Ethereum’s Biggest Upgrade Just Landed

Ethereum just rolled out the Fusaka upgrade, and while the name sounds like a new sushi combo, it’s actually one of the biggest improvements to the network since Dencun in 2024. The short version: Layer 2s (L2) get cheaper, transactions get faster, Ethereum scales harder, and builders get more room to ship.

So… what is Fusaka?

You can put down your chopsticks, I’ll break it all down for you so it’s easy to digest.

Fusaka is the latest upgrade aimed at fixing Ethereum’s biggest bottleneck: data availability. Right now, rollups dump their data onto Ethereum, and Ethereum has to store, verify, and keep track of it. This is what keeps L2 fees from dropping even lower.

And this is where PeerDAS (Peer Data Availability Sampling) steps in, the headliner.

Instead of every node storing all the data, nodes only need to store 1/8 of it. This means Ethereum can handle 8x more data without increasing hardware requirements.

More rollup data = cheaper gas on L2s, faster transactions, more space for builders, and more users onboarded without clogging the main chain.

This is basically the upgrade that L2 teams have been begging for.

But Fusaka isn’t just about L2s. Ethereum Layer 1 (L1) gets a throughput upgrade with gas limits jumping from 45M → 60M, that’s roughly 33% more transaction capacity.

More gas = more transactions per block, more complex transactions allowed, and potentially lower fees during busy periods.

This is one of the biggest L1 capacity increases Ethereum has ever shipped and they only did it after months of benchmarking to make sure it’s safe.

Fusaka also introduced native r1 signature support which is the same cryptography used by Apple Secure Enclave, Android Keystore and hardware wallets. This makes logins, sign-ins, and secure operations way smoother for regular users.

And last but not least, deterministic proposer lookahead, yeah.. wtf does that mean.

Basically this reduces transaction confirmations from minutes to milliseconds. Think: instant confirmations, smoother user experience, and better reliability for things like trading, wallets, and payments.

So why should you actually care?

Because this upgrade directly impacts what you feel as a user:

L2 gas fees trend lower over the coming months

Transactions execute faster

Apps get cheaper to run

More room for new products on Ethereum

Wallet UX improves as phones gain native support

The chain becomes more scalable without sacrificing decentralization

It’s Ethereum slowly morphing into the thing it has always claimed to be:

A global, decentralized, high-throughput computer that doesn’t break during bull markets.

The Year-End Moves No One’s Watching

Markets don’t wait — and year-end waits even less.

In the final stretch, money rotates, funds window-dress, tax-loss selling meets bottom-fishing, and “Santa Rally” chatter turns into real tape. Most people notice after the move.

Elite Trade Club is your morning shortcut: a curated selection of the setups that still matter this year — the headlines that move stocks, catalysts on deck, and where smart money is positioning before New Year’s. One read. Five minutes. Actionable clarity.

If you want to start 2026 from a stronger spot, finish 2025 prepared. Join 200K+ traders who open our premarket briefing, place their plan, and let the open come to them.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Shark Bait Hoo Ha Ha

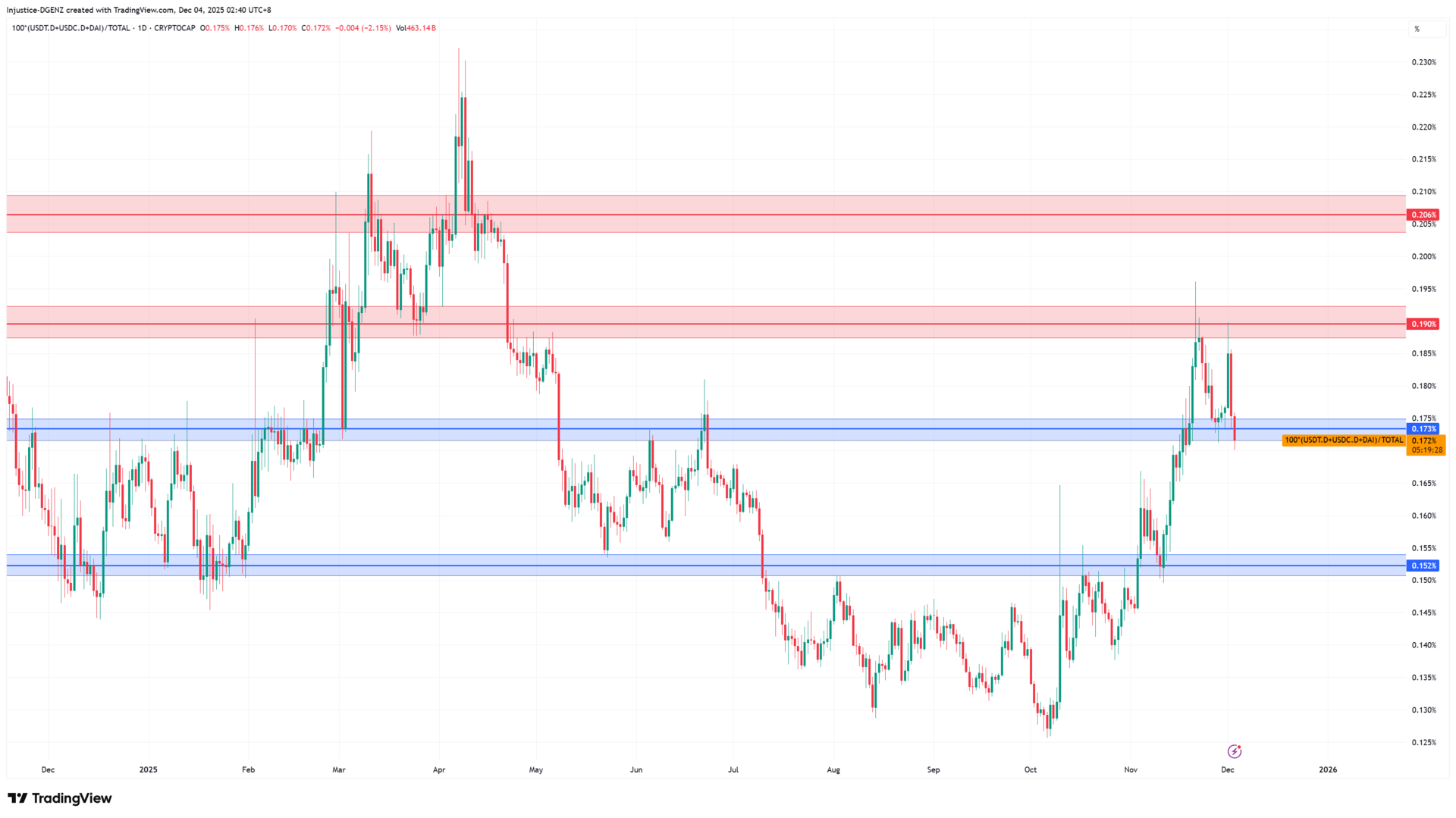

In last weeks issue I warned that the first retest of this support on stablecoin dominance was a bull trap, and indeed it was. Markets dumped on the bounce right up until we ran into that same resistance level I marked a few weeks back. This rejection did lead to some green relief yesterday, but unfortunately we are now back at this same support level again and currently sitting right on the lower bounds of it.

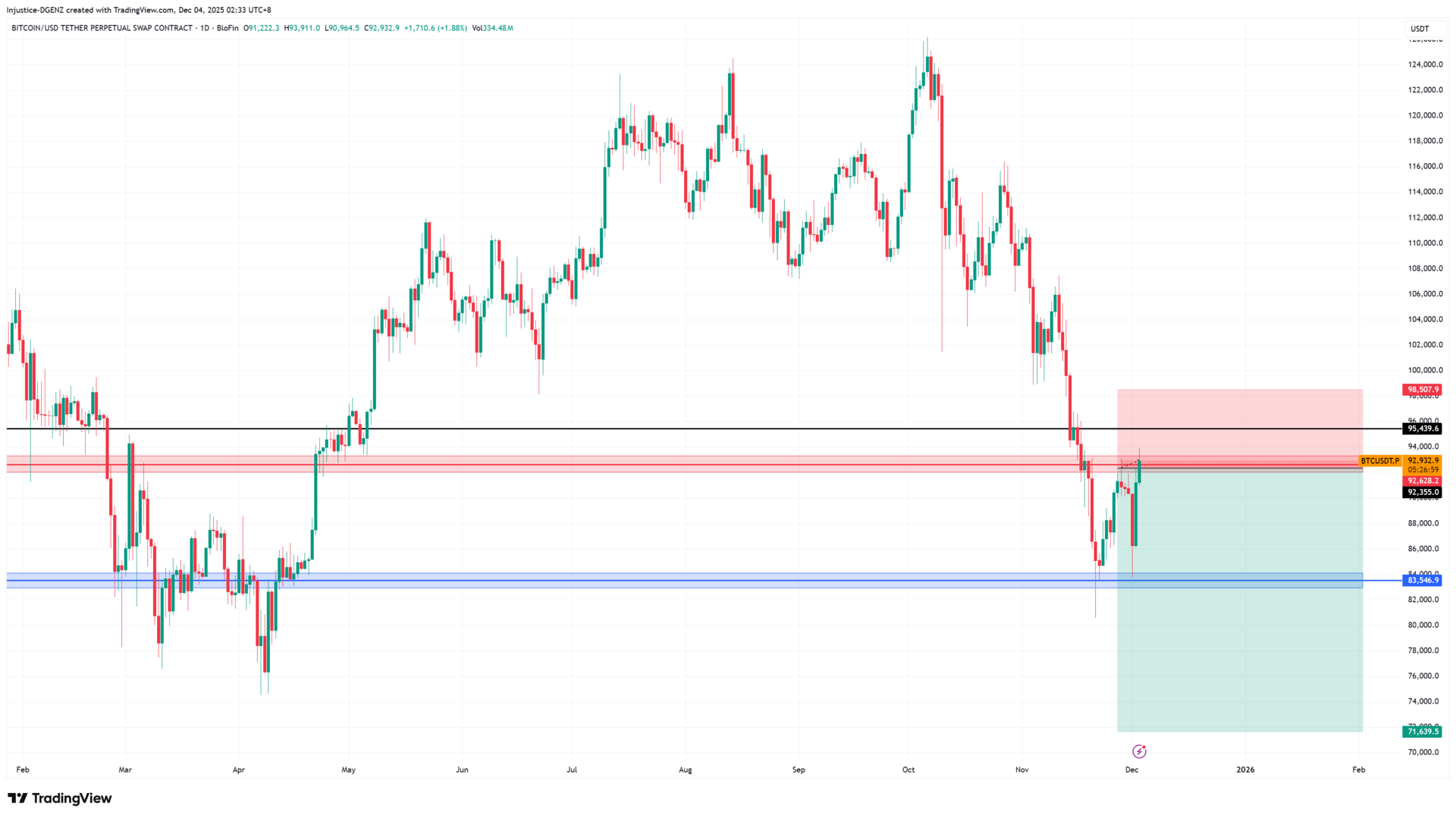

Every time the index has tapped this area in the past, the reaction has been decisive, so this is a point where we need to be cautious. At the same time, Bitcoin itself is hovering around the $93K resistance which creates a perfect confluence scenario.

Last week in our exclusive Dgenz Insiders section I gave this short on $BTC which played out well but unfortunately stopped us out at breakeven. Now, this short is still valid for re-entry since we are at resistance but it now comes with added risks I will outline below.

First, we have multiple high impact economic events lined up this week extending into the next one too and secondly, bitcoin’s constant consolidation right below $93K is something that should not be ignored. Compression under a major resistance zone often leads to a larger breakout, and entering here could result in being caught on the wrong side of a sudden move.

If we see a daily close below 0.172% on stablecoin dominance, I will enter a long on bitcoin instead and look to scale out at our next resistance of $98k. A breakdown here means the index will move towards the next major support at 0.152%, which is significantly lower and should take bitcoin back towards the $103K–$105K range.

But, if we do not get a daily close below 0.172%, then we remain trapped inside the current danger zone where a bigger drop remains very possible.

Make or Break.. Again

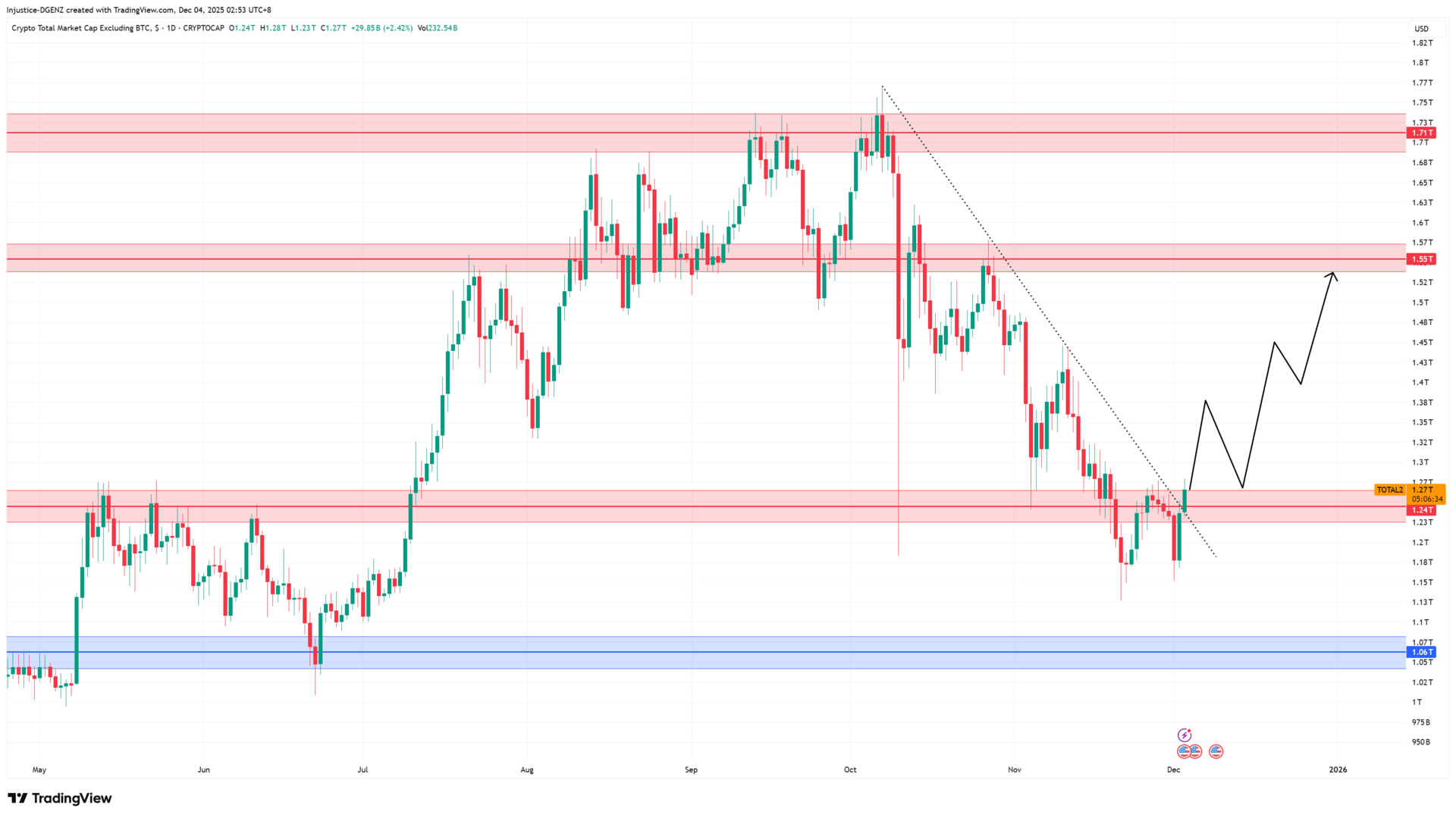

Another chart to keep your eyes on is the $TOTAL2 chart.

We have a daily trendline breakout happening but it is also still at a big resistance.

A daily close above $1.26T is your trigger to buy and price is already trading right there. But as long as it’s still trading under this resistance there is no reason to be buying just yet, wait for the daily to close above before you go apeing in.

Still Paying Full Price to Trade?

Real traders don’t do KYC, don’t wait for withdrawals, and don’t pay 1% in fees.

Our partners at BloFin give you the edge on all 3.

Sign up today and enjoy 10% off for life.

The Free Ride Ends Here.. But The Alpha Doesn’t

The rest of this newsletter is exclusive to our Dgenz Insider members.

Upgrade your subscription today to unlock access to all of the degen insights above, plus:

📈 Chart breakdowns of the majors like $BTC, $ETH & $SOL

🎯 Technical analysis on $USDT.D, $OTHERS.D, $BTC.D, $TOTAL and more

💰 Deep dives on our Token of the Week with key buy and sell levels

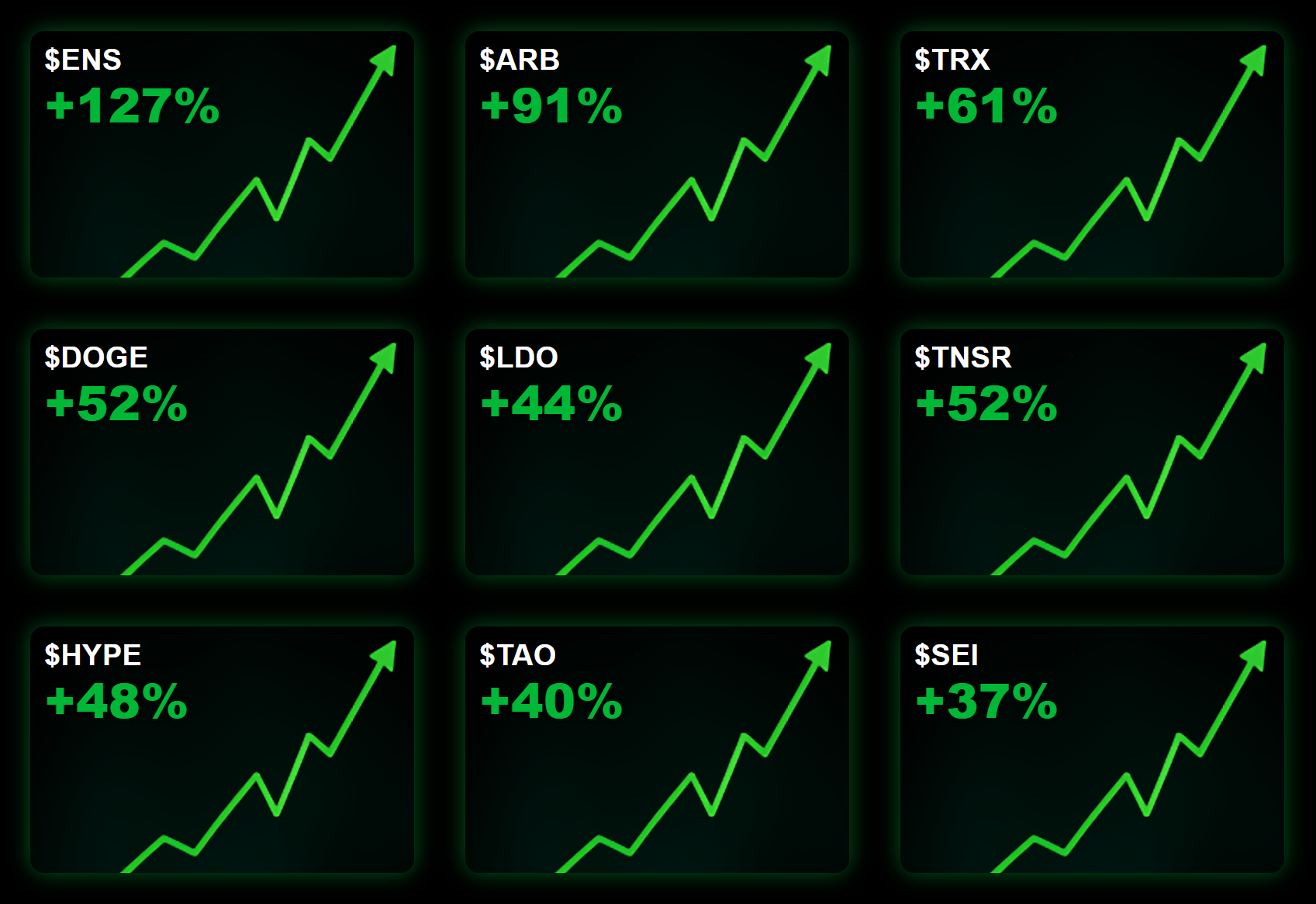

You’ve probably already seen what our calls can do, but if not, then let me tell you that over the last year we delivered 947% total gains to our readers for free. To put that into perspective for you, the S&P 500’s 2024 annual returns were only 23.8%.

We gave an average profit of 18% every single week, and if you don’t believe me then you can go and read our first 50 issues here and see for yourself.

If you’re too lazy to do that, I gotchu bro, just look at some of our biggest wins below.

Want to stay ahead of the moves? Join our Discord community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections

Dgenz Trade Calculator

The best way to manage risk and maximize your gains is with the right tools. Use the Free Dgenz Trade Calculator to size positions, track spot & futures trades, and master risk management across crypto, stocks, and forex markets.

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!