the Free Dgenz Trade Calculator to size positions, track spot & futures trades, and master risk management across crypto, stocks, and forex markets.

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!