Market Pulse

Welcome to 2026 - The Year of Good Times

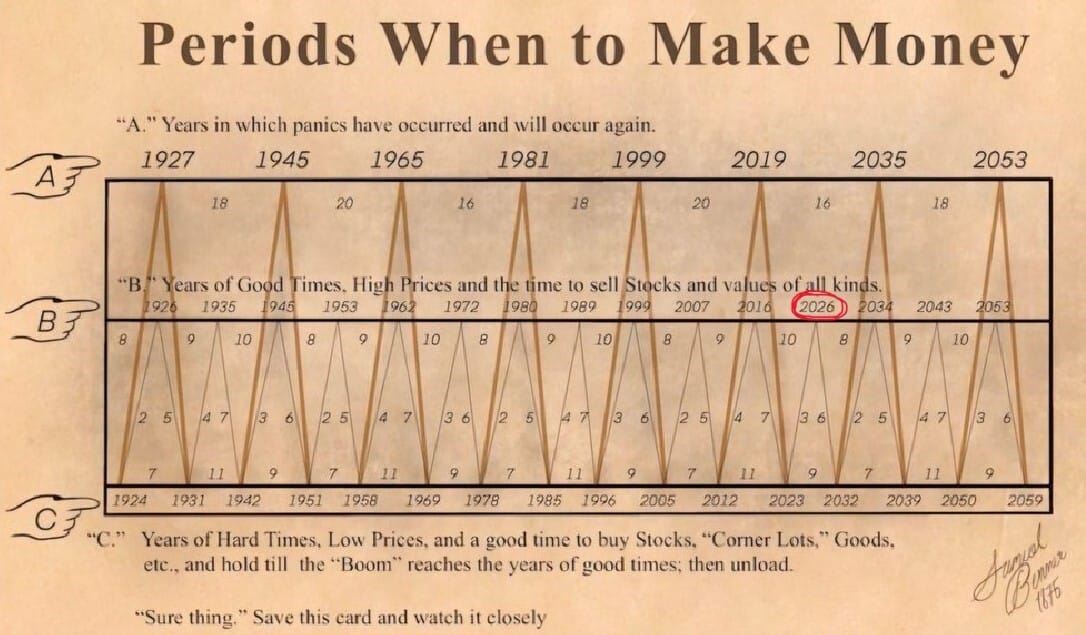

If you’ve been in crypto long enough, you’ve probably seen this mysterious chart doing the rounds. It’s from 1875 and somehow manages to line up with major market cycles. According to it, 2026 is supposed to be a year of good vibes, high prices, and the perfect time to cash in.

Whether you believe in technicals, fundamentals, or ancient financial prophecy scrolls, one thing is clear. We are entering a chapter filled with potential.

Let’s take a look at why this year might deliver the goods, and maybe even the long awaited altseason everyone has been screaming for.

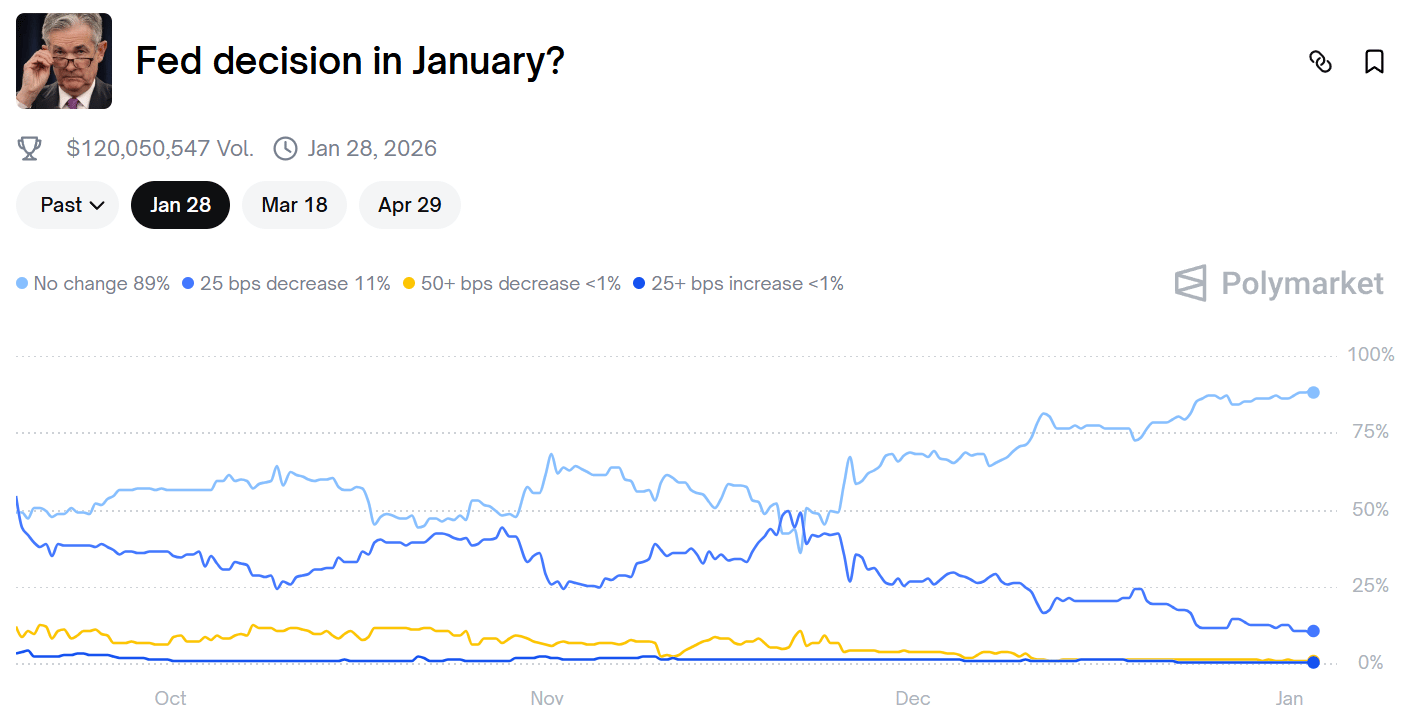

A Whole Year Ahead of Potential Rate Cuts

The Federal Reserve has eight FOMC meetings scheduled for 2026. That means eight possible chances to start lowering interest rates and loosening financial conditions.

Right now the January meeting looks boring with an 89% chance we see no change, but March & April are shaping up as a coin toss between no cut or a 0.25% cut. Ideally we want to see those odds tilt toward multiple cuts across the year.

Lower rates mean cheaper borrowing. That leads to more money sloshing around. And when the economy starts to heat up again, some of that capital spills over into risk assets. Yes, that means altcoins too.

The Market Structure Bill Could Unleash the Big Dogs

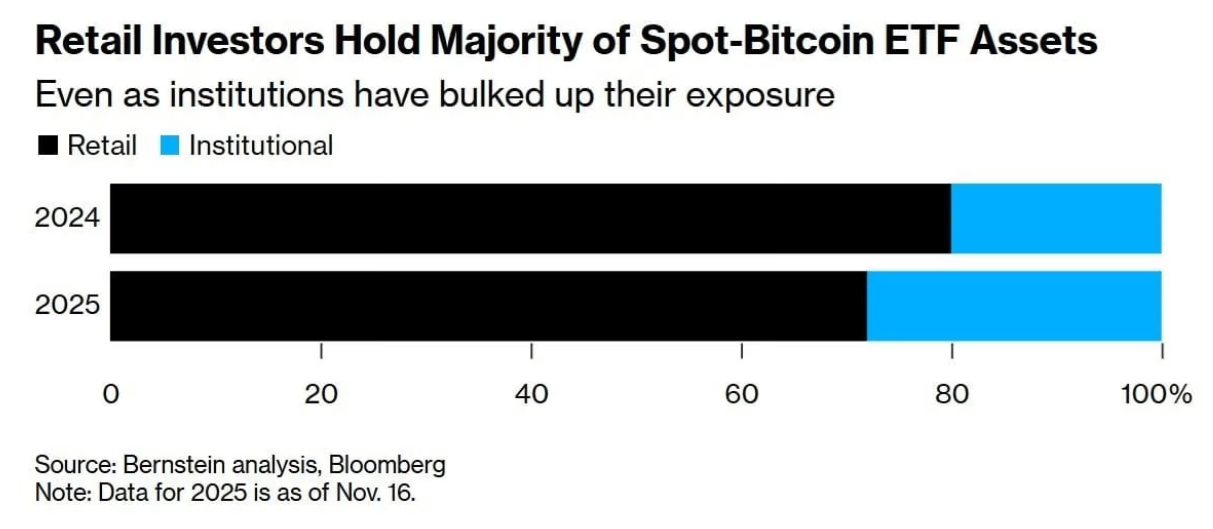

Institutions are not ignoring crypto. They are just waiting for permission to enter the arena.

Right now only a handful of tokens are clear for institutional investing. Everything else is in a regulatory grey zone. That is where the Market Structure Bill comes in.

If it passes in 2026, it could officially open the gates to billions of dollars in institutional capital. And since markets are forward looking, even early signs of progress could send prices moving ahead of time.

Keep in mind, institutions are not likely to ape into low cap meme coins. They will rotate into the majors first. The more legitimate the project, the more attractive it becomes for serious capital.

This thing could hand the steering wheel to institutions, you know.. the ones with deep pockets and a habit of pushing prices vertical.

3 Newsletters That Are Worth Cluttering Your Inbox

We don’t shill often, but when we do, it’s bangers only.

Here are three free crypto newsletters worth your precious email real estate.

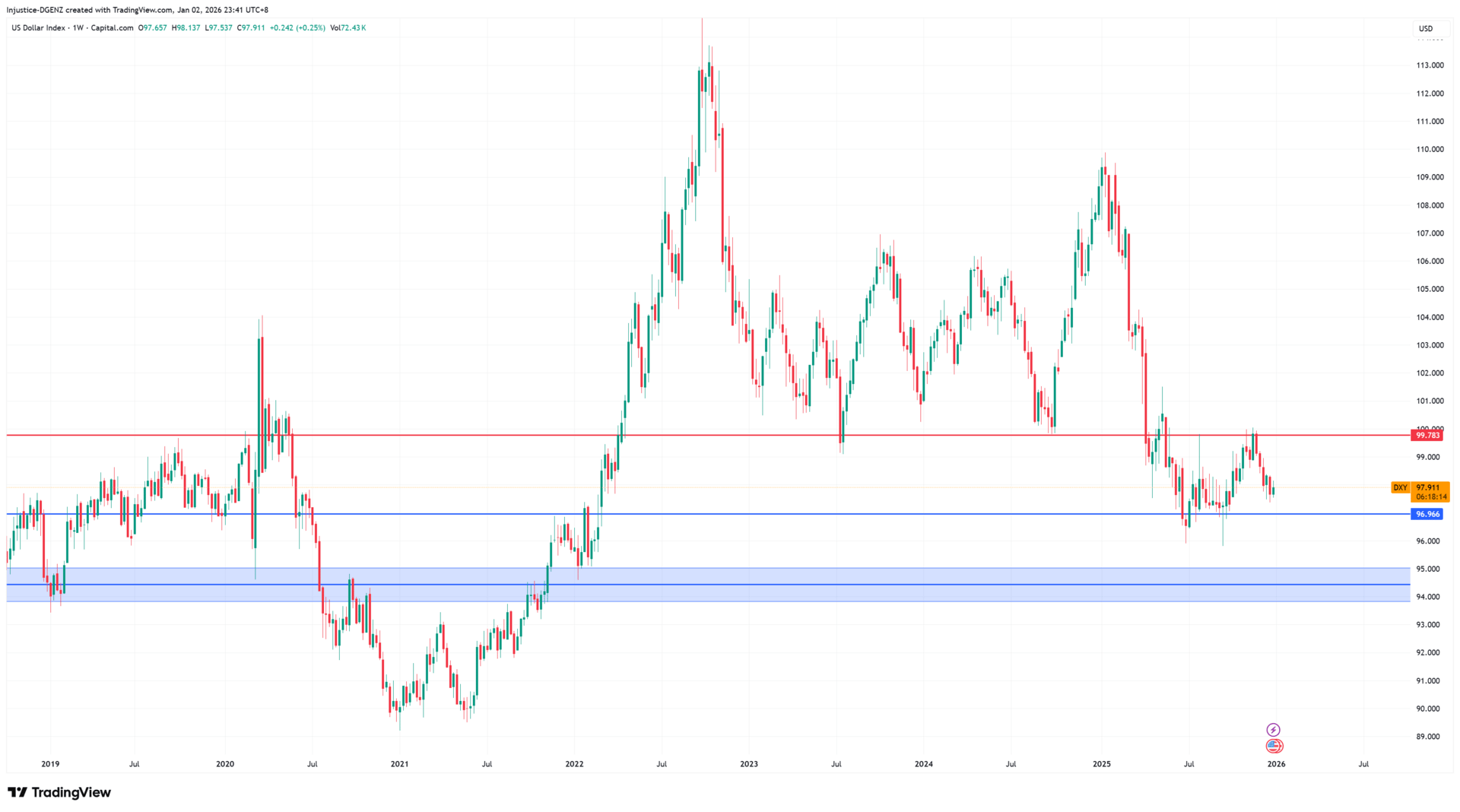

The DXY: A Weak Dollar = Stronger Alts

The DXY measures the strength of the US dollar. When it drops, investors start looking elsewhere for better returns. That usually leads to money flowing from dollars into assets.

The further the DXY falls, the further investors move out along the risk curve. That means moving from cash into BTC, ETH, SOL, and eventually alts.

If the DXY breaks below this range and manages to stay down under 97 it will act as a major green light for the crypto market.

TLDR

Rate cuts make risk assets more attractive

The Market Structure Bill could unlock institutional flows

A falling DXY would accelerate the rotation into alts

If two of these three happen this quarter, we might be looking at a real altseason. If all three line up, start prepping the exit plan and checking your bags.

Now, let’s dive into more charts and see where the market is heading for the week ahead.

Uh Oh.. Looks Like You Ain’t A True Degen

You’ve made it this far for free. But the real alpha? That stays locked inside.

Last week’s Token of the Week was Plasma ($XPL), which we called at $0.1361 and within just 48 hours it tagged our target of $0.1695 for a 24.5% spot gain.

Here’s the proof from my BloFin account:

These are the kind of plays Dgenz Insiders get every week.

🧠 Smart entries

🎯 Take profit zones

🚀 Alpha before the crowd

🪂 Airdrop guides to make that free moola in 2026

📈 In-depth chart analysis so you know which way the market is heading

If you're still reading the free version, just know.. you’re leaving gains on the table.

👉 Upgrade your subscription today and get this issues call before it moves.

Want to stay ahead of the moves? Join our Discord community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections

Dgenz Trade Calculator

The best way to manage risk and maximize your gains is with the right tools. Use the Free Dgenz Trade Calculator to size positions, track spot & futures trades, and master risk management across crypto, stocks, and forex markets.

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!