Market Pulse

New Year’s Resolution: Print Green

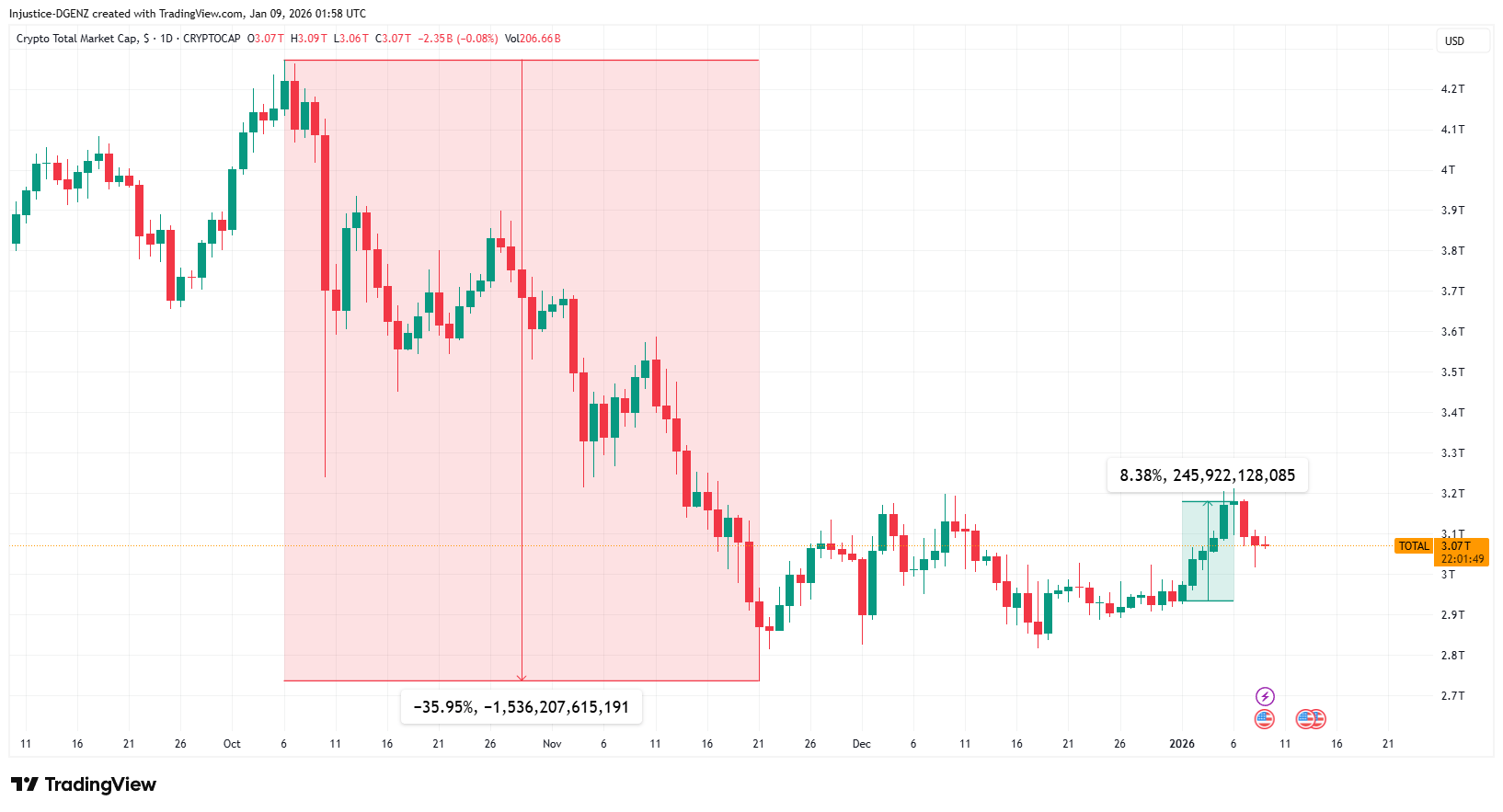

After a brutal Q4, the crypto market opened 2026 like someone knew something the rest of us didn’t. After bleeding out over $1.5 trillion since October, crypto rallied $246B in just the first week of 2026. That’s not a bounce, that’s a goddamn slap to the face of everyone who sold the bottom.

But while everyone's screaming “NEW ALL-TIME HIGH INCOMING,” crypto might be giving up on it’s new years resolution before you cancel that new gym membership.

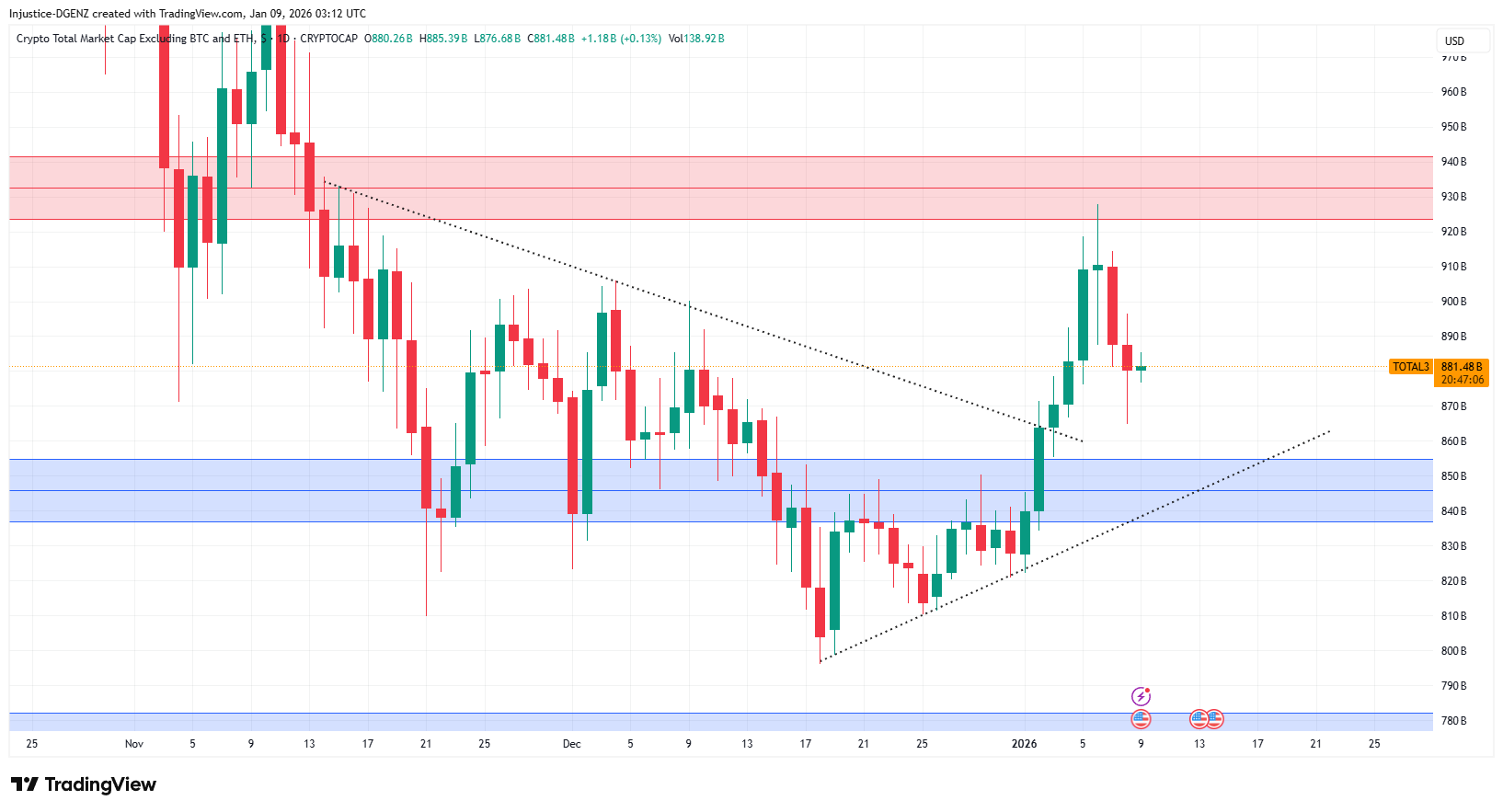

Zooming in on the $TOTAL3 chart (everything that isn’t BTC or ETH), we broke a major trendline resistance early in the year and alts went full send.

But like any good weekend bender, we’ve now slammed into a wall and are already showing signs of exhaustion.

Translation: we’re most likely heading back for a proper retest before any real breakout resumes.

Someone just spent $236,000,000 on a painting. Here’s why it matters for your wallet.

The WSJ just reported the highest price ever paid for modern art at auction.

While equities, gold, bitcoin hover near highs, the art market is showing signs of early recovery after one of the longest downturns since the 1990s.

Here’s where it gets interesting→

Each investing environment is unique, but after the dot com crash, contemporary and post-war art grew ~24% a year for a decade, and after 2008, it grew ~11% annually for 12 years.*

Overall, the segment has outpaced the S&P by 15 percent with near-zero correlation from 1995 to 2025.

Now, Masterworks lets you invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso. Since 2019, investors have deployed $1.25 billion across 500+ artworks.

Masterworks has sold 25 works with net annualized returns like 14.6%, 17.6%, and 17.8%.

Shares can sell quickly, but my subscribers skip the waitlist:

*Per Masterworks data. Investing involves risk. Past performance not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

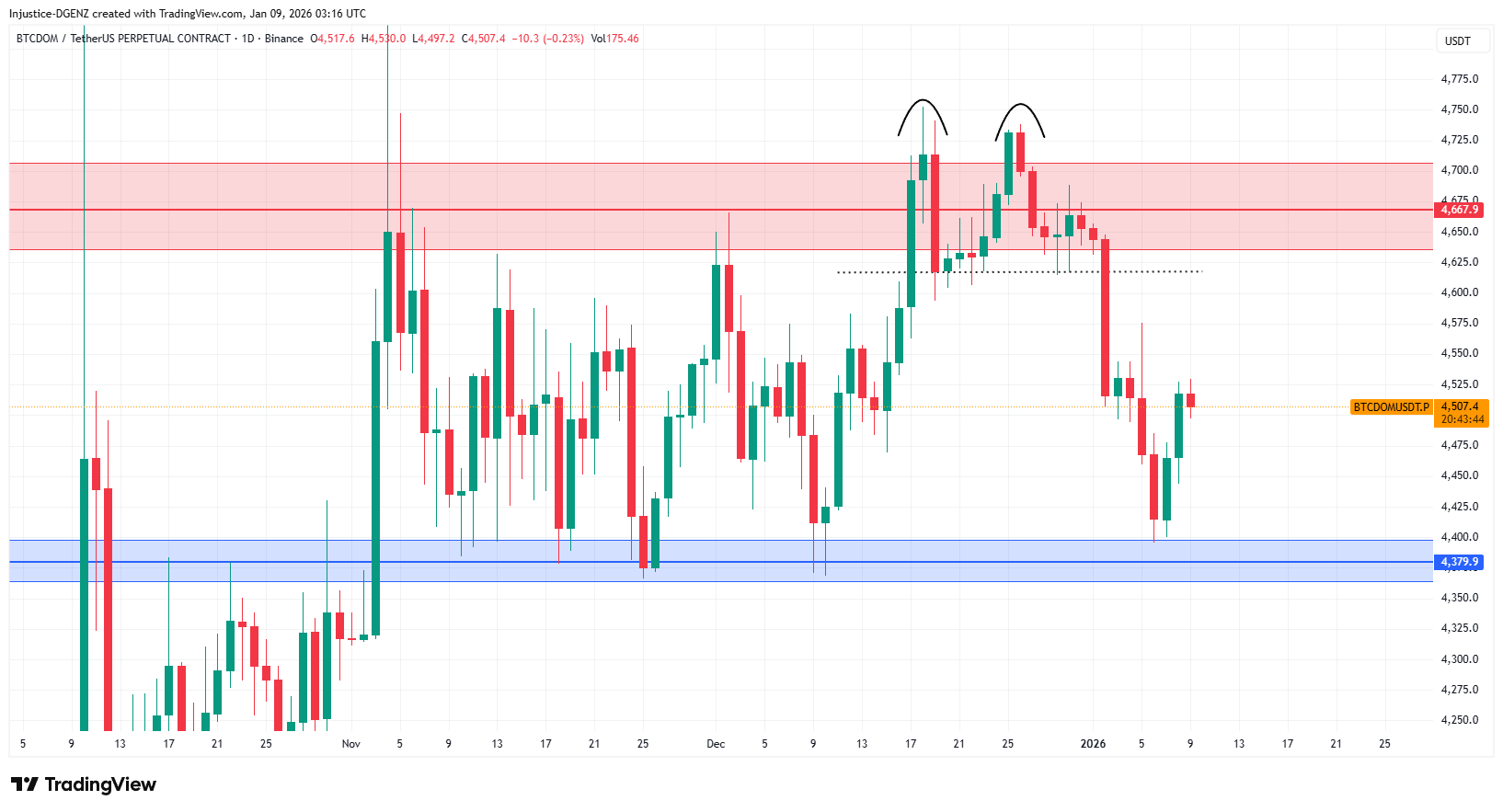

The Double Top That Pumped Our Bags

Alts weren’t popping off for no reason.

There was a huge Boxing Day sale on crypto.

The $BTCDOM (Bitcoin Dominance) chart printed a sexy little double top right at daily resistance. Neckline broke at the start of the year, and alts went into party mode.

But now? Not so sexy.

$BTCDOM is still chilling far from the resistance, meaning it’s probably gonna drift up again and squeeze the life out of any degens who jumped in too late.

If you’re thinking about longing alts right now, consider waiting till we see at least a $4590 retest.

This range we’ve been trading in since November has been a god-tier cheat code for picking altcoin tops and bottoms and you don’t wanna ignore it now.

Zooming Out: What the Macro Is Whispering

Short term price action is loud, emotional, and loves to fake people out.

Macro is quieter. Less exciting. But it’s usually the thing steering the ship over months.

It won’t tell us exactly when candles go up or down, but it does a pretty solid job of pointing us in the general direction.

And right now? It’s pointing up.

Here’s our 3 reasons why..

1. QT Is Dead. QE Is Back (Sort Of)

Let’s translate Fed-speak into human language.

Quantitative Tightening was the Fed sucking money out of the system. That phase is done.

Quantitative Easing is the opposite. The Fed starts adding liquidity back in to keep things from breaking.

Now, they’re not blasting the money printer like it’s 2020. It’s more like a slow drip.

But after two years of tightening, even a drip is a big deal.

Liquidity coming back into the system is historically good for risk assets. And yes, crypto is firmly in the “risk assets love liquidity” category.

Your Trading Setup Deserves Better

Wanna trade like a degen but look like a pro?

Then slap this bad boy on your desk.

Our brand new Dgenz Trading Desk Mat is built for killers, not keyboard warriors.

It’s packed with candlestick cheat codes, chart pattern guides, a wireless phone charger and a clean, RGB lit surface. This isn't just a flex, it’s your new trading edge.

Available now in the Dgenz store alongside our crypto tees, hoodies, mugs and more.

🛒 Grab yours here → https://shop.dgenznft.com

2. Jobs and Inflation Are Cooling Off

On paper, a slowing economy sounds scary.

In reality, markets usually like it.

Why? Because when growth weakens, the Fed tends to step in with rate cuts.

Lower rates mean cheaper borrowing. Cheaper borrowing means more spending. More spending means more money floating around.

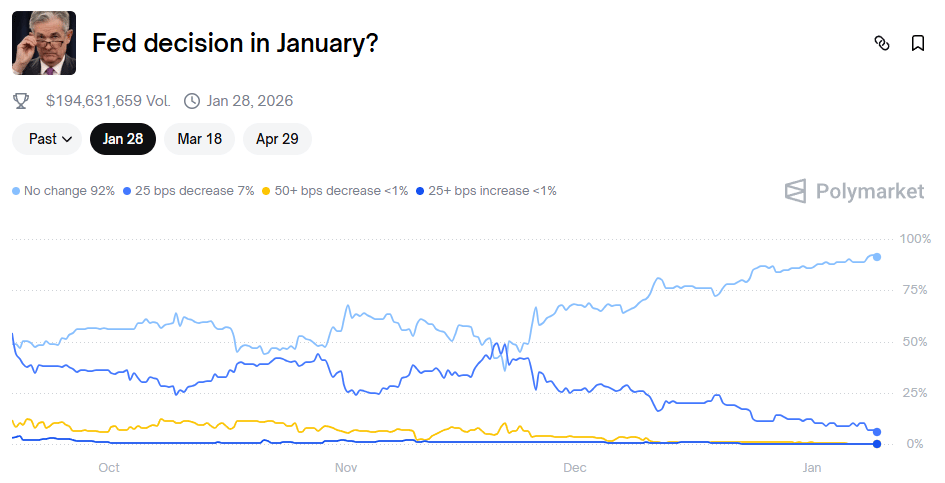

Right now, January rate cut odds are still weak.

But here’s the setup everyone’s watching.

A soft jobs report this Friday plus a tame inflation print on Tuesday next week could flip expectations fast. Markets move on expectations, not headlines.

If those numbers come in cold, the narrative shifts quickly.

And crypto loves a narrative shift.

3. The Rest of the World Is Already Easing

This part does not get talked about enough.

Nearly 80 percent of global economies are already in easing mode. That means lower rates, easier loans, and more accessible capital.

When money is easier to get, it gets spent.

When it gets spent, it finds its way into assets.

And when global liquidity expands, crypto usually benefits whether the US likes it or not.

This is not just a US story anymore.

The Big Picture Takeaway

Liquidity is slowly returning. Economic data is weakening. Global central banks are easing.

That combo has historically been pretty friendly to crypto.

So yes, we stay bullish on the longer term outlook for 2026.

Not blindly. Not permanently. But for now, the macro winds are at our backs.

If that changes, we’ll be the first to say it.

Until then, zoom out, stay patient, and let the bigger forces do their thing.

Now, let’s get to the alpha you’ve all been waiting for.. the Token of the Week.

Uh Oh.. Looks Like You Ain’t A True Degen

You’ve made it this far for free. But the real alpha? That stays locked inside.

Join Dgenz Insider Calls to unlock:

📈 Chart breakdowns of $BTC, $ETH, $SOL and more

🧠 Technical analysis on $TOTAL, $STABLES.C.D, $DXY, $BTC.D and more

🎯 Token of the Week with sniper-entry zones before the crowd

🪂 Airdrop guides to make that free moola in 2026

💰 Exclusive access to trade ideas that have returned over 962% annual gains

If you’re serious about catching the next move..

Upgrade Your Subscription

Because even though the free ride is over, the gains are just getting started!

Want to stay ahead of the moves? Join our Discord community and get real-time insights on the market—daily, hourly, anytime you need them. Learn from our 4 expert chart masters and engage with a community of traders out there in the trenches with you.

Dgenz NFT Collections

Dgenz Trade Calculator

The best way to manage risk and maximize your gains is with the right tools. Use the Free Dgenz Trade Calculator to size positions, track spot & futures trades, and master risk management across crypto, stocks, and forex markets.

Know a few friends who need crypto alpha in their life? Share your link, collect rewards and don’t miss out on the soon to be announced Dgenz perks - Start referring today!